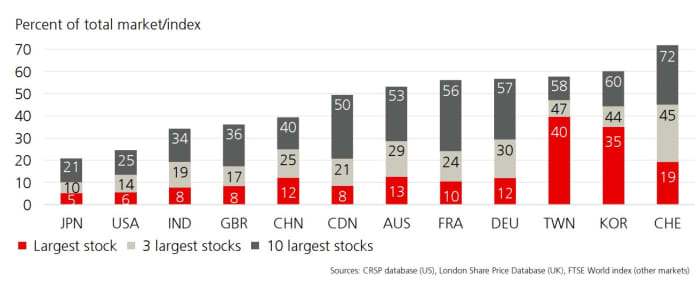

For all the talk about the Magnificent Seven and the ultra-reliance of just a handful of companies to drive stock-market returns, it turns out the U.S. is in fact one of the least concentrated markets in the world.

That’s according to the latest findings of the global investment returns yearbook, by Paul Marsh and Mike Staunton of London Business School and Elroy Dimson of Cambridge University, now being published at UBS after Credit Suisse’s untimely demise.

The U.S. — as represented by its largest stock (Microsoft), its largest three stocks (Apple and Nvidia are now 2 and 3), and its largest 10 stocks (the Magnificent 7 + Berkshire Hathaway, Eli Lilly and Broadcom) — is the second-least concentrated of the world’s 12 largest stock markets.

Related: Think the S&P 500 is top-heavy? Five stocks command 60% of this market.

That’s not to say the current set up is necessarily sustainable. But the authors, on a call with journalists, were at pains to say that there’s nothing instrincially unstable. “The future is very uncertain, always,” said Dimson. “There’s no easy shortcut for spotting a bubble.”

“We’re not in a position to outguess markets,” added Marsh. He also drew a distinction between now and the dot-com era in that the current stock-market leaders are producing big profits, with the only real question being the price afforded to them. “The question is whether the price is too high, it’s not whether or not it’s a bunch of junk,” he said.

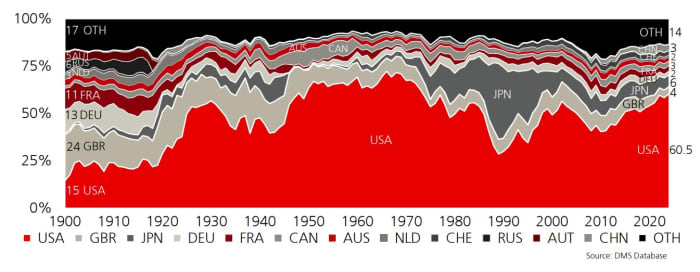

The U.S. accounts for three-fifths of the global stock market.

The U.S. dominance of global stock markets is near, but not at its peak, representing 61% of total market capitalization at the end of last year.

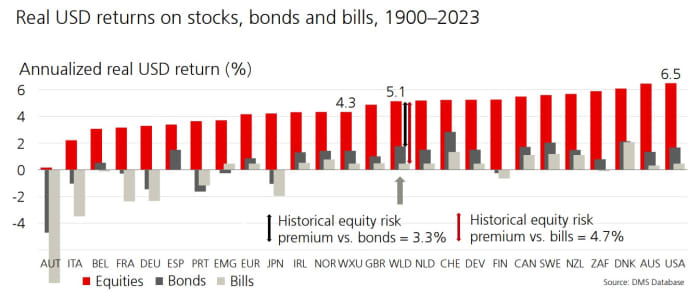

And the U.S. has been the best performing of the major stock markets over the last 124 years. After inflation, it’s generating returns of 6.5%. Globally, stocks over 124 years have generated an inflation-adjusted return of 5.1%, which is a 3.3% outperformance of bonds and a 4.7% outperformance of bills. Excluding the U.S., those returns have been 4.3% per year, after inflation.

They don’t think future returns will be so good, owing more to the luck of previous generations than worries about the future. They estimate Generation Z will see 4.5% annual real returns on stocks, 2% on bonds, and a 3.5% return on a 60/40 basis; that’s worse than what the baby boomers have experienced — 6.8% from stocks, 3% from bonds, 5.6% overall — but the same stock-market return that millennials have seen.

