Google and YouTube parent Alphabet GOOG didn’t look like a winner in the generative artificial intelligence arms race following Bard’s release. However, now that Gemini is replacing Bard, Alphabet has another chance to compete successfully in the AI-software arena. With that, GOOG stock provides immediate and direct portfolio exposure to AI technology in 2024.

Furthermore, as we’ll see, Alphabet has an AI-focused tie-in with a graphics processing unit developer that’s a darling of the market. All in all, it’s a win-win situation for the companies involved and for anyone smart enough to own Alphabet stock now.

Alphabet Brings Gemini’s AI Features Directly to Businesses

Make no mistake about it. While Bard wasn’t a tremendous success, Alphabet is moving full speed ahead with Gemini. For instance, the company just unveiled Gemini for Business. This is an add-on to Alphabet’s AI-enabled productivity-software suite, Gemini for Workspace.

Gemini for Business enhances the popular Gmail, Sheets, Slides, Docs and Meet programs with Gemini’s AI functionalities. Surprisingly, Gemini for Business only costs $20 per user per month.

This is a savvy way for Alphabet to court “enterprise” (i.e., business) clients and introduce them to Gemini’s AI features. In time, businesses will habitually use Gemini’s features to help create documents, draft email messages, conduct data analysis and so on. So, don’t be too surprised if Alphabet eventually charges more for access to Gemini for Business.

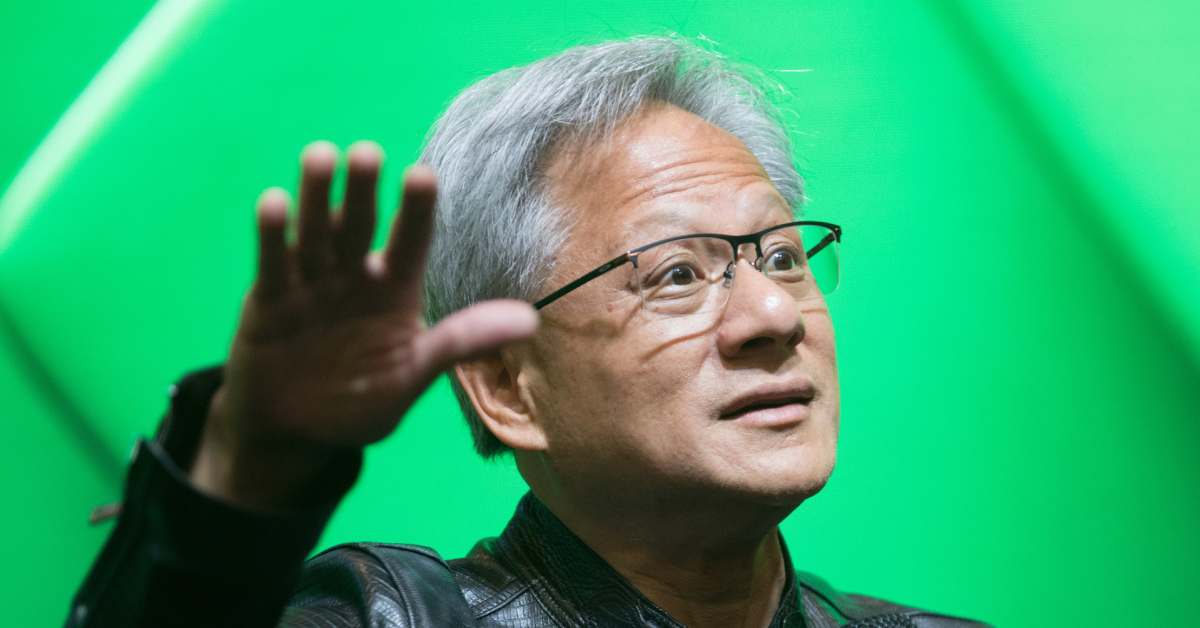

Alphabet Teams up With Nvidia

In 2024, a company can’t lose if it’s teaming up with the one and only Nvidia NVDA. Thus, it’s a huge coup for Alphabet to collaborate with Nvidia to offer optimized AI models.

More specifically, Nvidia announced that the two companies “launched optimizations across all NVIDIA AI platforms for Gemma” to run on Nvidia’s GPUs. Nvidia describes Gemma as Google’s “open language models that can be run anywhere.”

You’ll surely notice that Gemma sounds a lot like Gemini. That’s certainly by design, as Gemma is “built from the same research and technology used to create the Gemini models.”

Nvidia is effectively a kingmaker in today’s market. Alphabet doesn’t necessarily need the blessing of a kingmaker, but a tie-in with Nvidia is always a huge bonus. Now that Gemini is a collaborative effort with Nvidia’s involvement, there’s a prime opportunity for Alphabet to gain market share in the AI-software space.

GOOG Stock: Not Just a Search-Engine Investment Anymore

Alphabet in the 2020s is much more than just the Google search engine. It’s now a full-fledged AI company with a connection to the almighty Nvidia.

Plus, the Gemini for Business rollout could introduce Alphabet’s AI software to many enterprise customers. Consequently, if you’re serious about adding AI power to your portfolio in 2024, look no further than GOOG stock.

On the date of publication, David Moadel did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.

David Moadel has provided compelling content – and crossed the occasional line – on behalf of Motley Fool, Crush the Street, Market Realist, TalkMarkets, TipRanks, Benzinga, and (of course) InvestorPlace.com. He also serves as the chief analyst and market researcher for Portfolio Wealth Global and hosts the popular financial YouTube channel Looking at the Markets.

More from InvestorPlace