Stock Market Live: Benchmark Indian equity indices traded higher on Wednesday, following a lower open amid the cautious mood on Wall Street overnight

Share Market Today: Foreign institutional investors net sold shares worth Rs 3,978.61 crore, while domestic institutional investors net bought shares worth Rs 5,869.06 crore on Tuesday, October 21. (Photo: Bloomberg)

Stock Market LIVE Updates, Wednesday, October 23, 2024: Indian benchmark equity indices BSE Sensex and Nifty 50 were trading higher amid volatility in the markets.

At 10 AM, the BSE Sensex was up 139.72 points, or 0.16 per cent, at 80,351.44, while the Nifty 50 was at 24,500.85, up 28.75 points, or 0.12 per cent.

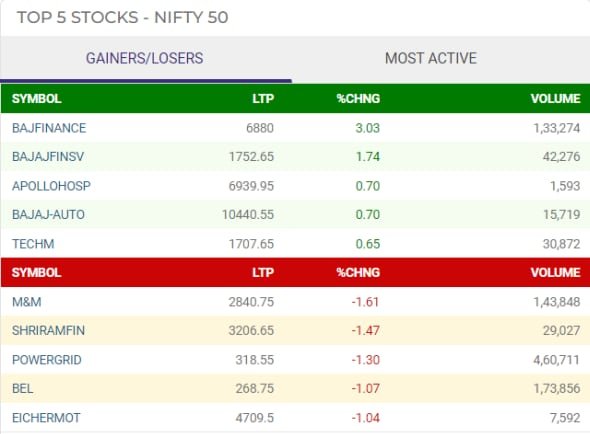

After opening bell, more than half the stocks on the BSE Sensex were trading with gains, led by Bajaj Finance (up 3.15 per cent), followed by Bajaj Finserv, HDFC Bank, Tata Steel, and Nestle India. In contrast, loses were capped by Mahindra & Mahindra (down 1.17 per cent), followed by Power Grid Corp., Sun Pharma, Asian Paint, and NTPC.

On the Nifty 50, half of the stocks were trading with gains, while the rest dragged. Loses were capped by Mahindra & Mahindra (down 1.36 per cent), followed by Eicher Motors, Power Grid Corp., Shriram Finance, and Dr Reddy’s, while gains were led by Bajaj Finance, (2.76 per cent), followed by Bajaj Finserv, Bajaj Auto, Adani Enterprises, and HDFC Bank.

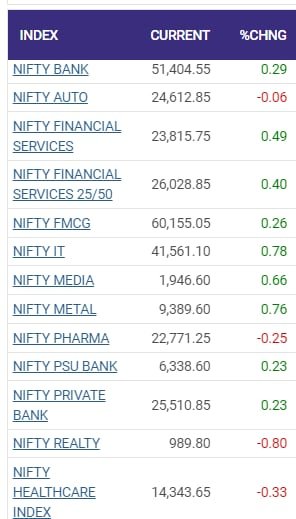

Among sectoral indices the Realty, Healthcare, Pharma, and Auto indices were trading in the red, while IT and Metal indices were trading in the lead with marginal gains.

In the broader markets, the BSE Midcap index was ahead by 0.21 per cent, and the BSE SmallCap was higher by 0.51 per cent.

Benchmark equity indices BSE Sensex, and Nifty 50 ended Tuesday’s trading session in the red, each falling by over 1 per cent. The BSE Sensex crashed 930.55 points, or 1.15 per cent, to settle at 80,220.72, while the Nifty 50 ended at 24,472.10, down 309 points, or 1.25 per cent.

Smallcap stocks were the worst hit among the broader markets, as the Nifty Smallcap 100 closed 3.92 per cent lower, and the Nifty Midcap 100 was 2.61 per cent lower at close.

Notably, the fear index, India VIX, which gauges the volatility in the Indian stock markets, ended higher by 4.21 per cent at 14.34 points.

Among sectoral indices, the Nifty PSU Bank index was the worst hit, ending down by 4.18 per cent. This was followed by realty and metal indices, which settled lower by 3.08 per cent and 3 per cent, respectively.

Auto, media, consumer durables, and select healthcare indices also closed down by over 2 per cent each.

Meanwhile, markets in the Asia-Pacific region were mixed, with Japan’s Nikkei 225 trading slightly below the flatline, down 0.04 per cent, while the broad based Topix was higher by 0.19 per cent.

South Korea’s Kospi was up 0.43 per cent, while the small-cap Kosdaq was down 0.72 per cent.

