Stock market LIVE updates on April 15, 2024: The war’s impact on oil prices would be a key factor to watch out for an energy-sensitive country like India

)

stock brokers, BSE, NSE, Sensex, Nifty

Stock market LIVE updates on April 15: Escalation in the Iran-Israel war over the weekend is expected to cloud the sentiment on Monday, and may drive investors towards safe haven like Gold.

Besides, the war’s impact on oil prices would be a key factor to watch out for an energy-sensitive country like India.

At 7:15 AM, Gift Nifty was down nearly 150 points at 22,453 levels.

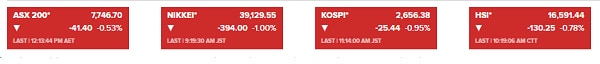

Elsewhere in Asia, Nikkei, and Kospi declined 1.3 per cent each, while ASX200 fell 0.7 per cent.

Corporate Earnings

Back home, focus would also be on March quarter (Q4FY24) results of GTPL Hathway, Hathway Bhawani Cabletel & Datacom, Metalyst Forgings, Ontic Finserve, Rajoo Engineers, Hit Kit Global Solutions, Shekhawati Poly-Yarn, Atam Valves, and Sybly Industries.

Market participants will also react to the Q4 numbers of Tata Consultancy Services (TCS) which came after market hours last Friday.

9:13 AM

Pre-open: Sensex down 930 points

9:01 AM

ALERT :: Adani Green Q4 business update

>> Solar energy sold up 7% YoY at 3,066 million units

>> Solar plant availability unchanged at 99.8% YoY

>> Solar grid availability at 99.7% vs 99.6% YoY

>> Wind energy sales up 43% YoY at 614 million units

>> Wind plant availability at 96.6% vs 94.7% YoY

>> Wind grid availability at 98.6% vs 99.7% YoY

8:56 AM

Near-term growth snags could keep IT services giant TCS in a bind

The headcount reduction that started at the beginning of FY24 continued in the January–March quarter, which saw a 2.2 per cent drop year-on-year (Y-o-Y). While the company had over 614,000 employees at the start of the financial year, it is down to a shade over 600,000 at the end of the year. Further gains on the employee front could be hard to come by. READ MORE

8:52 AM

‘Govt bond yields expected to stabilise after witnessing last week’s surge’

“The rising tension between Iran and Israel has thrown this region into deeper crisis. The unabated geopolitical tensions will lead to a rise in crude prices that will be a big worry for us,” said VRC Reddy, head of treasury at Karur Vysya Bank. READ MORE

8:48 AM

Stocks to Watch today: TCS, GIC, HAL, LIC, Anand Rathi, Aster DM, IT shares

Results today: Nine companies scheduled to report earnings today, including GTPL Hathway, Bhawani Cable and Rajoo Engineers.

TCS: The IT major reported a net profit of Rs 12,434 crore, up 9.1 per cent year-on-year (Y-o-Y) on Friday post market hours. Sequentially, profit grew 6 per cent. Revenue for the quarter was up 3.5 per cent Y-o-Y at Rs 61,237 crore, and up 1 per cent QoQ. The company signed one of its highest total contract values (TCV) – $13.2 billion – in the fourth quarter of FY24. READ MORE

8:44 AM

Nifty may have formed a short-term top; momentum indicators turn bearish

Traders should be cautious as the index may encounter selling pressure on any upward movements in the near term. Regarding resistance levels, significant barriers are anticipated at 22,595, 22,675, and 22,800. These levels are crucial for traders to observe as selling opportunities, especially considering the supportive signals from technical indicators like the Moving Average Convergence Divergence (MACD) and the Relative Strength Index (RSI). Both indicators indicate bearish tendencies, reinforcing the potential for underperformance in the near term. READ MORE

8:40 AM

Fund Flow :: DIIs buy equities worth Rs 6,341.53 crore on April 12

8:36 AM

Fund Flow :: FIIs/FPIs massively sold Indian equities last Friday

>> FIIs/FPIs sold equities worth Rs 8,027 crore on April 12

8:33 AM

Gift Nifty cues :: Index down over 100 points

>> Gift Nifty futures were down 132 points at 22,467 levels, indicating a firm gap-down start

