Stock Market LIVE updates on Tuesday, April 16: Overnight, US stocks retreated on Monday as rising yields and worries over the conflict in the Middle East overshadowed strong Goldman Sachs earnings

)

Stock market LIVE updates on April 16: The rout in global equities, including India, may extend on Tuesday amid reports that Israel is preparing for an ‘imminent’ attack on Iran.

The latter, on its part, has said that it doesn’t want to escalate the conflict but would defend its territory.

At 7:05 AM, Gift Nifty futures were down 107 points at 22,250 level.

Across Asia, Japan’s Nikkei, and South Korea’s Kospi tumbled 2 per cent each, while Australia’s ASX 200, and Hong Kong’s Hang Seng shed 1.4 per cent each.

Overnight, US stocks retreated on Monday as rising yields and worries over the conflict in the Middle East overshadowed strong Goldman Sachs earnings and hot retail sales data.

The Dow Jones Industrial Average lost 0.65 per cent, the S&P 500 slipped 1.2 per cent, and the Nasdaq Composite tumbled 1.79 per cent.

Stocks to Watch

Oil-linked stocks: The Central government has raised windfall tax on petroleum crude to Rs 9,600 ($114.99) a metric ton from Rs 6,800 with effect from April 16.

Reliance Industries: Jio Financial Services, led by Mukesh Ambani, plans to venture into the stockbroking and wealth management business through an equal joint venture (JV) with US-based BlackRock. This is the duo’s second JV.

Manappuram Finance: The Board of the gold financier will meet on April 19 to consider raising funds amounting to $500 million.

9:04 AM

Pre-open: Sensex slips 420 points at 72,978

9:01 AM

Should FPIs be worried about latest change to India-Mauritius tax treaty?

” This change the in the treaty means that benefits of lower taxation as available under the treaty can be denied to investors investing via Mauritius if one of the primary purposes of investing via Mauritius was to obtain a tax Benefit. Investment via the Mauritius route were already on the decline and this step will further ensure that only those funds which can prove legitimate business reasons to be based out of Mauritius, will choose to invest through that jurisdiction,” said Pallav Pradyumn Narang, Partner, CNK READ MORE

8:57 AM

Market Strategy :: Sectors to focus on as markets likely to stay weak in near-term

Triggers for markets:

1) The economic factor is the rising US bond yields (10-year yield is above 4.6% ) which reduces the prospects of rate cuts by the Fed this year. High bond yields are negative for risky assets like equity and will accelerate FII selling in emerging markets like India.

2) Israel’s military chief’s statement that “there will be a response to Iran’s attack on Israel” has increased the probability of escalation of tensions in the Middle East.

Strategy:

Investors may wait and watch the developments. Meanwhile, long-term investors can slowly accumulate high quality large-caps on corrections.

Large-caps in banking, IT, autos, capital goods, oil & gas and cement are ideal for long-term investment. Since metal prices are firming up, metal stocks will remain resilient.

Views by: V K Vijayakumar, Chief Investment Strategist, Geojit Financial Services

8:53 AM

From SBI to Quant, smallcap schemes witness easing of stress levels

SBI and Axis smallcap funds managed to improve their liquidity metrics even as their smallcap exposure inched up in March from February. SBI smallcap fund’s smallcap holdings rose from 81 per cent to 82 per cent. Axis smallcap fund also saw a 1 percentage point rise in exposure. READ MORE

8:50 AM

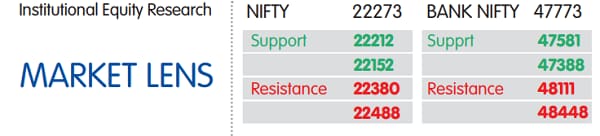

Market Lens :: Key levels for Nifty, Bank Nifty

8:46 AM

NCLAT to hear IDBI Bank, Axis Finance plea on Zee-Sony merger on May 17

Meanwhile, Senior Advocate Arun Kathpalia, appearing for Zee Entertainment Enterprises Limited (ZEEL), said the NCLAT case was an appeal against the sanction to the Zee-Sony merger, while the one in NCLT dealt with the implementation of the merger. READ MORE

8:44 AM

HDFC MF divests 2% stake in VST Industries shares for Rs 122 crore

HDFC Mutual Fund on Monday sold a 2 per cent stake in VST Industries for Rs 122 crore through open market transactions. According to the bulk deal data available with the BSE, HDFC Mutual Fund sold a total of 3,30,811 shares, amounting to a 2.14 per cent stake in VST Industries. READ MORE

8:41 AM

Stocks to Watch today: Jio Financial, Cipla, Vi, Brigade, Vedanta, Aster DM

Results today: Crisil, Den Networks, Integra Essential, Lotus Choclate and SG Mart to announce Q4 earnings today. Angel One, Hathway Cable, ICICI Lombard General Insurance, Just Dial and Tata Communications to report results on Wednesday.