Australia’s S&P/ASX 200 was up 0.14 per cent, while in mainland China, the Shanghai Composite was down 0.08 per cent, and the CSI300 was down 0.53 per cent.

However, the Hang Seng index was ahead by 0.39 per cent.

That apart, global stocks dropped for the second straight session while US yields rose on Tuesday amid market uncertainty ahead of the US election as well as the outlook on interest rate cuts.

Democratic Vice President Kamala Harris held a marginal lead of 46 per cent to 43 per cent over Republican former President Donald Trump, according to a Reuters/Ipsos poll, as both candidates vie to capture swing states ahead of November 5.

The benchmark S&P 500 and the Dow finished lower in choppy trading driven by losses in industrials, materials and utilities stocks. The Nasdaq ended higher as investors digested corporate results from companies across sectors in the US economy.

The Dow Jones Industrial Average fell 0.02 per cent to 42,924.89, the S&P 500 fell 0.05 per cent to 5,851.20 and the Nasdaq Composite rose 0.18 per cent to 18,573.13.

The pan-European STOXX 600 index finished down 0.21 per cent. MSCI’s gauge of stocks across the globe fell 0.29 per cent to 851.14.

“Yields being up is a big headwind,” said David Spika, chief markets strategist at Turtle Creek Wealth Advisors in Dallas. “We’ve seen the largest increase post a rate cut in the 10-year in the last 30 years … I think the bond market is telling us don’t be pricing in a whole bunch of rate cuts anytime soon. To expect the Fed to just be cutting rates 50 basis points every meeting is not realistic.”

The odds that the Fed will deliver a quarter-point cut at its November 7 meeting are at 92 per cent, while the chance of no rate cut is at 8 per cent, according to CME’s FedWatch tool.

Benchmark 10-year Treasury yields were up 2.2 bps at 4.204 per cent, after earlier reaching 4.222 per cent, the highest level since July 26.

The US dollar rose to a fresh 2-1/2-month high amid Fed rate cut expectations. The dollar index, which measures the dollar against a basket of currencies, rose 0.13 per cent to 104.09, after hitting 104.10, its highest since August 2.

“I think the election odds are fairly split between Trump and Harris, and broadly, it’s a story of stronger economic growth,” said Eric Wallerstein, chief markets strategist at Yardeni Research in Santa Monica, California.

Oil prices rose for the second consecutive session, as traders downplayed hopes of a Middle East ceasefire and focused on a tightening global supply and demand balance.

Brent crude futures for December settlement rose 2.36 per cent to $76.04 per barrel. US West Texas Intermediate futures for November delivery, which expire after Tuesday’s settlement, rose 2.17 per cent to $72.09 a barrel.

Gold hit an all-time peak. Spot gold rose 1.03 per cent to $2,747.56 an ounce. US gold futures settled 0.8 per cent higher at $2,759.8.

(With inputs from Reuters.)

10:45 AM

Stock Market LIVE Updates: ITC Q2 preview: Cigarette, hotel, FMCG biz to aid profit; margins may slip

Stock Market LIVE Updates: The cigarette-to-hotel conglomerate ITC is set to announce its July-September quarter (Q2) results for financial year 2024-25 (FY25) on Thursday, October 24.

The brokerages tracked by Business Standard expect ITC’s net profit to rise 1.95 per cent in the quarter ended September on an average to Rs 5,023.13 crore as compared to Rs 4,927 crore a year ago. On a sequential basis, the PAT is expected to rise by 2.15 per cent. READ MORE

10:43 AM

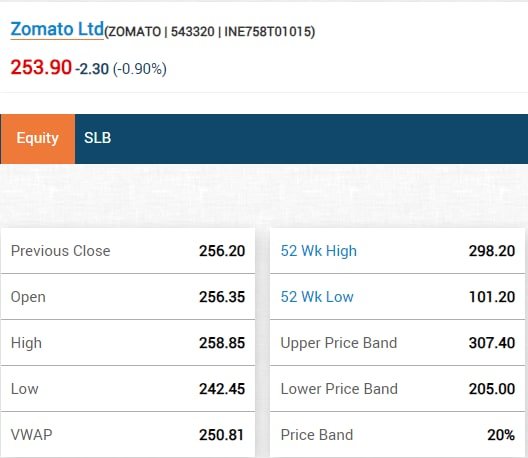

Stock Market LIVE Updates: What led Zomato to slip 5% despite 5x rise in Q2 PAT? Should investors buy?

