Here’s why AppLovin stock could still have a lot of upside, even after a whopping 650% gain this year.

Palantir Technologies (PLTR 4.87%) is one of the hottest stocks of 2024, but I think there is another hot artificial intelligence (AI) software stock that investors should consider as well. AppLovin‘s (APP 4.74%) stock price is up more than 650% so far this year, far outpacing the stellar 250% gain seen in Palantir’s stock (all returns are as of this writing).

While Palantir is getting plenty of attention because its data collection, analytics, and AI platform are being used successfully by the U.S. government as well as several commercial entities, AppLovin’s business has flown under the radar. The company owns a legacy gaming app business, but its core business involves advertising technology used by mobile gaming companies and others to attract and better monetize users.

Let’s take a closer look at why investors should consider investing in this stock even after its huge gains this year.

AppLovin is seeing huge growth

AppLovin has generated spectacular revenue growth since the launch of its new AI-powered adtech platform Axon-2 (introduced in Q2 2023). That growth continued last quarter, when its software revenue surged 66% year over year to $835 million, while its overall revenue climbed 39% to $1.2 billion.

Just as important as the revenue growth, the company has also seen a lot of operating leverage in its business as well, which is leading to even stronger profitability growth. Last quarter, gross margins improved to 77.5% from 69.3% a year ago, while it lowered its sales and marketing spending by 3%.

This led AppLovin’s earnings per share (EPS) to more than quadruple from $0.30 a year ago to $1.25, while its adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) soared 72% to $722 million.

Eventually, the company expects to settle into long-term revenue growth of between 20% to 30% from just its gaming customers, although if it can move its adtech platform beyond its core gaming vertical, there is certainly an opportunity for its growth to continue to exceed its long-term target. The company has also said that it can grow beyond 30% a year in the gaming segment if it can start to implement more than one major enhancement to its adtech platform a year.

Outside gaming, AppLovin just started piloting its adtech platform within the broader e-commerce sector. It said results thus far are good, and it thinks e-commerce can be a meaningful contributor as early as next year. It will open a broader self-serve platform in the coming quarters.

If the company can innovate quickly and move beyond gaming, it should still see continued outsized revenue growth for years to come.

Image source: Getty Images.

Attractive valuation

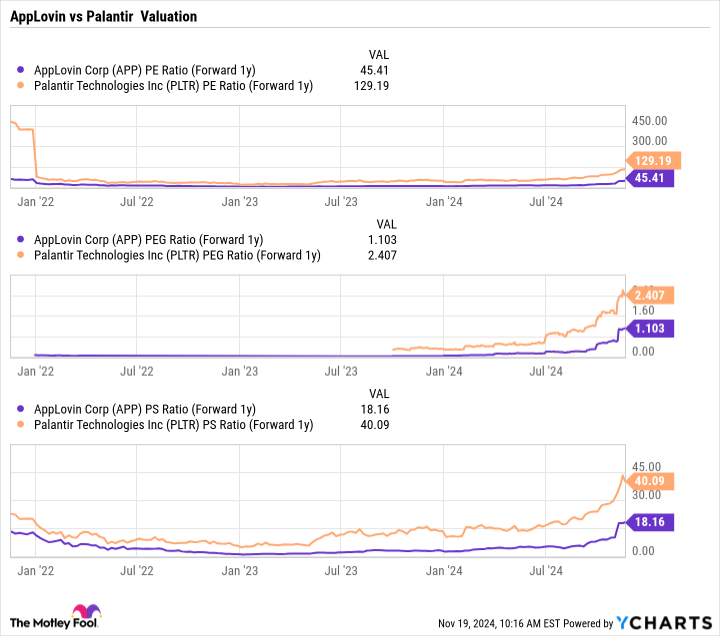

In addition to the continued growth opportunities, AppLovin still trades at an attractive valuation despite the huge gains in its stock this year. Based on next year’s analyst estimates, the stock trades at a forward price-to-earnings (P/E) of just over 45 times, while it has a price/earnings-to-growth (PEG) of 1.1 times. A PEG ratio of under 1 is typically viewed as undervalued, but growth stocks will often have PEG multiples well above 1. Thus, I would say that based on its long-term growth prospects, AppLovin still trades at an attractive valuation.

Meanwhile, compared to Palantir, AppLovin’s valuation is much lower. Palantir trades at 40 times next year’s revenue, while AppLovin trades at 45 times next year’s earnings. Meanwhile, AppLovin has also been growing its revenue at a faster clip. Last quarter, it grew its overall revenue by 39%, while Palantir grew its revenue by 30%.

APP PE Ratio (Forward 1y) data by YCharts

In December 2022, investors could have scooped up AppLovin stock for under $10, so investors could have turned a $35,000 investment into over $1 million in less than two years if they had held on to the stock.

I would not expect that type of return from AppLovin moving forward, but I continue to think the stock could be a good option to consider for investors looking to build out a millionaire-making portfolio. I first wrote favorably about the stock back in April, when it was up 375% over the past year at the time, and the stock has not slowed down one bit. While its valuation has risen since then, its growth opportunities remain in place, and the stock is still not pricey.

Geoffrey Seiler has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends AppLovin and Palantir Technologies. The Motley Fool has a disclosure policy.