The earnings calendar is loaded with top-rated growth stocks in the coming week with results due from Eli Lilly (LLY), Chipotle Mexican Grill (CMG), Cloudflare (NET) and Pinterest (PINS).

X

Meanwhile, widely followed Palantir (PLTR) reports Monday after the close. The stock tried to break out of a downtrend on Jan. 22, but Palantir got turned away at its 50-day line. With Palantir stock on a downtrend, sellers are dictating the action amid growth concerns, particularly when it comes to new government deals. That said, fourth-quarter revenue growth is expected to accelerate from the third quarter, rising nearly 19% to $603.5 million.

Five members of the Investor’s Business Daily Leaderboard model portfolio also are on the earnings calendar. In the investment management group, KKR (KKR) reports Tuesday before the open, while industry group mate Apollo Global Management (APO) will be out premarket Thursday.

Bank stocks fell sharply Wednesday, weighed down by a 38% plunge for New York Community Bancorp (NYCB). New York Community cut its dividend by more than 70% to shore up capital after the company purchased the assets and liabilities of Signature Bank. Signature was one of three banks that failed in early 2023.

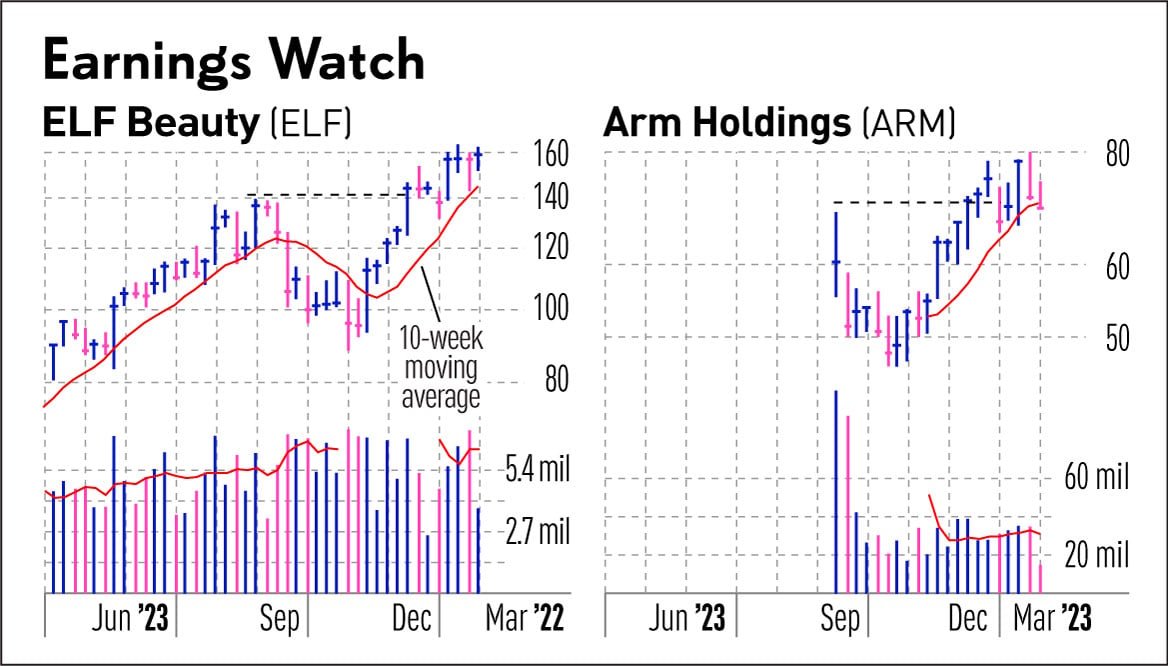

Chip designer Arm (ARM), Spotify (SPOT) and ELF Beauty (ELF) are other Leaderboard stocks on the earnings calendar.

Earnings Calendar Spotlight

ELF Beauty rallied after its last three earnings reports. But a 15% intraday gain faded to 3.7% on Nov. 2 even after the company reported its fourth straight quarter of triple-digit earnings growth and raised its full-year outlook for the second consecutive reporting period.

ELF predicted full-year revenue of $896 million to $906 million, up 55% to 57% from the prior fiscal year and above analyst estimates for $852 million at the time.

Digital revenue jumped 75%, while international revenue soared 157%. The company’s skin care line, particularly popular with younger consumers, was also up more than 100%, according to Chief Executive Tarang Amin.

“We’re quite bullish about the future and particularly in terms of how we’re positioned,” he said during the earnings conference call. “We’ve doubled our market share in the last three years, and I feel we can double our market share again over the next few years.”

