In recent months, most Gulf bourses have experienced gains driven by upbeat earnings, with Saudi Arabia’s benchmark index advancing 0.8% and other regional indices showing positive momentum. As geopolitical tensions ease and investor focus shifts towards robust corporate earnings, the Middle East market presents a fertile ground for discovering promising stocks that are well-positioned to capitalize on these favorable conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

Let’s dive into some prime choices out of from the screener.

Fourth Milling (SASE:2286)

Simply Wall St Value Rating: ★★★★★☆

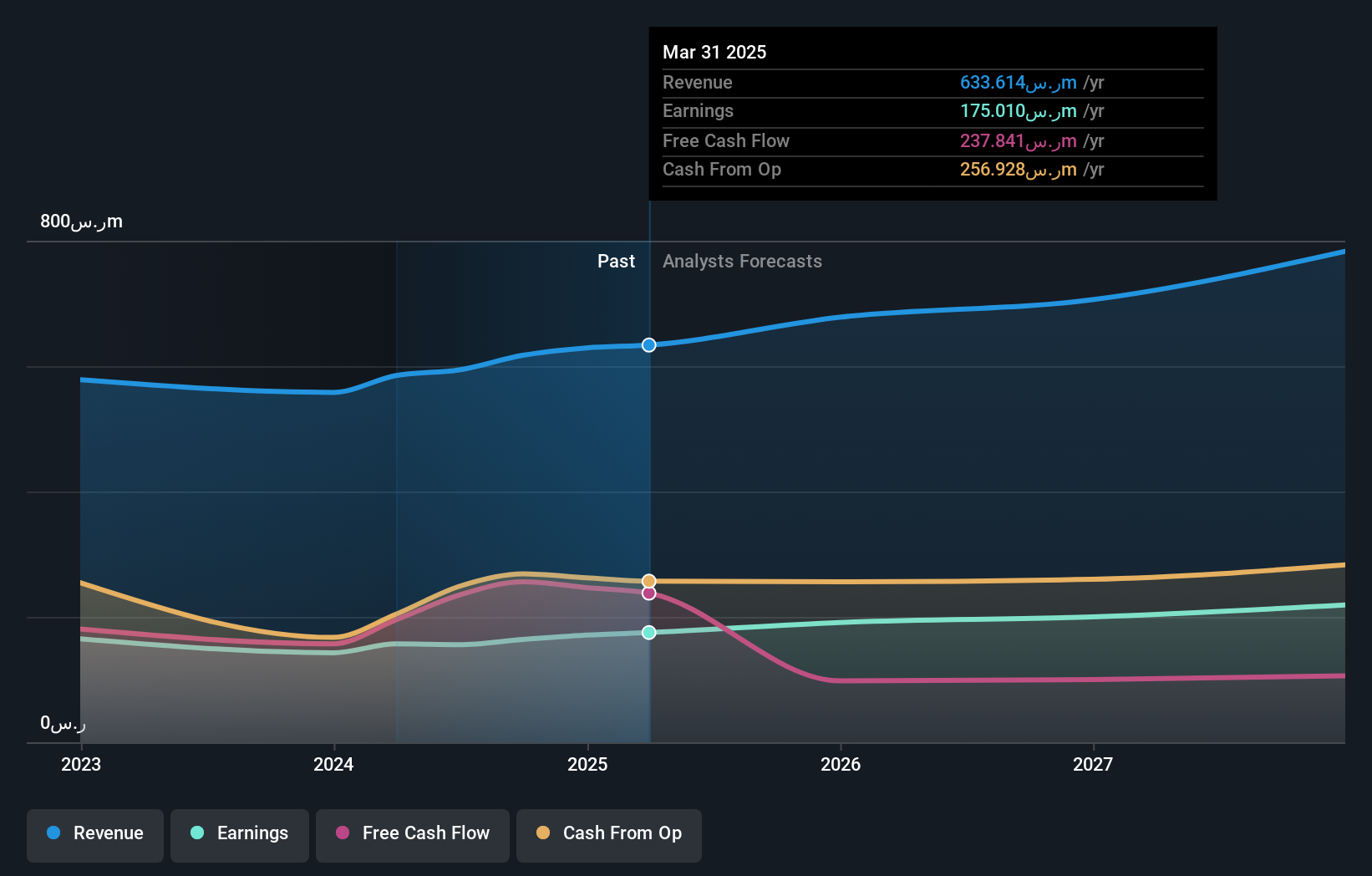

Overview: Fourth Milling Company operates in the Kingdom of Saudi Arabia, producing flour, feed, bran, and wheat derivatives with a market capitalization of SAR1.95 billion.

Operations: Fourth Milling generates revenue primarily from its food processing segment, which totals SAR646.51 million. The company’s financial performance is influenced by the costs associated with producing flour, feed, bran, and wheat derivatives.

Fourth Milling stands out with a debt-free balance sheet, enhancing its financial stability. Its earnings growth of 10% last year surpassed the food industry’s average of 5.5%, indicating strong operational performance. The company is trading at an attractive value, estimated to be 38% below its fair value, suggesting potential for appreciation. Recent board changes include appointing Mr. Yousef Afifi to the Audit Committee and Mr. Abdulaziz Al-Darrab as a Board Member, both bringing extensive industry expertise that could drive strategic growth and innovation in the coming years.

- Dive into the specifics of Fourth Milling here with our thorough health report.

-

Assess Fourth Milling’s past performance with our detailed historical performance reports.

Najran Cement (SASE:3002)

Simply Wall St Value Rating: ★★★★★★

Overview: Najran Cement Company is involved in the manufacture and sale of cement products within the Kingdom of Saudi Arabia, with a market capitalization of SAR1.05 billion.

Operations: The company generates revenue primarily from manufacturing cement, with sales amounting to SAR531.16 million.

Najran Cement, a relatively small player in the cement industry, has shown resilience despite recent challenges. Over the past year, its earnings growth of 35% outpaced the broader Basic Materials sector’s negative trend. The company’s debt to equity ratio improved from 17% to 14.5% over five years, indicating prudent financial management. Despite a net income drop to SAR 3 million in Q3 from SAR 15 million a year ago, Najran maintains high-quality earnings and satisfactory debt levels with interest payments well covered by EBIT at four times coverage. Recent Shariah-compliant financing of SAR 50 million supports subsidiary expansion plans.

- Navigate through the intricacies of Najran Cement with our comprehensive health report here.

-

Examine Najran Cement’s past performance report to understand how it has performed in the past.

Al Rajhi REIT Fund (SASE:4340)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Al Rajhi REIT Fund is a Sharia-compliant investment fund listed on Tadawul, focused on generating periodic income by investing in income-generating real estate assets in Saudi Arabia, with a market cap of SAR2.23 billion.

Operations: The fund primarily generates revenue from its commercial real estate segment, amounting to SAR258.85 million.

Al Rajhi REIT Fund offers a compelling narrative with its recent financial performance. Its earnings surged by 31% over the past year, outpacing the broader REIT industry which saw a -46% shift. The fund’s debt to equity ratio improved from 52% to 40%, reflecting prudent financial management. Additionally, interest payments are comfortably covered by EBIT at three times coverage, indicating sound operational efficiency. Despite a one-off gain of SAR81M impacting results, the price-to-earnings ratio remains attractive at 11.9x compared to the Saudi market average of 17.6x. A recent dividend increase further enhances investor appeal with SAR0.14 per share announced on February 1, 2026.

Key Takeaways

- Click here to access our complete index of 193 Middle Eastern Undiscovered Gems With Strong Fundamentals.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St’s portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St’s app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven’t yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com