Benzinga and Yahoo Finance LLC may earn commission or revenue on some items through the links below.

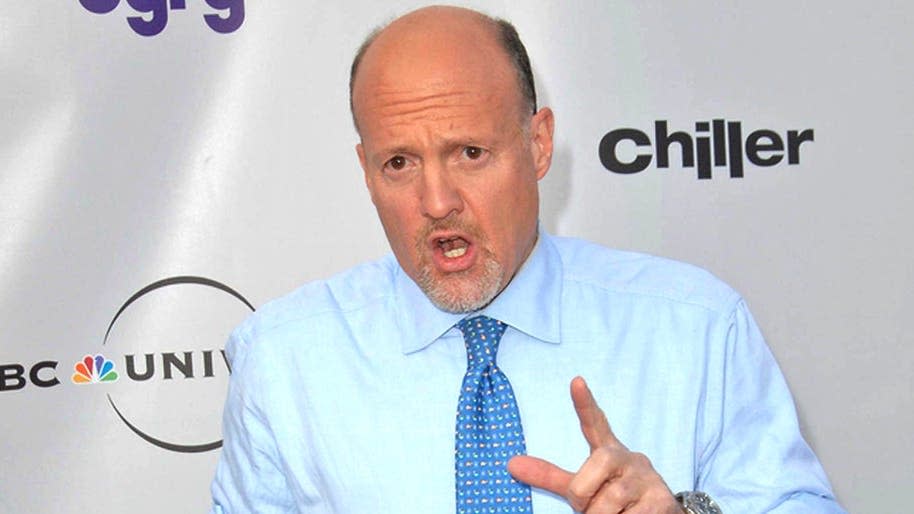

On CNBC’s “Mad Money Lightning Round,” Jim Cramer said Wells Fargo & Company (NYSE:WFC) is going to go higher, adding that it’s a “winner.”

On Sept. 17, the San Francisco-based bank launched specialized Application Programming Interfaces (APIs) for its Commercial Banking clients, expanding its API portfolio.

These APIs offer real-time data access aimed at boosting sales, improving liquidity, reducing credit risk, and cutting expenses for floorplan and channel finance clients across several industries.

Trending Now:

-

A billion-dollar investment strategy with minimums as low as $10 — you can become part of the next big real estate boom today.

This is a paid advertisement. Carefully consider the investment objectives, risks, charges and expenses of the Fundrise Flagship Fund before investing. This and other information can be found in the Fund’s prospectus. Read them carefully before investing. -

Your biggest returns may not come from the stock market. Invest the way colleges, pension funds, and the 1% do. Get started investing in commercial real estate today.

“It’s had too big a move up,” Cramer said when asked about Iron Mountain Incorporated (NYSE:IRM). “Let’s move on.”

On Aug. 1, Iron Mountain reported better-than-expected second-quarter financial results and issued FY24 AFFO guidance above estimates. Also, the company increased its quarterly dividend.

Palantir Technologies Inc. (NYSE:PLTR) is a “cold” stock, Cramer said.

On Sept. 17, the company inked a multi-year, multi-million-dollar contract with Nebraska Medicine. As per the deal, Palantir will utilize its Artificial Intelligence Platform (AIP) to enhance healthcare through transformative technologies.

The “Mad Money” host recommended buying PG&E Corporation (NYSE:PCG). “That stock is a good one, rate increase or no,” he added.

On Sept. 12, B of A Securities analyst Ross Fowler reinstated PG&E with a Buy and announced a $24 price target.

Keep Reading:

-

This billion-dollar fund has invested in the next big real estate boom, here’s how you can join for $10.

This is a paid advertisement. Carefully consider the investment objectives, risks, charges and expenses of the Fundrise Flagship Fund before investing. This and other information can be found in the Fund’s prospectus. Read them carefully before investing. -

Mark Cuban believes “the next wave of revenue generation is around real estate and entertainment” — this new real estate fund allows you to get started with just $100.

This article Jim Cramer: This Utilities Stock Is A Buy, Calls Wells Fargo A ‘Winner’ originally appeared on Benzinga.com