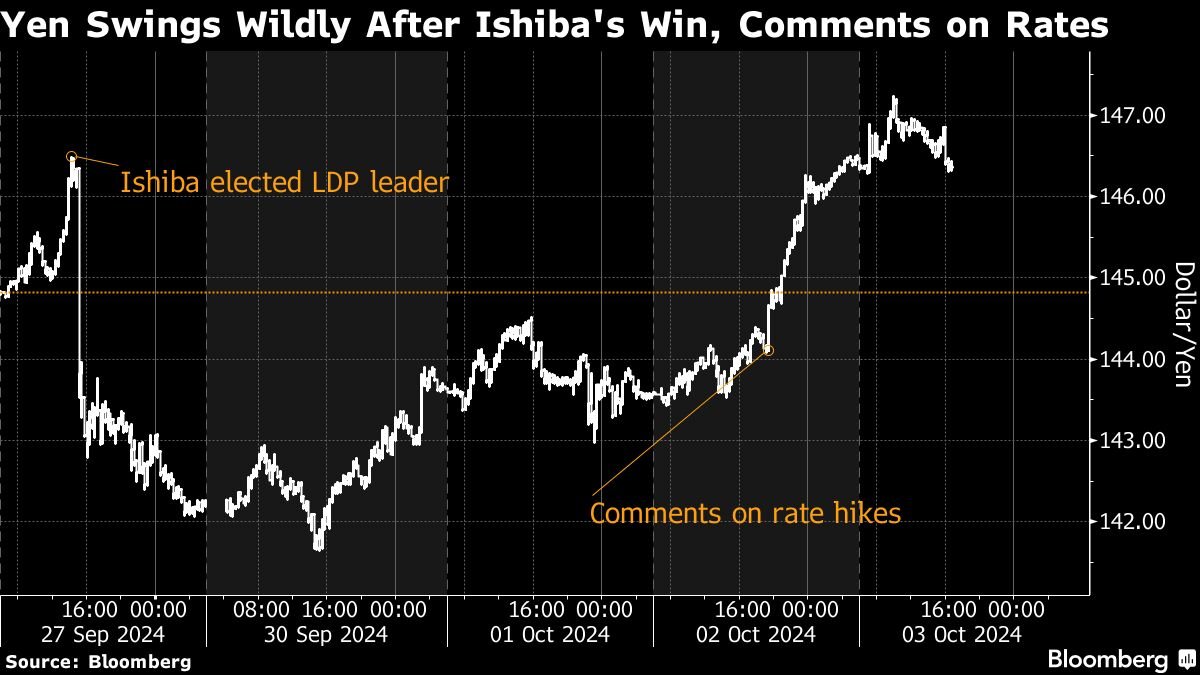

(Bloomberg) — New Japanese Prime Minister Shigeru Ishiba took just days following his appointment to wade into the biggest question facing investors in the country: When is the next interest rate hike coming?

Most Read from Bloomberg

-

Roofs of Mexico City’s Massive Food Market Will Power Public Buses

-

NYC Schools Reverse Course on Cell-Phone Ban After Parents Balk

His unexpected remarks that Japan isn’t ready for more rate increases — an abrupt change from his hands-off approach to the central bank during the recent leadership race — led to a 2% decline in the yen against the dollar, the currency’s worst one-day performance in more than two years. That came just days after a stock market selloff following his election that drew comparisons to the “Kishida shock,” when early comments by his predecessor about tax hikes sent stocks plummeting.

Fumio Kishida walked back his comments and later became popular with investors for policies that helped push Japanese stocks to an all-time high, while also appointing a central bank governor who brought an end to a decade of ultra-loose monetary policy. Investors are now weighing up if Ishiba, who will lead his party in an election later this month, will be as market-friendly as his predecessor.

Economists and analysts in Japan point to three key achievements that took place under Kishida’s premiership, all of which could lead to more volatility if Ishiba changes direction.

Central Bank Move

Kishida’s choice of Kazuo Ueda to run the Bank of Japan brought an end to a decade of leadership by Haruhiko Kuroda, who had unleashed a huge program of monetary stimulus and maintained a policy of negative interest rates long after other big central banks had moved on.

Since taking the helm in April 2023, Ueda has scrapped the negative interest rate policy, reduced the central bank’s bond buying and hiked interest rates.

“Japan’s emergence from negative to positive interest rates is an extremely delicate one which could have been dangerous had a more ideologically extreme governor been chosen,” said Daniel Carter, investment manager of Japanese equities at Jupiter Asset Management Ltd. He said it was one of Kishida’s achievements that “has not been fully appreciated.”

During the Liberal Democratic Party leadership election, Ishiba — a self-described “defense geek” with little experience of economic policymaking — appeared to take a hands-off view of the BOJ. But on Wednesday, after a meeting with Governor Ueda, he said the country wasn’t ready for higher interest rates, an unusual move in a country where central bank independence is generally respected.

The yen weakened to around 146 per dollar following his remarks, after its worst day in more than two years.

Savings Plan Reforms

One of Kishida’s biggest achievements — at least from the point of view of investors — was an aggressive expansion of a tax-free investment scheme for individuals, called NISA.

During the eight months since the start of the new program in January, Japanese households poured 9.5 trillion yen ($65 billion) in domestic stocks and foreign equity funds, according to Japan Securities Dealers Association. This demand helped cushion against a market crash in early August.

With more than half of Japanese households’ $15 trillion financial assets still stuck in bank deposits, there’s room for plenty more investment into the stock market.

This seems likely to be a lasting change, at least for now: Ishiba has said he will follow Kishida’s lead on asset management reforms. That could lead a few more trillion yen more being invested into Japan’s equity market by the end of the year, said Nana Otsuki, senior fellow at Pictet Asset Management.

Stock Exchange Push

Over the last three years, the Tokyo Stock Exchange has made big steps to improve corporate governance and encouraged companies to boost their valuations. That helped fuel a rise in stock prices in Japan, and encouraged increasing bets on the market by foreign investors.

The bourse’s name-and-shame campaign on companies with low stock valuations is goading them to engage investors and boost shareholders’ return.

To be sure, this wasn’t a political move — but it fit with Kishida’s wider attempt to boost the country’s wealth, including by driving up stock prices.

Ishiba may be reluctant to hew too closely to his predecessor’s example. Although many investors now give Kishida the thumbs up, his approval rating with the general population was below 30% by the time he stepped down.

But after the wild market response to Ishiba’s recent comments on interest rates, some analysts think he will draw another important lesson from Kishida’s time in office: how to avoid spooking the market.

“Ishiba can maybe learn from his experience,” said Hiroshi Watanabe, senior economist and the head of financial markets research at Sony Financial Group. The new prime minister needs to strike a balance between pushing economic growth and meeting wage demands from low-paid workers. “Otherwise the stock market will reject him.”

Most Read from Bloomberg Businessweek

-

Elon Musk’s Role in Reanimating the Far-Right Term ‘Remigration’

-

How a Short Seller’s Attack Threatens This Spanish Family Company

©2024 Bloomberg L.P.