Lyft Inc (LYFT) said on Feb. 13 that it generated a positive $14.9 million in free cash flow in Q4 2023 and the ride-share company said it expects positive FCF in 2024. That could push LYFT stock 25% higher and is good for short-put investors.

LYFT stock closed at $17.91, which was substantially higher than its pre-earnings price of $12.40. It’s possible that, based on the company’s own guidance, the stock could still be worth substantially more.

This article will show how that price target could be 25% higher than today’s price. We will use that figure to help set an income play using short-put plays.

FCF Estimates

Lyft said that it expects to generate free cash flow (FCF) for the full year. It also gave us some guidance. Roughly half of its adjusted EBITDA (earnings before interest, taxes, depreciation, and amortization) will convert into FCF.

So, working backward, we can use Lyft’s average adjusted EBITDA margins to estimate its EBITDA for 2024. Then we can estimate its FCF. Based on that we can set a price target.

For example, in Q4 the company generated a 1.8% adj. EBITDA margin (i.e., 1.8% of sales became EBITDA cash flow). So, using analysts’ estimate of $5.08 billion in sales for 2024, we estimate $91.44 million in adj. EBITDA for 2024 (i.e., 0.18 x $5,080 million).

This implies $45.7 million in FCF for 2024. But that may not be it.

For example, if we assume that its adj. EBITDA margin improves throughout 2024, we can estimate that it will rise to 2.5% or so. That leads to an estimate of $63.5 million in FCF for 2024 (i.e., 0.25 x $5,080m x 0.5). And since analysts forecast $5.7b billion in sales for 2025, that puts the company on a run rate of achieving $71.25 million in FCF sometime in the next 12 months.

Setting a Price Target for LYFT Stock

That allows us to set a price target. For example, using a 0.80% FCF yield leads to a market cap estimate of $8.9 billion (i.e., $71.25m/0.008 = $8,900m). Why use a 0.80% FCF yield?

Well, consider this. Meta just started paying a dividend, and it now has a 0.42% dividend yield. So, if Lyft were to pay out all its FCF as a dividend, it would likely have at least a 0.80% dividend yield, or 2x higher (worse) than Meta’s.

Our estimate of an $8.9 billion market cap is 25% higher than its present market cap of $7.1 billion. In other words, LYFT stock could be worth as much as $22.39 (i.e., 1.25 x $17.91 per share today) sometime in the next 12 months.

Existing shareholders can use that to help set price targets for short-put option plays to generate extra income. Here is how.

Shorting OTM Puts in LYFT Stock

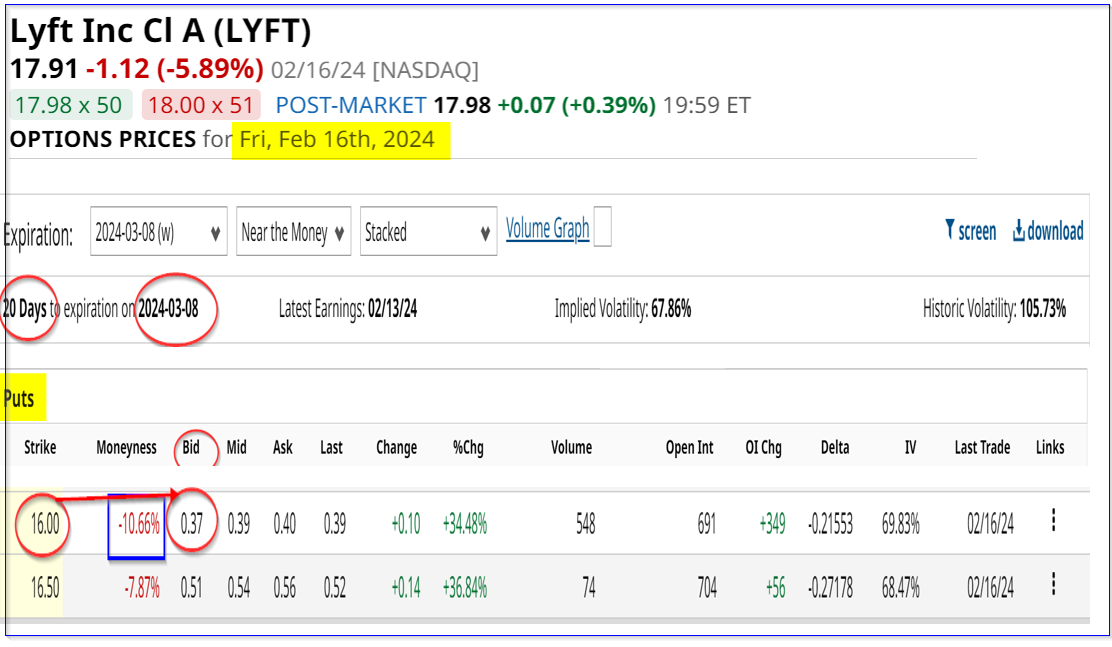

Right now LYFT stock has high put option premiums. The market may be expecting the stock to fall and have bid up the put option prices. Short sellers can generate good income taking advantage of this by selling short deep-out-of-the-money (OTM) puts in nearby expiry periods.

For example, look at the March 9 option expiration period, which is three weeks away. It shows that the $16.00 strike price puts, which are over 10% below Friday’s price of $17.91, trade for 37 cents on the bid side.

That implies that the short seller of these puts can make an immediate yield of 2.3125%. For example, if the investor secures $1,600 in cash and/or margin with their brokerage firm, they can enter an order to “Sell to Open” 1 put contract at $16.00 for expiration on March 8. The account then will immediately receive $37.00

Or they can secure $16,000 with the brokerage firm and sell short these puts to receive $370 immediately. That works out to over 2.31% (i.e., $370/$16,000).

Downside Protection

Moreover, there is good downside protection. LYFT stock would have to fall to $15.63 (i.e., $16-0.37) before there would be an unrealized capital loss. That provides 12.73% in downside breakeven protection with this trade (i.e., $15.63/$17.91-1).

If the investor can repeat this trade 4 times over the next quarter (i.e., 12 weeks) they stand to make 9.25% (i.e., $1,480/$16,000). That shows there is a good expected return, even if all of these trades are not profitable.

The bottom line is that LYFT stock still has good upside and shorting OTM puts is a good way to take advantage of this.

More Stock Market News from Barchart

- 2 Cheap Growth Stocks to Buy and Hold This February

- Stocks Finish Lower as Sticky Price Pressures Dampen Rate Cut Hopes

- Europe’s Most Valuable Stock Is a Must-Own Near 52-Week Highs

- Coinbase Stock Looks Attractive to Short Put Investors Based on Its Profitability and Positive Cash Flow

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.