It may not be the growth stock it once was, but there’s still has plenty of fuel left in the tank.

What is Warren Buffett’s favorite stock? Other than the company he chairs, Apple (AAPL -1.41%) may well be at the top of that list. The iPhone maker has been one of Buffett’s largest holdings for years, even as he has decreased his stake in the tech company over the past 12 months.

Regardless, Apple remains a top stock to buy, and thanks to ongoing development and progress, the company could deliver market-beating returns through the end of the decade. Let’s find out why.

Apple’s artificial intelligence (AI) play

The latest iteration of Apple’s famous device, the iPhone 16, came out earlier this year. The iPhone no longer generates the buzz it once did, but the company is counting on a suite of artificial intelligence (AI) features the iPhone 16 comes with to raise consumers’ interest.

None of Apple’s AI features are particularly new. They include generative AI-assisted writing, editing, and summarization tools; ChatGPT integrated with Siri; the ability to create images; and more, all of which many other companies offer in some capacity.

However, few companies have the kind of ecosystem and consumer loyalty that Apple has. Its integration of nifty AI tools into its most popular device (and others) at a time when people are generally excited about what the technology can do could lead to a robust renewal cycle, resulting in solid revenue growth.

Apple is just getting started, too. During the company’s fourth-quarter earnings conference call, CEO Tim Cook said: “This is just the beginning of what we believe generative AI can do, and I couldn’t be more excited for what’s to come.”

Some investors and analysts were unhappy with Apple because they thought it was trailing its tech industry peers in using AI. Apple, though, does not necessarily seek to be first to market. The iPhone was not the first portable phone or even smartphone, nor were its AirPods the first headphones. They were just significant improvements over the then-available options.

While it’s not known what Apple will do next in AI, but clearly, the company has big plans in that department. It could provide a significant tailwind for Apple in the coming years, especially as it has plenty of money to invest.

AAPL Free Cash Flow data by YCharts

Apple ended its latest period, the fourth quarter of its fiscal year 2024, with $108.81 billion in free cash flow, a slight increase compared to the year-ago period.

Services will play a role, too

In Apple’s fourth quarter (ended Sept. 28), the company reported revenue of $94.9 billion, an increase of 6% year over year. Apple’s services segment continues to grow faster than the rest of the business, with services sales coming in at about $25 billion, 12% higher than the year-ago period. According to management, Apple’s number of active devices reached a new all-time high, although it did not give an exact number. But it’s believed to be well over 2 billion.

Apple’s massive ecosystem is a major strength. It now boasts more than 1 billion subscriptions across its range of services.

True, this segment still makes up a relatively small part of the company’s revenue, but it has been growing faster than the rest of its business for some time. And as its ecosystem continues to grow, Apple’s product offerings and subscriptions will, too. That will add more fuel to the company’s growth engine through 2030, and likely well beyond that.

Don’t forget the dividend

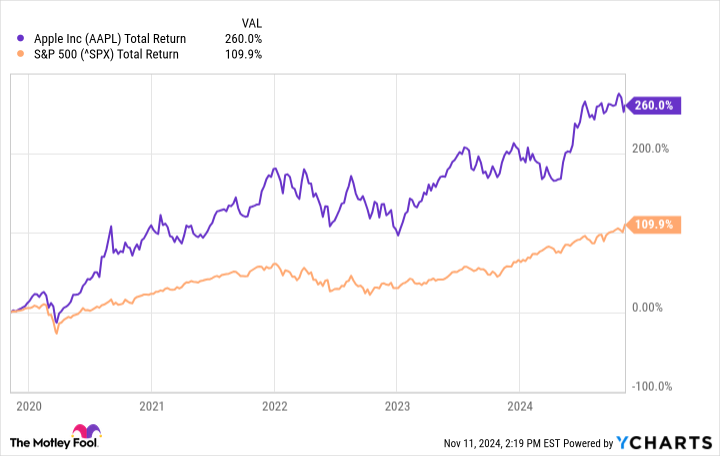

Apple’s total returns — including dividends reinvested — have outpaced the broader market in the past five years.

AAPL Total Return Level data by YCharts

Apple’s dividend program is most certainly one reason why Warren Buffett — who famously loves dividends — thinks so highly of the stock. Apple’s forward yield of 0.44% isn’t impressive. The average for the S&P 500 (^GSPC -1.32%) is 1.32%.

However, the company’s solid business, incredible ability to generate cash flow, and extremely conservative cash payout ratio of just 14% means Apple is a good dividend growth stock. That, combined with Apple’s financial results, could lead to superior returns through 2030.

Prosper Junior Bakiny has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple. The Motley Fool has a disclosure policy.