My top 10 things to watch Thursday, Feb. 22

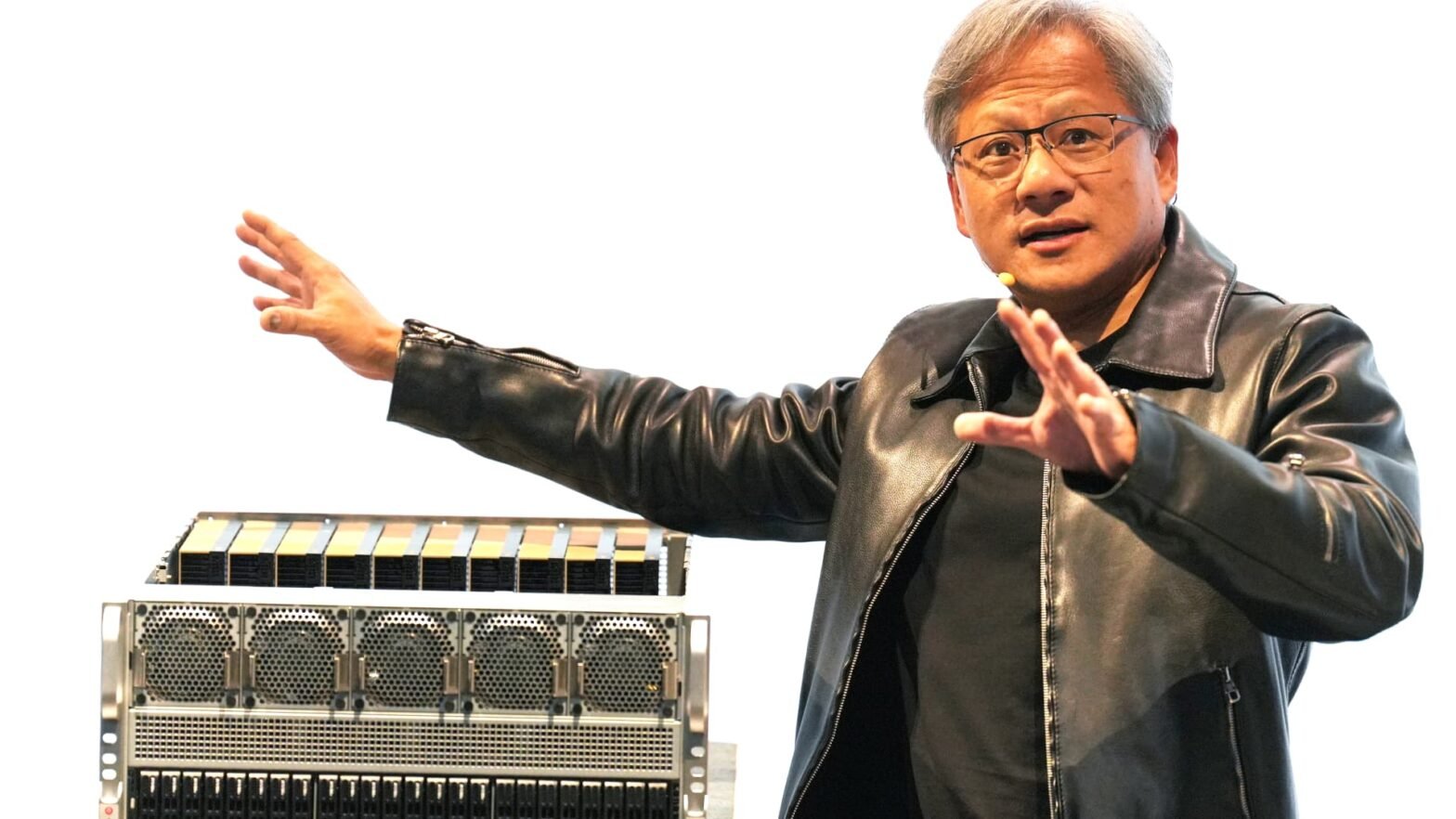

- Nvidia spawns a new industrial revolution without a product gap and with far more customers than it can handle. Many businesses and countries haven’t even been exposed to it yet. Revenue up 22% quarter over quarter. Data Center up 27% QoQ. Guidance $2 billion above consensus $24 billion despite China. Networking $13 billion. $1 billion in software and going to grow at monster pace.

- We raised our Club price target Wednesday evening on Nvidia to $850 per share from $750. Lots of analysts on Wall Street also hiked their PTs. The stock is tracking to open up roughly 13% and poised to add more than $200 billion in market value.

- Winners on the Nvidia post-earnings conference call: ServiceNow and Dell as well as Club names Meta Platforms, Microsoft and Alphabet‘s Google. All mentioned as beneficiaries of implementing generative artificial intelligence and accelerated computing with Nvidia’s help. We’ll be talking a lot about AI and how you can invest in it at our CNBC Investing Club annual meeting on Saturday. Members can stream the event starting at 1:30 p.m. ET.

- Wall Street powers ahead on the back of Nvidia incredible quarter and guidance. The tech-heavy Nasdaq was looking to open 2% higher. Nvidia’s early gains put the stock nearly $20 per share above last week’s Valentine’s Day all-time high of $746. Semiconductor stocks also soar. Bullpen names Advanced Micro Devices and Marvell both up more than 5% each.

- Following Wednesday’s 28% drop, the biggest single-session decline ever, Palo Alto Networks shares are up nearly 3%. Tuesday evening’s complicated quarterly print and softer outlook were to blame. But I told members it was time to buy the leading cybersecurity name, not sell it. The Club is restricted but we plan to buy when we can.

- Japan stocks soar, with the Nikkei up more than 2%, closing above 39,000 and surpassing an all-time high that’s held for 35 years. Will the world’s fourth-largest economy export inflation?

- Multiple price cuts on Rivian. Tough quarter and job cuts and bad forecast. The EV maker’s stock drops nearly 18%.

- Etsy sees slowing market. Will first quarter be the low point? No gross merchandise sales growth. Shares of the online marketplace for handmade goods falls 5%.

- Barclays raises Walmart price target to $180 per share from $167. Keeps buy-equivalent overweight rating after a strong quarter. Walmart CEO Doug McMillon told me on “Mad Money” on Tuesday the retailer is well-positioned to grow its advertising business. Acquisition of connected TV maker Vizio for $2.3 billion part of the plan.

- TD Cowen upgrades Coty to outperform from market perform (buy from hold) and boosts price target to $16 per share from $13. The analysts see fragrance momentum and opportunities to go premium. Will those types of market forces boost E.l.f. Beauty and Club name Estee Lauder, too?

Sign up for my Top 10 Morning Thoughts on the Market email newsletter for free

(See here for a full list of the stocks at Jim Cramer’s Charitable Trust.)

What Investing Club members are reading right now

As a subscriber to the CNBC Investing Club with Jim Cramer, you will receive a trade alert before Jim makes a trade. Jim waits 45 minutes after sending a trade alert before buying or selling a stock in his charitable trust’s portfolio. If Jim has talked about a stock on CNBC TV, he waits 72 hours after issuing the trade alert before executing the trade.

THE ABOVE INVESTING CLUB INFORMATION IS SUBJECT TO OUR TERMS AND CONDITIONS AND PRIVACY POLICY, TOGETHER WITH OUR DISCLAIMER. NO FIDUCIARY OBLIGATION OR DUTY EXISTS, OR IS CREATED, BY VIRTUE OF YOUR RECEIPT OF ANY INFORMATION PROVIDED IN CONNECTION WITH THE INVESTING CLUB. NO SPECIFIC OUTCOME OR PROFIT IS GUARANTEED.