8:30 AM

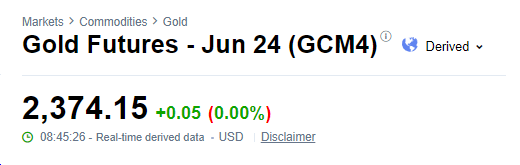

Gold Futures hold above $2,350 per ounce in International markets

8:26 AM

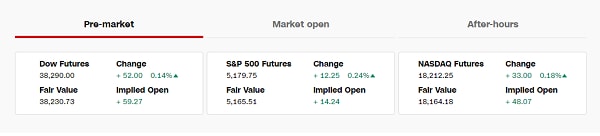

Wall Street Futures :: US index futures in green despite Middle East tensions

8:23 AM

Iranian currency plunges to record low against dollar

>> Iran’s currency, the rial, briefly plunged to a record low against the dollar on the unofficial market, after Tehran launched an expansive missile and drone attack on Israel on Saturday night, exacerbating tensions in the Middle East.

>> The exchange rate was at 705,000 rials / USD on the open market on Sunday, according to data from foreign exchange monitoring site Bonbast. The Iranian currency has since pared some losses.

>> The government set an official exchange rate of 42,000 rials / USD in 2018.

Source: Agencies

8:20 AM

Oil prices could see ‘super spike well above $100’ if…

>> Oil prices could soar to $100 per barrel and beyond, said market watchers, after Iran mounted an aerial attack against Israel reigniting fears of a regional war.

>> Iran is home to vast oil resources and is the third-largest producer in oil cartel OPEC.

>> Any disruption in its capacity to supply global markets could send oil prices higher, analysts told CNBC. Markets will also closely monitor for developments or closure of the Strait of Hormuz, a key chokepoint which sits between Iran and Oman and through which one-fifth of global oil production flows daily.

Source: CNBC

8:17 AM

Japan’s machinery orders rise sharply, may ease concerns about domestic demand

>> Japan’s key gauge of capital spending jumped the most in a year in February, rebounding sharply from the prior month’s decline

>> Core machinery orders rose 7.7% in February from the previous month, blowing past a 0.8% increase expected by economists in a Reuters poll

>> It was the fastest growth in core orders since January 2023 and more than recouped a 1.7% fall in the previous month.

Source: Reuters

8:15 AM

China central bank keeps policy rate unchanged, drains cash from banking system

>> China’s central bank on Monday left a key policy interest rate unchanged as widely expected when rolling over maturing medium-term loans, and drained some cash from the banking system through the bond instrument.

>> Keeping the medium-term lending facility (MLF) rate steady underscores the central bank’s intention to maintain currency stability amid a shaky economic recovery and push back on market expectations around the timing of a first US Federal Reserve interest rate cut this year

Source: Reuters

8:13 AM

Cryptocurrencies turn volatile on increased Middle East tensions

>> Bitcoin and other cryptocurrencies were volatile after Iran launched an unprecedented drone and missile attack on Israel.

Source: Agencies

8:10 AM

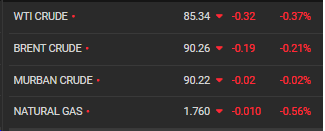

Oil prices fall slightly after Israel fends off large-scale aerial attack by Iran

>> US crude oil futures were slightly lower Sunday as traders breathed a sigh of relief after Israel fended off a large-scale air assault by Iran and the US emphasised it wants to avoid a wider war in the Middle East.

>> The West Texas Intermediate contract for May lost 34 cents to $85.32 a barrel as trading began Sunday evening. June Brent futures eased slightly to $90.18 a barrel.

>> US crude closed at $85.66 a barrel Friday, while the global benchmark settled at $90.45. WTI futures began the year around $71 a barrel.

Source: CNBC

8:07 AM

Commodity Check :: Brent crude holds $90 per barrel

8:05 AM

Asian markets :: Indices fall up to 1% led by Nikkei

8:02 AM

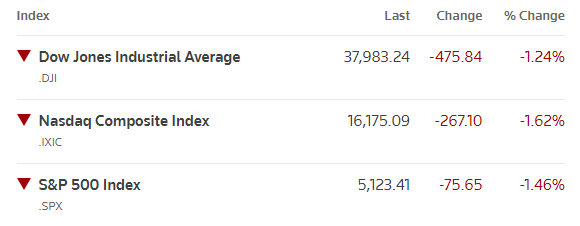

Wall Street on Friday :: All indices lose ground, fall over 1%

Don’t miss the most important news and views of the day. Get them on our Telegram channel

First Published: Apr 15 2024 | 7:56 AM IST