Stock Market LIVE Updates: Zomato shares lost 5.3 per cent in Wednesday, October 23’s trade and registered an intraday low of Rs 242.45 per share on the BSE. The selling pressure in the stock came after the company reported robust growth in its second quarter (Q2FY25) results, although on certain parameters, it missed estimates.

At around 9:32 AM, Zomato shares were down 4.18 per cent at Rs 245.5 per share. In comparison, the BSE Sensex was up 0.10 per cent at 80,298.86 around the same time. The market capitalisation of the company around the time stood at Rs 2,16,883.91 crore. READ MORE

10:37 AM

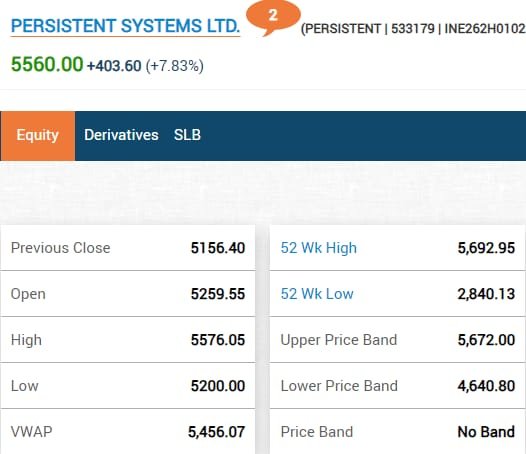

Stock Market LIVE Updates: Persistent Systems share price rallies 10% on strong September qtr results

Stock Market LIVE Updates: Persistent Systems share price rallied 9.9 per cent to Rs 5,672 on the BSE in Wednesday’s intraday trade after the company reported a strong set of earnings for the July-September quarter (Q2) of financial 2024-25 (FY25). Persistent Systems’ share price on the NSE, also, surged 9.9 per cent to a high of Rs 5,674 per share.

Persistent System’s consolidated net profit grew 23.44 per cent to Rs 324.90 crore in the September quarter (Q2FY25). The company’s profit stood at Rs 263.2 crore in the year-ago period (Q2FY24). READ MORE

10:35 AM

Stock Market LIVE Updates: Here’s why NBCC (India) share is buzzing in trade on Oct 23; Check details

Stock Market LIVE Updates: Shares of construction major NBCC (India) zoomed as much as 2.99 per cent to hit an intraday high of Rs 99.60 per share.

However, NBCC (India) shares were off highs and slipped into the red. At 9:47 AM, NBCC (India) shares were trading 3.72 per cent lower at Rs 93.10 per share. In comparison, BSE Sensex was down 0.12 per cent to 80,121.12 levels. READ MORE

10:31 AM

Stock Market LIVE Updates: RITES up 3% on Rs 454-cr order from K’taka Mining Environment Restoration Corp

Stock Market LIVE Updates: Shares of engineering services company RITES soared as much as 2.98 per cent to hit an intraday high of Rs 298.60 per share on Wednesday, October 23, 2024.

The rise in RITES share price came after the company announced that it has secured an order worth Rs 453.99 crore from Karnataka Mining Environment Restoration Corporation. READ MORE

10:27 AM

Stock Market LIVE Updates: Coforge stock zooms 9% on strong Q2FY25 results, bulging order book

Stock Market LIVE Updates: Shares of Coforge surged up to 8.85 per cent at Rs 7397.25 a piece on the BSE on Wednesday after the company delivered strong quarterly earnings for the second quarter of the financial year 2024-25 (Q2FY25).

The information technology firm reported a nearly 17 per cent increase in net profit, reaching Rs 212 crore for the July-September quarter, compared to Rs 181 crore a year earlier. READ MORE

10:14 AM

Stock Market LIVE Updates: Sonata Software soars 4% on multi-year AI-backed managed services deal win

Stock Market LIVE Updates: Software company Sonata Software rose up to 4.37 per cent to hit an intraday high of Rs 609.95 per share on Wednesday, October 23, 2024.

The uptick in Sonata Software share price came after the company announced that it has secured a multi-year artificial intelligence (AI)-powered managed services contract from a Fortune 500 manufacturing company. READ MORE

10:03 AM

Stock Market LIVE Updates: 10 AM market update – Sensex, Nifty climb amid volatility

Stock Market LIVE Updates: Indian benchmark equity indices BSE Sensex and Nifty 50 were trading higher amid volatility in the markets.

At 10 AM, the BSE Sensex was up 139.72 points, or 0.16 per cent, at 80,351.44, while the Nifty 50 was at 24,500.85, up 28.75 points, or 0.12 per cent.

