Despite its rocky start, January ended up being an OK one for blue chip stocks. The Dow Jones Industrial Average (DJINDICES: ^DJI) logged a 1.2% gain last month. The move offers a much-needed glimmer of hope that we’ll be able to avoid reentering a bear market.

Not every Dow name dished out a gain in January, however. A handful of its 30 stocks lost ground in defiance of the overall trend.

Of course, that’s not necessarily a problem. Veteran investors know the time to scoop up quality stocks is when they’re down for all the wrong reasons. That may be the stance we should be taking now with these three particular tickers.

Or … maybe not.

What went wrong for who?

There’s no need to belabor the point. The Dow Jones Industrial Average’s biggest January losers are 3M (NYSE: MMM), Intel (NASDAQ: INTC), and Boeing (NYSE: BA), down 13.7%, 14.2%, and 19% (respectively).

The funny thing is, none of this weakness comes as a real surprise. In all three cases, last month’s losses simply extend or rekindle longer-standing headwinds.

Take 3M as an example. Long beleaguered because of its waning competitiveness, 3M has also spent the past few years in a serious legal battle over claims of faulty earplugs. This litigation was brought nearer to its end late last year when it agreed to settle the class action suit for $6 billion.

That’s roughly a full year’s worth of its net income though, and isn’t an expense the company can quickly or easily shrug off. Neither the claimants nor the courts have officially agreed yet to accept the offer, either.

In the meantime, the bulk of last month’s loss for the stock took shape after the release of its fourth-quarter numbers, which laid out tentative plans for navigating its post-settlement existence. 3M’s shareholders are worried the intended spinoff of its healthy business could prove costly and complicated. Guidance for sales growth of no more than 2% this year is also less than thrilling.

Intel’s setback also mostly came in one fell swoop late in the month. Namely, shares plunged following the release of its fourth-quarter numbers and its guidance for the first fiscal quarter now underway. Last quarter’s sales of $15.4 billion drove earnings of $0.54 per share.

While the top line improved to the tune of 10% and earnings topped expectations, the company’s only looking for revenue of between $12.2 billion and $13.2 billion this quarter, which should generate non-GAAP (generally accepted accounting principles) per-share earnings of $0.13. Analysts were expecting an average of $14.2 billion in first-quarter revenue to produce profits of $0.34 per share.

As for Boeing, more design problems with its flagship commercial passenger jet are the culprit. In early January, United Airlines and Alaska Airlines both discovered loose bolts with some of their Boeing-made 737 MAX jets, with the latter airline also reporting a panel had blown off one of its same kind of aircraft mid-flight. It’s a stark reminder of all the recent design problems the company’s faced with this particular plane. At least some airline executives are starting to balk at the once-iconic company’s aircraft.

Still, are these setbacks ultimately opportunities?

There’s always more to the story

The headlines are admittedly ugly. There’s a difference between news and noise, however.

That’s not to say you should simply ignore these recent headlines. Rather, it’s simply to suggest taking a step back and putting them in their proper context. The news currently in circulation will eventually be forgotten, but the companies will still be around. What’s their long-term prognosis?

For 3M, it isn’t great. Although its legal headaches and subsequent costs are a recent and temporary challenge, bear in mind that 3M was struggling well before now. Although there was a time when being a one-stop-shop supplier of everything ranging from automotive care products to dentistry supplies to orange safety cones made sense, technology (and the internet in particular) has democratized these businesses, allowing other manufacturers to penetrate these markets while at the same time allowing customers to find alternatives.

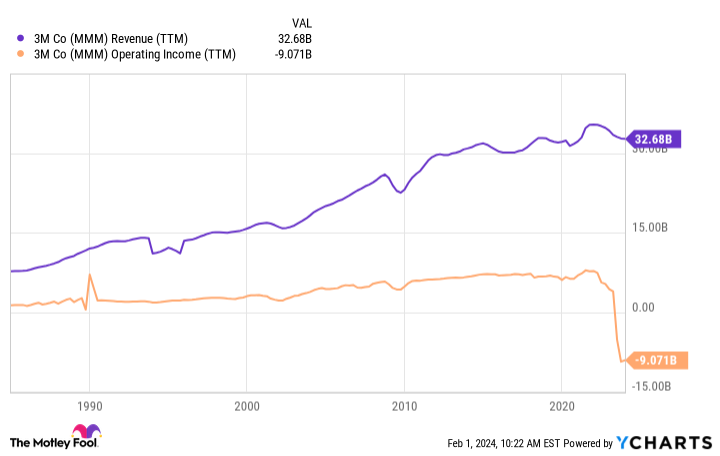

3M’s revenue growth has been rather anemic since 2012, and operating income growth outright stalled three years later. The company also has bigger problems than costly lawsuits that have yet to be solved.

Intel’s is a similar story. Once a titan within the tech world, the chipmaker has allowed competitors like Advanced Micro Devices and Nvidia to cultivate businesses that could have been — and arguably should have been — Intel’s to dominate; artificial intelligence (AI) tech comes to mind.

Then there’s the company’s struggle to remain the premier name in semiconductor manufacturing. You may recall even before the COVID-19 pandemic that Intel repeatedly postponed the debut date of its first-ever 7-nanometer processors, unable to figure out how to mass-produce these chips at a reliable and cost-effective pace.

It’s since figured it out (although AMD was mass-producing 7-nanometer silicon well before Intel ever did). But, the company’s never quite been the same iconic name it was since suffering that series of shortcomings. Overall economic malaise crimping demand for semiconductors only further weakens the longer-term bullish argument.

Here’s the thing: Although headwinds are currently blowing, the analyst community still believes Intel’s sales growth will accelerate later in the year, and then continue accelerating to a pace of nearly 12% next year. Maybe it’s not a buy right now. Intel’s a name you might want to put on your watch list for later, though, just to see if it’s gearing up for the anticipated sales-growth rebound.

As for Boeing, sure, the never-ending revelations of its planes’ design problems are getting old for investors. Ditto for its current and prospective customers. Voicing similar feelings from other airline executives, American Airlines CEO Robert Isom bluntly commented early last month that “Boeing needs to get [its] act together.” Ouch.

There’s a curious data nugget buried in the company’s recently posted Q4 results, though. That is, Boeing’s backlog of orders now stands at $520 billion. That’s a multiyear high above 2018’s figure, before the 737 MAX started showing evidence of design and fabrication problems — when airlines were still super-stoked about the plane’s potential and promise. Clearly, demand for Boeing’s jets remains robust despite well-publicized criticism of the company’s oversight.

There’s a larger lesson to be learned here, of course: While one bad month is worth exploring as a potential buying opportunity, it’s not a reason in and of itself to buy a stock. In the grand scheme of things, there are far more important details to consider.

Should you invest $1,000 in Boeing right now?

Before you buy stock in Boeing, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Boeing wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of January 29, 2024

James Brumley has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices and Nvidia. The Motley Fool recommends 3M, Alaska Air Group, and Intel and recommends the following options: long January 2023 $57.50 calls on Intel, long January 2025 $45 calls on Intel, and short February 2024 $47 calls on Intel. The Motley Fool has a disclosure policy.

Is It Time to Buy the Dow Jones’ 3 Worst-Performing January Stocks? was originally published by The Motley Fool