Rollins (ROL) is back in the spotlight after receiving new analyst coverage from JPMorgan. The coverage highlighted the company’s steady growth, recurring service revenues, and ongoing expansion efforts through acquisitions and technology upgrades.

This fresh analyst attention comes as Rollins continues to attract investors with its robust business model and resilient fundamentals. While the past year’s total shareholder return of nearly 19% underscores the company’s ability to create value over time, recent events such as solid earnings estimates and strategic acquisitions suggest momentum is building rather than fading.

If consistent performance and a wave of positive news have you searching for other companies on the rise, now is a great moment to broaden your search and discover fast growing stocks with high insider ownership

With shares recently hitting fresh highs and analysts highlighting robust earnings projections, investors may wonder if Rollins is still trading at an attractive valuation or if the stock now fully reflects its growth prospects. Does opportunity remain, or has the market already priced in future gains?

Most Popular Narrative: 1.6% Undervalued

Compared to the last close price, the most-followed narrative values Rollins at just above its recent market level, reflecting an almost even match between expectations and reality. Analysts are zeroing in on the factors that could push the stock higher, especially as operational momentum stays strong and market opportunities remain substantial.

There is a significant untapped market opportunity in the under-penetrated $20B U.S. pest control industry, giving Rollins a long runway for compounded growth. Strong performance momentum in late Q2, particularly in June, signals a robust pipeline and sets expectations for a solid Q3.

Want to know the secret behind that valuation uptick? The forecast depends on Rollins turning fresh commercial wins and efficiency bets into real margin gains. Dive into the full narrative to see which bold assumptions and sector moves shape the current price target. What do the analysts know that the market might be missing?

Result: Fair Value of $59.67 (UNDERVALUED)

However, potential headwinds such as rising operating costs or integration challenges from acquisitions could undermine these optimistic forecasts and affect Rollins’ growth trajectory.

Another View: What Do Price Ratios Say?

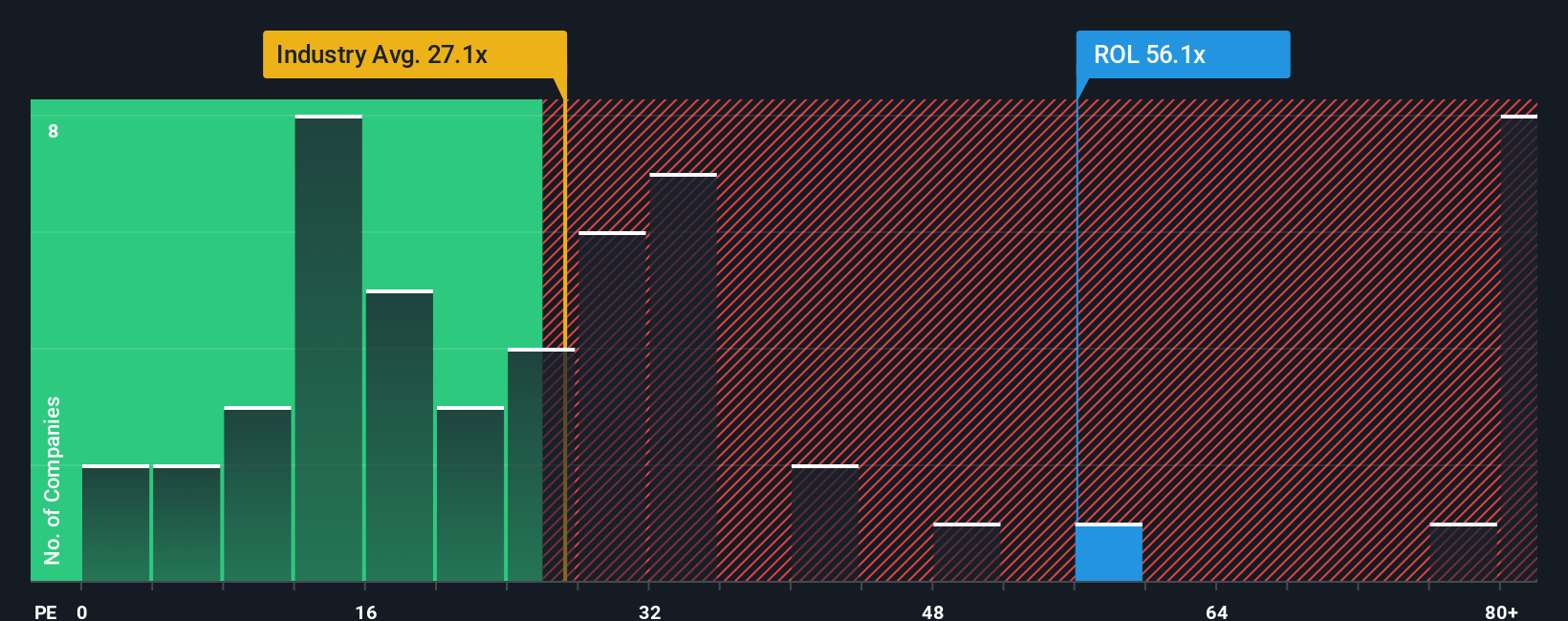

While analyst forecasts suggest Rollins is close to fair value, a look at its price-to-earnings ratio tells a different story. The company trades at 58.1x earnings, which is well above the US industry average of 29.6x, its peer average of 41.1x, and even the fair ratio estimate of 29.4x. This significant gap could mean the stock carries higher valuation risk. Will the market catch up to justify the premium, or is caution needed?

Build Your Own Rollins Narrative

If you want to challenge the consensus or prefer drawing your own conclusions from the numbers, you can quickly craft your own perspective in just a few minutes. All it takes is Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Rollins.

Looking for more investment ideas?

Stay ahead of the curve and supercharge your watchlist by checking out other stand-out opportunities that investors are talking about on Simply Wall Street.

- Supercharge your portfolio income and see which companies offer strong yields with these 19 dividend stocks with yields > 3%. This can provide steady returns even in volatile markets.

- Tap into tomorrow’s breakthroughs with these 26 quantum computing stocks. This resource pinpoints innovators at the forefront of quantum computing and advanced digital solutions.

- Strengthen your investment strategy by targeting real value in these 901 undervalued stocks based on cash flows. This tool connects you to businesses priced below their intrinsic worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.