The market

U.S. stock futures ES00,

| Key asset performance | Last | 5d | 1m | YTD | 1y |

| S&P 500 | 5,078.18 | 2.06% | 3.11% | 6.46% | 27.91% |

| Nasdaq Composite | 16,035.30 | 2.59% | 3.39% | 6.82% | 39.98% |

| 10 year Treasury | 4.299 | -2.13 | 38.03 | 41.84 | 30.48 |

| Gold | 2,036.30 | -0.02% | -1.04% | -1.71% | 10.45% |

| Oil | 78.13 | 0.09% | 3.01% | 9.53% | 0.53% |

| Data: MarketWatch. Treasury yields change expressed in basis points | |||||

The buzz

Tesla TSLA,

Apple AAPL,

Beyond Meat stock BYND,

Salesforce CRM,

Fourth-quarter GDP data will be revised as the advance U.S. trade report is published, as a trio of Fed officials speak.

In the Michigan primary, President Joe Biden brushed off a challenge from Rep. Rashida Tlaib’s “uncommitted” campaign, while former President Donald Trump cruised to victory on the Republican side.

Best of the web

Surge pricing is coming to Wendy’s — here’s how it has affected other purchases.

Behind the “nuclear” option Universal Music has invoked against TikTok.

South Korea’s baby bust breaks records.

Top tickers

Here were the most active stock market tickers on MarketWatch as of 6 a.m. Eastern.

| Ticker | Security name |

| NVDA, |

Nvidia |

| TSLA, |

Tesla |

| AMC, |

AMC Entertainment |

| MARA, |

Marathon Digital |

| BYND, |

Beyond Meat |

| SOUN, |

SoundHound AI |

| GME, |

GameStop |

| AAPL, |

Apple |

| COIN, |

Coinbase Global |

| NIO, |

Nio |

The chart

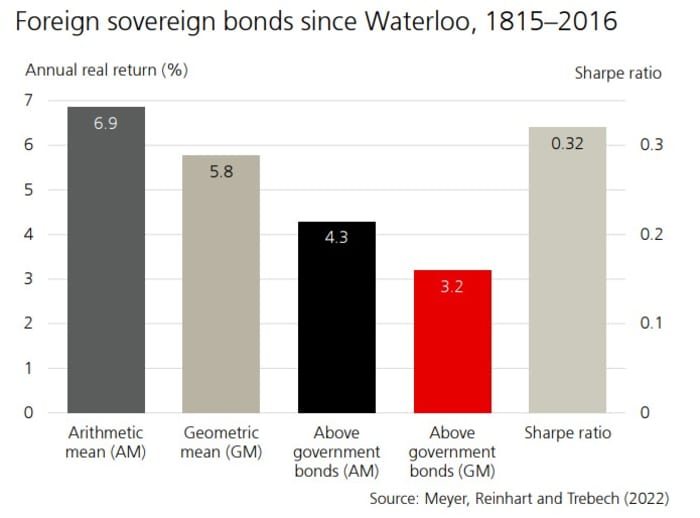

How is it that countries like Argentina, which has defaulted 9 times, can continually access capital markets? Check out this chart — again from the global investment returns yearbook — showing the return on sovereign bonds issued in foreign countries, since Waterloo in 1815. (That was an important date since Napoleon’s defeat set the stage for so many Latin American countries to become independent, and then to seek foreign capital.) The trio also estimated the credit premium on corporate bonds vs. government bonds dating back to 1900, which they say for investment-grade bonds is 0.75% per year.

Random reads

A hearse driver tried to use a corpse as a passenger in the carpool lane.

A real life Winnie the Pooh — a bear in North Carolina emerged from a small vent opening.

Woman lifts a paving slab in the garden, finds World War II-era tunnel underneath.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Check out On Watch by MarketWatch, a weekly podcast about the financial news we’re all watching — and how that’s affecting the economy and your wallet.