Why Rubrik stock is back on investors’ radar

Recent analyst coverage and revised opinions have put Rubrik (RBRK) in the spotlight again, as investors weigh its growth profile against ongoing questions around margins, valuation, and the durability of recent efficiency gains.

See our latest analysis for Rubrik.

Rubrik’s share price has cooled in recent months, with a 30 day share price return of 12.46% decline and a year to date share price return of 5.43% decline, even as the one year total shareholder return sits at 9.72%. This points to momentum fading after earlier enthusiasm around efficiency gains and growth expectations. At a latest share price of $71.37, recent moves suggest the market is reassessing how much it is willing to pay for that growth profile and the risks tied to margins and profitability.

If Rubrik’s recent swings have you thinking about what else is moving in data security and cloud, it could be worth scanning high growth tech and AI stocks for other potential ideas in the space.

With Rubrik still reporting a net loss of $376.751 million on revenue of $1,196.607 million and trading at $71.37, you have to ask yourself: is this an overlooked data security name, or is the market already pricing in future growth?

Most Popular Narrative: 36.3% Undervalued

With Rubrik’s last close at US$71.37 and the most followed narrative pointing to fair value around US$111.95, the gap between market price and narrative assumptions is hard to ignore.

The company’s pivotal role at the intersection of data security and AI, especially through products like Annapurna, can expand their total addressable market (TAM), potentially driving future revenue growth and enhancing their market position in this expanding field.

Curious what kind of growth it takes to justify that gap? This narrative focuses on revenue expansion, margin improvement and a rich future earnings multiple. Want to see how those pieces fit together to support that fair value?

Result: Fair Value of $111.95 (UNDERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, this bullish story can break if competition in cyber resilience limits Rubrik’s market share, or if AI and cloud products see slower than expected adoption.

Find out about the key risks to this Rubrik narrative.

Another View On Rubrik’s Valuation

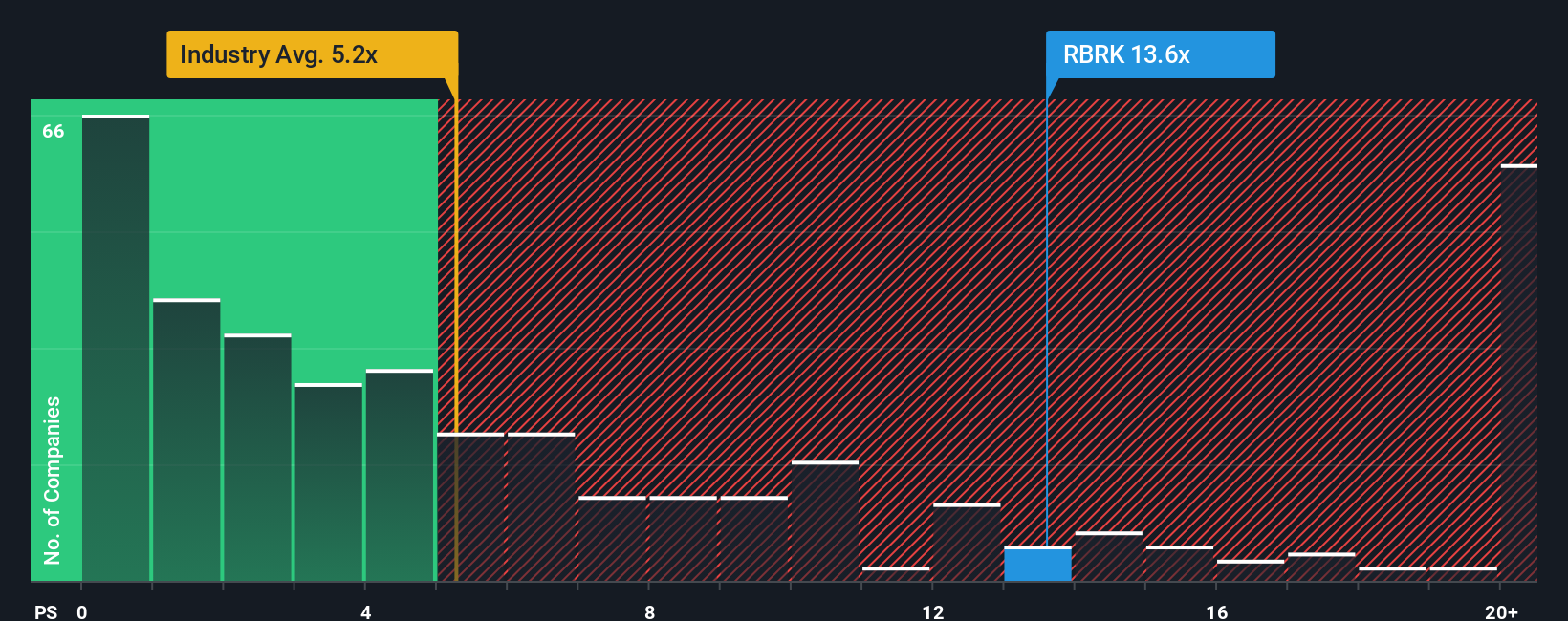

The most followed narrative leans on future earnings and a rich P/E to argue Rubrik looks undervalued. A simpler yardstick, today’s P/S ratio of 11.9x, tells a tougher story when you compare it with the US Software industry at 5x, peers at 8.4x, and a fair ratio of 10.2x. That gap suggests you are paying a higher price for each dollar of current sales, so the margin for error feels tighter, especially while the company is still loss making. The key question is whether you think future execution justifies that extra stretch.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Rubrik Narrative

If you look at this and think the assumptions do not quite fit, or prefer to test the numbers yourself, you can build a custom thesis in just a few minutes by starting with Do it your way.

A great starting point for your Rubrik research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Rubrik has sparked your interest, do not stop here. The next smart move is lining up a few more high conviction ideas to compare against it.

- Spot potential value opportunities by scanning these 881 undervalued stocks based on cash flows to find companies where the share price sits well below their estimated cash flow potential.

- Ride major tech shifts by checking out these 26 AI penny stocks focused on businesses building and monetizing AI driven products and services.

- Strengthen your income stream by reviewing these 12 dividend stocks with yields > 3% to see companies offering yields above 3% with regular dividend payments.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com