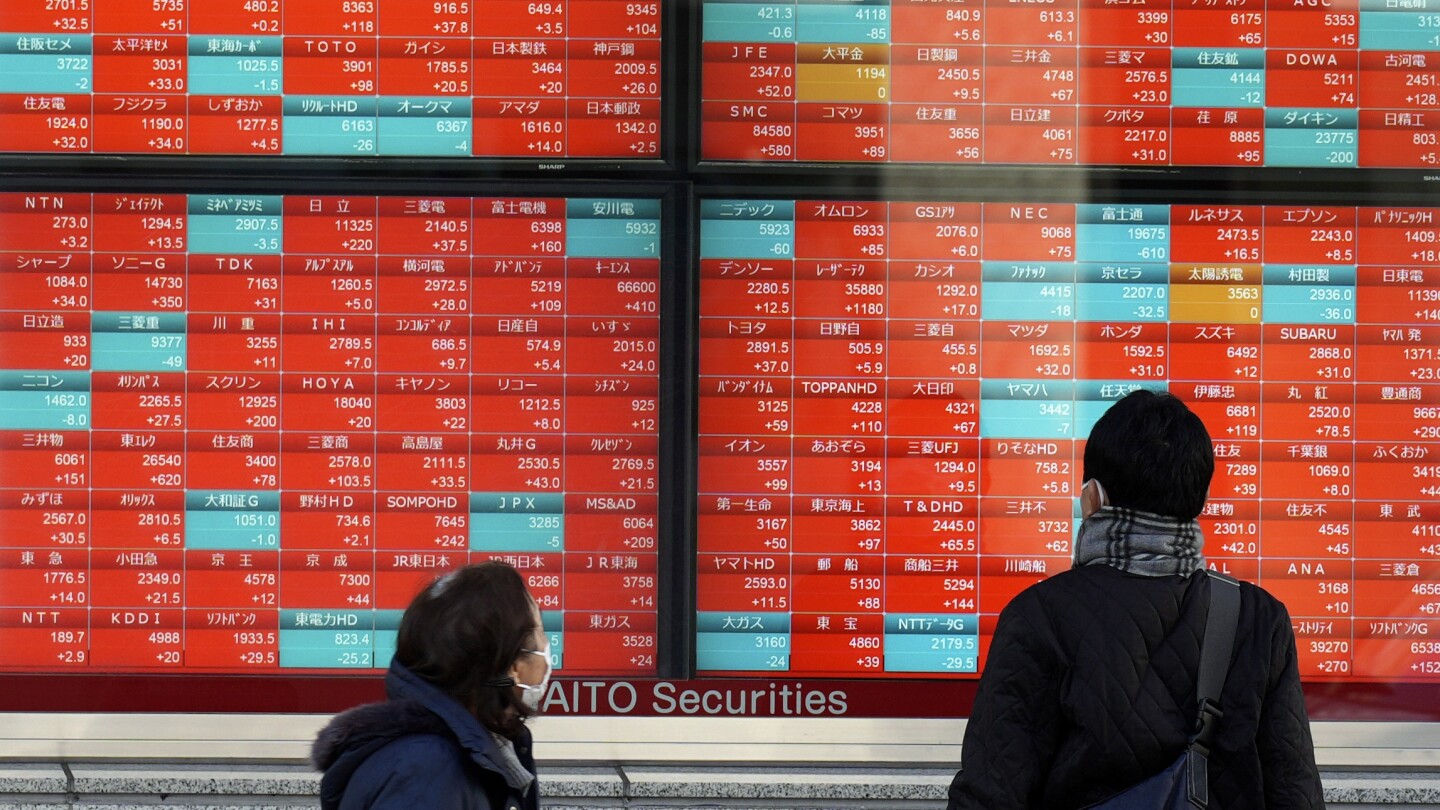

TOKYO (AP) — Global shares were mostly higher on Friday, helped by optimism about technology shares. But Shanghai’s benchmark saw wild swings on worries over the economic outlook and other risks.

The Shanghai Composite index ended 1.5% lower at 2,730.15, capping its worst week of losses in five years. Hong Kong’s Hang Seng shed 0.2%, to 15,533.56, as gains for technology companies offset declines in property shares.

At point, the Shanghai index dropped below 2,700, to 2,666.74, prompting a flood of social media comments in China, including one commentator who exclaimed, “now we’re all sitting ducks.” The benchmark is down nearly 17% in the past year and 9.3% in the past 3 months.

Analysts said the sell-off was at least partly sparked by so-called “snowball derivatives” that yield high returns on gains but likewise cause big losses when share prices fall. Selling of biotech companies was also heavy on concern over a possible U.S. move to impose controls on dealings with Chinese companies like WuXi AppTec, whose shares dropped 21%.

Also undermining confidence was a report by the International Monetary Fund, which forecast that the Chinese economy would grow at a 4.6% pace this year and 4% in 2025, dropping from 5.2% last year.

In early European trading, France’s CAC 40 advanced 0.6% to 7,632.04, while Germany’s DAX rose 0.8% to 16,988.93. Britain’s FTSE 100 gained 0.4% to 7,649.70. The future for the Dow Jones Industrial Average was unchanged, while that for the S&P 500 was up 0.5%.

Japan’s benchmark Nikkei 225 added 0.4% to finish at 36,158.02. Aozora Bank’s shares plunged nearly 16% after it reported losses on its U.S. property investments. On Thursday, the bank’s shares dived 27.4 percent. The lender attributed its losses to high interest rates and a weaker commercial property market during and after the pandemic, as companies switched to hybrid or remote working arrangements.

The Japanese bank’s woes are similar to those of New York Community Bancorp whose shares have fallen by more than 40% this week after it reported a loss for its latest quarter and cut its dividend to build its financial strength. New York Community Bancorp acquired much of Signature Bank last year after it and other regional banks collapsed and its losses reflect problems for the entire industry.

Elsewhere in Asia, Australia’s S&P/ASX 200 jumped 1.5% to 7,699.40. South Korea’s Kospi surged 2.9% to 2,615.31 after the country reported strong export data.

Thursday on Wall Street, U.S. stocks bounced back in a widespread rally following their worst day since September.

The S&P 500 gained 1.2% to recover three quarters of its sharp loss from the day before, while the Dow rose 1%. The Nasdaq composite leaped 1.3%, lifted by Big Tech stocks, which have an outsized influence.

Traders are increasingly betting the Federal Reserve will begin cutting interest rates in May, after pushing back expectations from March. Whenever it does begin, it would mark a sharp turnaround after the Fed hiked its main interest rate to the highest level since 2001 in hopes of getting inflation under control.

High interest rates intentionally slow the economy, and they undercut prices for investments.

In energy trading, benchmark U.S. crude rose 31 cents to $74.13 a barrel in electronic trading on the New York Mercantile Exchange. Brent crude, the international standard, rose 40 cents to $79.10 a barrel.

In currency trading, the U.S. dollar was little changed at 146.72 Japanese yen, up from 146.43 yen. The euro cost $1.0893, up from $1.0874.