Although nothing has been more popular with the investing community than artificial intelligence (AI) in 2024, the euphoria surrounding stock splits can, arguably, give AI a run for its money.

A stock split is a tool publicly traded companies have at their disposal that gives them the option of adjusting their share price and outstanding share count by the same factor. Keep in mind that stock splits are purely surface scratching and have no impact on a company’s market cap or its operating performance.

Most investors tend to gravitate to companies announcing forward stock splits. A forward split is designed to reduce a company’s share price to make it more nominally affordable for retail investors and/or employees who lack access to fractional-share purchasing with their broker. This type of split is almost always announced by businesses that are out-executing and out-innovating their competition.

On the other hand, investors typically avoid companies completing reverse stock splits. A reverse split aims to increase a publicly traded company’s share price, with the goal often to ensure continued listing on a major stock exchange. The lion’s share of companies conducting reverse splits are doing so from a position of operating weakness.

In 2024, a little over a dozen industry-leading businesses have announced or completed a stock split. Only one of these premier businesses completed a reverse split — and it’s the stock I’ve more than quintupled my stake in since mid-April.

Meet Wall Street’s most-anticipated reverse stock split of 2024

Though reverse stock splits happen all the time, none was more anticipated on Wall Street in 2024 than the recent split from satellite-radio operator Sirius XM Holdings (NASDAQ: SIRI).

In mid-December, Sirius XM announced it would be merging with Liberty Media’s Sirius XM tracking stock, Liberty Sirius XM Group, to eliminate the confusion and share price variance caused by having multiple classes of common shares. Prior to their combination, which went into effect following the close of trading on Sept. 9, Liberty Sirius XM Group shares were vastly outperforming Sirius XM’s shares over the trailing year.

But in addition to this merger, Sirius XM announced and completed a 1-for-10 reverse stock split (also after the close of trading on Sept. 9), which reduced its outstanding share count from close to 3.4 billion to a little north of 339 million.

Unlike the countless businesses that conduct reverse splits each year to maintain minimum continued share price listing standards and avoid delisting, Sirius XM was a roughly $10 billion company at the time of its split and was in no danger of delisting.

Rather, the company’s board wanted to increase its share price to make it more appealing to institutional investors. Stocks that trade below $5 per share are deemed off-limits or too risky by some fund managers. Splitting the company’s stock and cosmetically lifting its share price to the mid-$20 range should make it more palatable for big-money investors.

However, it’s not just institutional investors that have been lured by Sirius XM.

I’ve increased my position in this legal monopoly by 463% since mid-April

Well before Sirius XM’s board announced plans to conduct a reverse split, I was busy adding to what began the year as a token stake in Sirius XM. Since mid-April, I’ve increased the number of shares I own by a cool 463%.

Let me preface this discussion by plainly stating that Sirius XM is far from perfect. Its total subscribers have declined in each of the last two quarters, with concerns mounting about the health of the U.S. economy and the auto market.

With regard to the latter, promotional subscriptions to Sirius XM’s services are sometimes offered to new vehicle buyers for a period of three months. The company counts on these promotional listeners to become self-pay subscribers. If fewer autos are being sold, it means less opportunity for Sirius to convert promotional users into paying subscribers.

There are also a couple of predictive metrics, such as the first notable decline in U.S. M2 money supply since the Great Depression, as well as the longest yield-curve inversion in history, which suggest economic weakness is in the U.S. economy’s not-too-distant future. Most radio operators are heavily reliant on advertising revenue to keep the lights on, and ad spending tends to be highly cyclical.

Despite these headwinds, I view Sirius XM as historically cheap and worth piling into.

One phenomenal aspect of its operating model is that it’s a genuine legal monopoly. Though it still faces competition for listeners with terrestrial and online radio providers, Sirius XM is the only legally licensed satellite-radio operator. This does afford the company some degree of pricing power with its subscriptions, and should help it stay ahead of the inflationary curve.

Another reason I’m drawn to Wall Street’s most-anticipated reverse stock split of 2024 is because of how it generates revenue. Whereas traditional radio companies rely almost exclusively on advertising to keep the lights on, Sirius XM has closer to an 80/20 revenue split from subscriptions and advertising (via Pandora Media, which it acquired in 2019).

The silver lining for the radio industry as a whole is that the U.S. economy enjoys lengthy periods of expansion. But when inevitable downturns do occur, it’s perfectly normal for ad revenue to notably taper. Since Sirius XM generates most of its sales from subscriptions, and subscribers are less likely to cancel their service than businesses are to pare back their ad spending, it puts Sirius XM on a firmer foundation than its competition.

I’ve also come to appreciate Sirius XM’s somewhat predictable cost structure over the years. Line items like equipment costs and transmission expenses aren’t going to change much, if at all, no matter how many subscribers Sirius XM signs up.

But the primary lure, at least right now, has to be Sirius XM’s historically cheap valuation. Even with sales growth stagnant at the moment, shares are valued at a forward-year earnings multiple of less than 8, which is pretty much an all-time low since the company went public in September 1994.

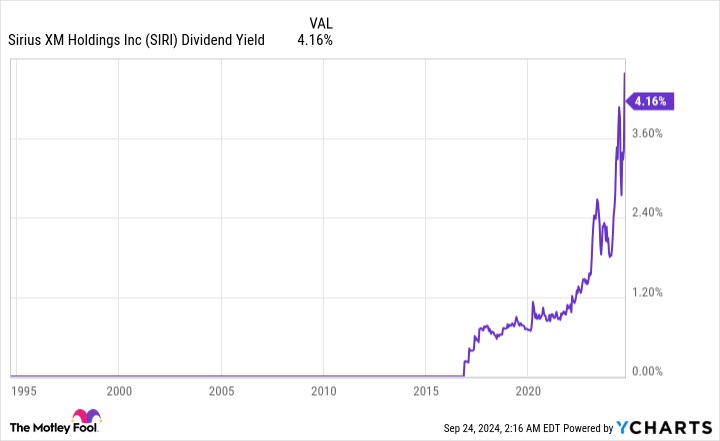

Furthermore, recent weakness in its shares has lifted the company’s annual yield to 4.2%. Sirius XM’s board is committed to sustaining the company’s annual payout of more than $1 per share.

Sirius XM may not be a sexy stock selection when compared to high-growth/high-flying AI stocks, but it’s a historically cheap legal monopoly that should, over time, deliver solid returns for patient investors.

Should you invest $1,000 in Sirius XM right now?

Before you buy stock in Sirius XM, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Sirius XM wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $740,704!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

Sean Williams has positions in Sirius XM. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

I’ve More Than Quintupled My Stake in This Historically Cheap Legal Monopoly That Just Conducted a Reverse Stock Split was originally published by The Motley Fool