9:59 AM

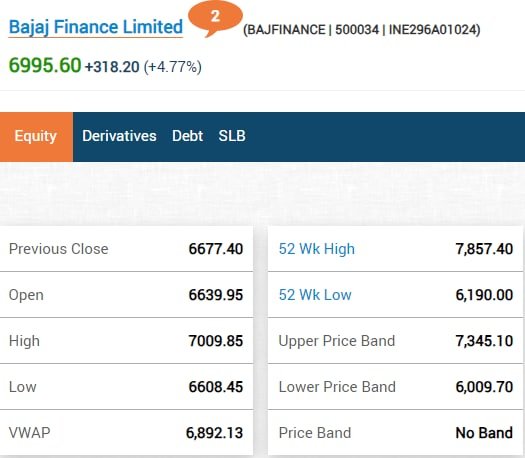

Stock Market LIVE Updates: Bajaj Finance climbs 5% on strong growth in Q2 numbers

Stock Market LIVE Updates: The company reported a consolidated revenue growth of 27.72 per cent year-on-year, reaching Rs 17,095 crore, with a net profit increase of 13.03 per cent at Rs 4,014 crore. The net interest income rose by 23 per cent to Rs 8,838 crore, while assets under management (AUM) grew by 29 per cent to Rs 3.73 lakh crore.

9:52 AM

Stock Market LIVE Updates: Persistent Systems climbs 8% after co reports 6% increase in Q2 net profit

Stock Market LIVE Updates: The company saw a consolidated revenue growth of 5.84 per cent to Rs 2,897 crore, with a net profit increase of 6.2 per cent at Rs 325 crore.

9:51 AM

Stock Market LIVE Updates: Zomato slips into red even after posting 388% YoY growth in Q2 net profit

Stock Market LIVE Updates: Zomato witnessed a consolidated revenue surge of 68.5 per cent year-on-year to Rs 4,799 crore, with a net profit soaring by 388.88 per cent to Rs 176 crore. Zomato also approved a fundraise of up to Rs 8,500 crore via QIP.

9:48 AM

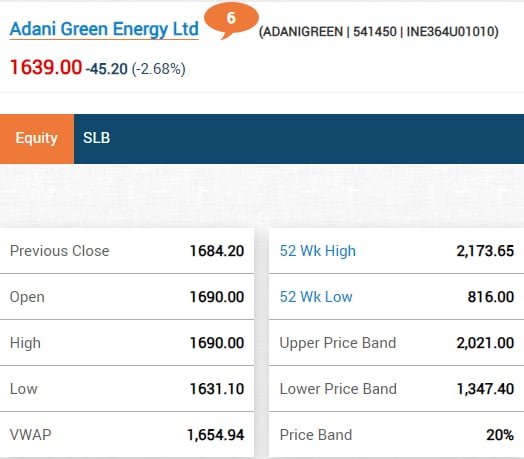

Stock Market LIVE Updates: Adani Green dips 3% despite positive second quarter results

Stock Market LIVE Updates: The company saw a consolidated revenue increase of 38 per cent year-on-year, amounting to Rs 3,055 crore, with Ebitda up by 30 per cent to Rs 2,205 crore and a net profit rise of 39 per cent to Rs 515 crore.

9:44 AM

Stock Market LIVE Updates: Godavari Biorefineries IPO opens today: Key details, GMP, & brokerage views

Stock Market LIVE Updates: The initial public offering (IPO) of Godavari Biorefineries opens for public subscription today. With the public issue, Godavari Biorefineries seeks to raise Rs 554.75 crore by offering a fresh issue of 9,232,955 shares, and an offer for sale of 6,526,983 shares, each with a face value of Rs 10.

Godavari Biorefineries has announced that it has already raised Rs 166.42 crore from anchor investors on bidding concluded on October 22, 2024. READ MORE

9:27 AM

Stock Market LIVE Updates: M&M, Shriram Finance trade losses on NSE

On the NSE, M&M, Shriram Finance, and Powergrid among others were trading losses, while Bajaj twins, Apollo Hospital and Bajaj Auto were trading in green.

9:24 AM

Stock Market LIVE Updates: Nifty IT, Metal lead in sectors

Among sectors, Nifty IT ouran others, rising 0.78 per cent, followed by Nifty Metal, Nifty Financial Services among others.

Don’t miss the most important news and views of the day. Get them on our Telegram channel

First Published: Oct 23 2024 | 7:41 AM IST