According to analysts polled by Zacks Investment Research, ELF is expected to report adjusted profit of 58 cents a share this quarter, up 21% from the year-ago quarter. Revenue is seen rising 62% to $237.05 million.

Watching Azek, Chipotle

When stocks move, they tend to move in groups, and perhaps nowhere is this more evident now than in the building sector. Inside the construction products group, Azek (AZEK) is still in a buy zone after clearing a flat base with a 39.04 entry.

The maker of engineered outdoor living products is known for its decking and railings made from recycled material. Results are due Tuesday after the close.

See Which Stocks Are In The Leaderboard Model Portfolio

The company is expected to report adjusted profit of 5 cents a share, reversing a year-ago loss of 9 cents. Look for revenue to be up 8% to $234.1 million. Competitor Trex (TREX) broke out powerfully Thursday, topping an 84.67 entry.

Meanwhile, restaurant stocks have started to outperform, so all eyes will be on Chipotle when the fast-casual chain reports Tuesday after the close.

Chipotle stock broke out of a downtrend and rose above its 200-day line and 50-day line in late October even though earnings and revenue growth decelerated from the second quarter. But earnings of $11.36 a share came in well above Wall Street views for $10.55, while same-store sales growth of 5% beat the 4.6% analyst consensus estimate.

Chipotle opened 62 new restaurants in the third quarter. Fifty-four of the locations included “Chipotlane,” a drive-through lane reserved for picking up digital orders. During the quarter, digital sales made up nearly 37% of total food and beverage revenue.

ARM Stock Holds Support

In the semiconductor sector, Leaderboard stock Arm Holdings (ARM) is also on the earnings calendar, with results due Wednesday after the close.

The chip designer has been testing its 10-week line for the past few weeks amid volatile price action. After an inauspicious debut in mid-September at 51, ARM’s uptrend is still intact after a breakout from a base during the week ended Dec. 8.

In 2020, Nvidia (NVDA) offered to buy Arm from Japan’s Softbank for $40 billion. But the deal collapsed in February 2022 due to regulatory scrutiny.

Arm is the leader in energy-efficient central processing units, or CPUs, mostly for smartphones. But the company is making inroads into other areas like automotive, cloud computing and artificial intelligence.

Options Trading Strategy

A basic options trading strategy around earnings — using call options — allows you to buy a stock at a predetermined price without taking a lot of risk. Here’s how the option trading strategy works and what a call option trade recently looked like for Elf Beauty.

Join IBD experts as they analyze top stocks in the stock market on IBD Live

First, identify top-rated stocks with a bullish chart. Some might be setting up in sound early-stage bases. Others already might have broken out and are getting support at their 10-week lines for the first time. And a few might be trading tightly near highs and refusing to give up much ground. Avoid extended stocks that are too far past proper entry points.

A call option is a bullish bet on a stock. Put options are bearish bets. One call option contract gives the holder the right to buy 100 shares of a stock at a specified price, known as the strike price.

Once you’ve identified a bullish setup in the earnings calendar, check strike prices with your online trading platform, or at cboe.com. Make sure the option is liquid, with a relatively tight spread between the bid and ask.

Look for a strike price just above the underlying stock price — that’s out of the money — and check the premium. Ideally, the premium should not exceed 4% of the underlying stock price at the time. In some cases, an in-the-money strike price is OK as long as the premium isn’t too expensive.

Choose an expiration date that fits your risk objective. But keep in mind that time is money in the options market. Near-term expiration dates will have cheaper premiums than those further out. Buying time in the options market comes at a higher cost.

Earnings Calendar Option Trade

ELF Beauty is somewhat thinly traded in the options market, but the technical setup is bullish so a call-option trade could make sense. At one point Thursday, the expected move for ELF was about 19 points up or down.

When shares traded around 160, an in-the-money weekly call option with a 160 strike price and a Feb. 9 expiration came with a premium of around $9.10 per contract. That was 5.7% of the underlying stock price at the time.

One contract gave the holder the right to buy 100 shares of ELF at 160 per share. The most that could be lost was $910 — the amount paid for the 100-share contract. To break even, the stock would need to rise to 169.10, factoring in the premium paid.

Follow Ken Shreve on X/Twitter @IBD_KShreve for more stock market analysis and insight.

YOU MAY ALSO LIKE:

Best Growth Stocks To Buy And Watch

Catch The Next Big Winning Stock With MarketSmith

IBD Stock Of The Day: See How To Find, Track And Buy The Best Stocks

IBD Digital: Unlock IBD’s Premium Stock Lists, Tools And Analysis Today