Interest in Linde (LIN) has spiked after Jim Cramer called the stock “nothing but nastiness” during its recent slide. At the same time, a new bullish analyst initiation and a fresh 364 day credit facility have reshaped the narrative.

See our latest analysis for Linde.

Despite the negative headlines, Linde’s recent slide, including a roughly 15.8% 90 day share price return and a 9.9% 1 year total shareholder return, looks more like cooling momentum after a strong multi year run than a broken story.

If this kind of volatility has you rethinking where to hunt for opportunities, it could be a good moment to explore fast growing stocks with high insider ownership.

With shares down double digits over the past year but analysts still seeing meaningful upside versus today’s price, is Linde quietly turning into a rare value in quality, or is the market simply baking in years of growth already?

Most Popular Narrative: 21% Undervalued

Compared with Linde’s last close of $399.57, the most-followed narrative pegs fair value materially higher, setting up a valuation gap driven by long dated growth assumptions.

Strategic investments and customer commitments in rapidly expanding growth markets such as commercial space launches, electronics, and clean hydrogen (with almost $5 billion in new clean energy contracts) provide a runway for high margin revenue streams and new project conversion that will structurally lift blended margins and earnings.

Want to see what kind of revenue climb and margin expansion justify that higher fair value, and which future earnings multiple underpins it all? The narrative lays out the full earnings roadmap, the projected profitability shift, and the valuation math tying those forecasts back to today’s price.

Result: Fair Value of $505.61 (UNDERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, structural weakness in European industrial demand and oversupply pressures in certain gases could weigh on volumes, pricing power, and the long term growth story.

Find out about the key risks to this Linde narrative.

Another Angle on Value

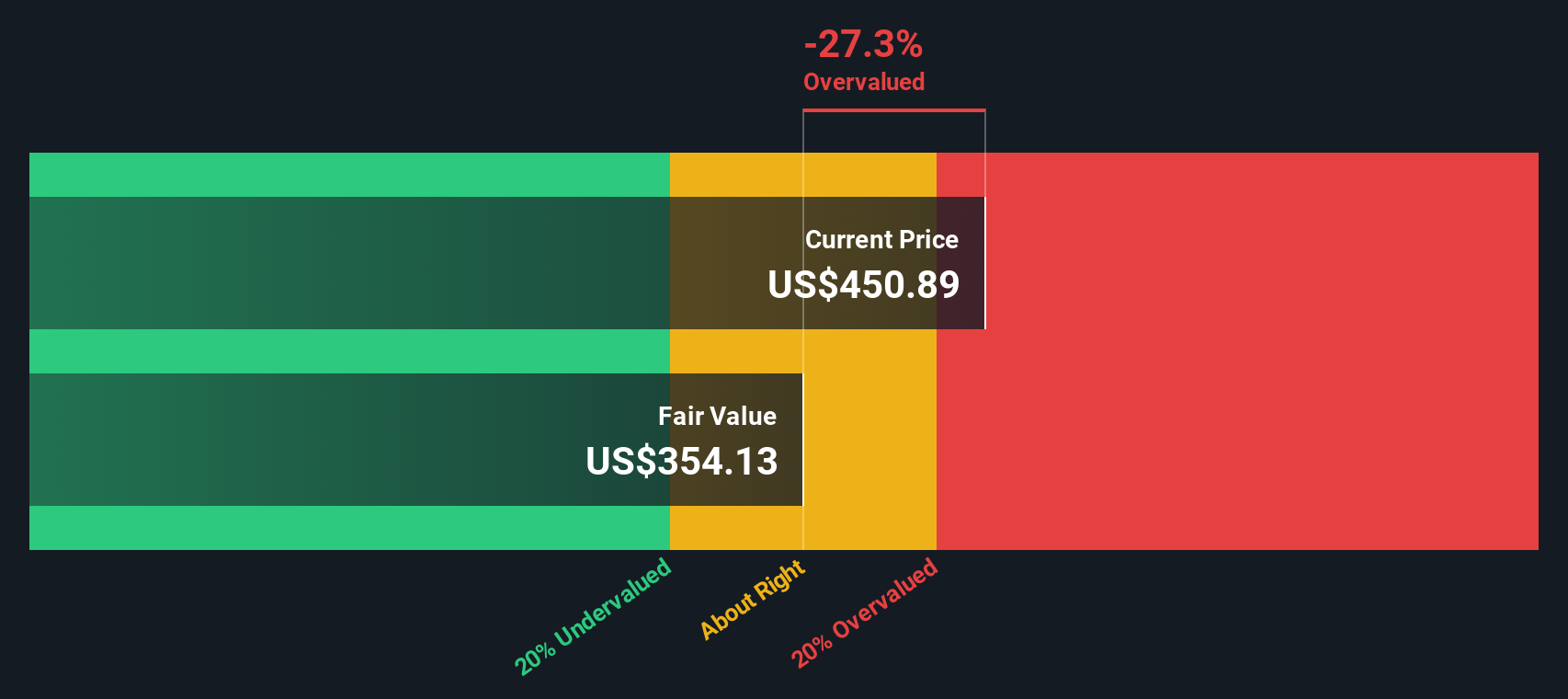

Our SWS DCF model is less forgiving than the growth narrative. It points to a fair value near $310.78, which makes today’s $399.57 share price look overvalued. If cash flows do not ramp as quickly as hoped, is the market already paying up for years of future execution?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Linde for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 907 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match – so you never miss a potential opportunity.

Build Your Own Linde Narrative

If you see the story differently or prefer to test the assumptions yourself, you can build a personalized view in minutes: Do it your way.

A great starting point for your Linde research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investment move?

Do not stop at one opportunity. Use the Simply Wall Street Screener to uncover targeted ideas that match your goals before others act first.

- Capture potential deep value by hunting through these 907 undervalued stocks based on cash flows that the market may be mispricing based on long term cash flows.

- Ride powerful innovation trends by zeroing in on these 26 AI penny stocks positioned to benefit from accelerating adoption of artificial intelligence.

- Strengthen your income strategy by scanning these 15 dividend stocks with yields > 3% that can supplement returns with steady cash payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com