Jio Financial: The Mukesh Ambani led company plan to venture into the stockbroking and wealth management business through an equal joint venture (JV) with US-based BlackRock. Earlier, the two had entered into an agreement for Mutual Fund JV, they awaiting Sebi’s approval for a licence. READ MORE

8:38 AM

Nifty Bank, Nifty Financial Services charts signal downtrend in near-term

Given this scenario, the recommended trading strategy would be to sell on rallies. The indication of a negative trend is further supported by the MACD indicator, which is trending downwards. This adds credence to the bearish outlook for the near term, signaling that downward momentum may persist. READ MORE

8:34 AM

ALERT :: Sell-off in Gift Nifty deepens

>> Index sinks over 200 points at 22,135

8:30 AM

ALERT :: Japan’s Yen hits a fresh three-decade low of 154

>> Japanese Finance Minister Shunichi Suzuki said on Tuesday he was closely watching currency moves and will provide a “thorough response as needed” after the dollar surged to a fresh 34-year high.

>> The dollar hovered around 154.15 yen after breaching the 154 yen level in Asia late Monday, the highest since June 1990.

>> In a press conference, Suzuki said he was not aware that foreign exchange will be explicitly addressed at the G20 finance minister meeting in Washington this week, but the subject would be brought up as a topic of conversation.

Source: Reuters

8:27 AM

Record bond-sale spree fuels profits for Goldman, Citi, JPMorgan

>> Banks are getting an earnings boost from underwriting fees as companies sell debt in the US at a record pace.

>> The issuance spree helped to generate $699 million of debt-underwriting revenue for Goldman Sachs Group Inc. in the first quarter, a nearly 40% jump from a year earlier, contributing to its stronger-than-expected earnings.

>> Citigroup’s profits – released on Friday (Apr 12) – were fuelled in part by the surge in corporate borrowing.

>> JPMorgan Chase & Co’s investment-banking fees jumped 21 per cent, while Wells Fargo & Co’s revenue topped estimates due to an increase in investment advisory fees and brokerage commissions.

>> The pace of debt sales quickened this year as the market dialled back expectations for interest-rate cuts from the Federal Reserve, giving corporations a strong incentive to tap the market in case the presidential election sows uncertainty in markets.

>> Companies borrowed a record US$573.7 billion so far this year to Friday, according to data compiled by Bloomberg.

Source: Bloomberg

8:24 AM

ALERT :: Israeli military pledges response to Iran attack amid calls for restraint

>> Israel’s military chief said on Monday his country would respond to Iran’s weekend missile and drone attack amid calls for restraint by allies anxious to avoid an escalation of conflict in the Middle East.

>> Prime Minister Benjamin Netanyahu summoned his war cabinet for the second time in less than 24 hours to weigh how to react to Iran’s first-ever direct attack on Israel, a government source said.

>> Israel’s military Chief of Staff Herzi Halevi said the country would respond, but provided no details.

Source: Reuters

8:21 AM

ALERT :: Hong Kong regulators approve launch of spot bitcoin and ether ETFs

>> Hong Kong regulators on Monday approved the launch of spot Bitcoin and Ether exchange-traded funds (ETFs), asset managers said.

>> Three ETF providers have been approved by Hong Kong’s Securities and Futures Commission (SFC).

>> While these asset managers have received the green light for the ETFs, they have not yet launched them.

>> Crypto trading is effectively banned in mainland China after a massive crackdown on the sector in 2021.

>> However, Hong Kong has slowly been trying to make itself a regulated crypto hub to compete with places like Dubai and Singapore.

Source: CNBC

8:18 AM

ALERT :: China’ Q1 GDP grows at 5.3%

>> China’s economy in the first quarter grew faster than expected, official data released Tuesday by China’s National Bureau of Statistics showed.

>> Gross domestic product in the January to March period grew 5.3% compared to a year ago, faster than the 4.6% growth expected by economists polled by Reuters, and compared to the 5.2% expansion in the fourth quarter of 2023.

>> On a quarter-on-quarter basis, China’s GDP grew 1.6% in the first quarter

>> Beijing has set a 2024 growth target of around 5%.

Source: CNBC

8:15 AM

Crypto universe :: Bitcoin falls over 1%, Ether up

8:12 AM

Commodity Check :: Gold, Silver extend rally amid safety rush

8:09 AM

Commodity Check :: Oil prices extend gains, Brent up 0.7%

8:06 AM

US Futures :: Index futures remain in red zone

8:03 AM

Asian markets :: Nikkei, Kospi lead the broad-based selling

Don’t miss the most important news and views of the day. Get them on our Telegram channel

First Published: Apr 16 2024 | 7:56 AM IST