HONG KONG (AP) — Asian stocks were mostly higher on Friday after U.S. stocks slipped as the market’s big rally following Trump’s election victory cooled further.

U.S. futures and oil prices were lower.

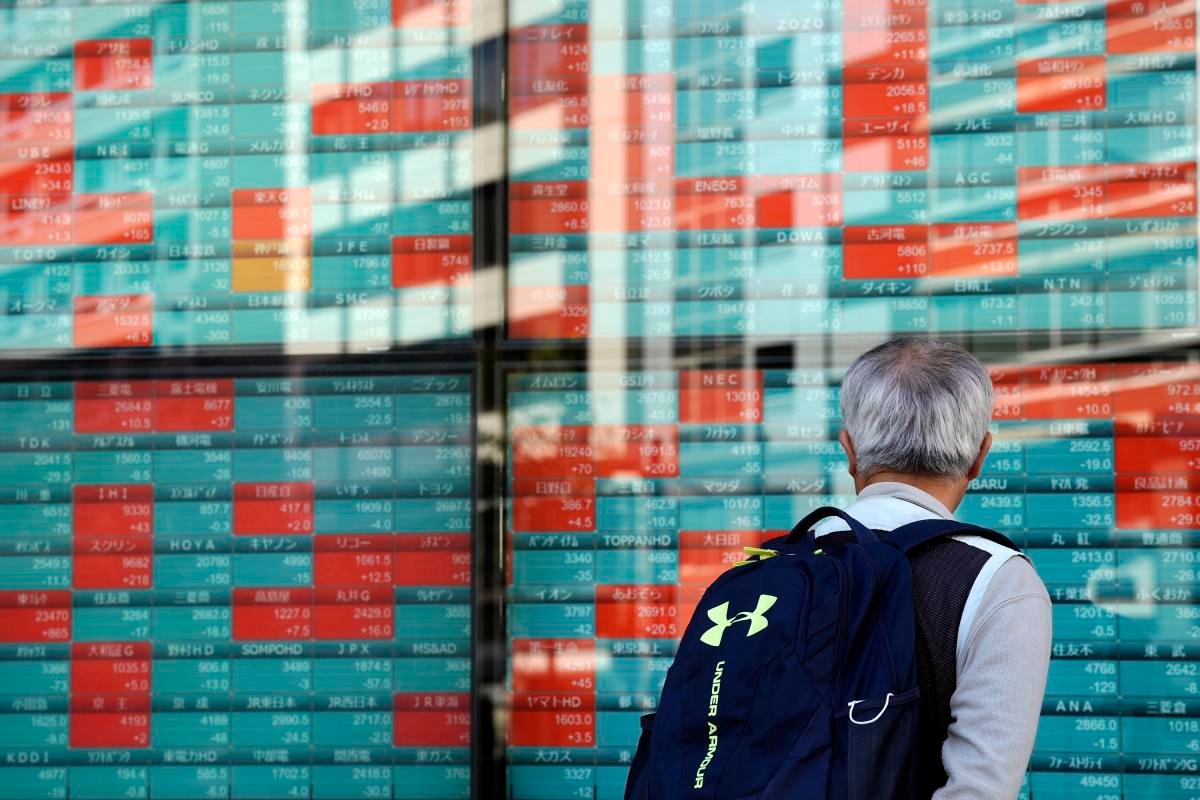

In Tokyo, the Nikkei 225 index was up 0.8% at 38,842.13 as the yen continued dropping against the U.S. dollar, fueling exporters’ sales. Nissan Motor Co.’s shares jumped 4.7% during morning trading.

Japan’s economy grew at a 0.9% annual pace in the July-September quarter, higher than the 0.5% increase in the previous quarter, even as the Bank of Japan raised its key interest rate to 0.25% from 0.1% in July. The BOJ said during its October meeting that it plans to continue increasing rates, with a potential target of 1% in the second half of the next fiscal year, which begins in April, if economic activity and prices develop as expected.

The Hang Seng in Hong Kong added 0.3% to 19,486.97 and the Shanghai Composite index dropped 0.4% to 3,367.94 after a report from the National Bureau of Statistics on Friday showed the nation’s retail sales rose 4.8% year-on-year in October, beating forecasts. But industrial output slowed from the previous month and improvements in the property industry were marginal.

Australia’s S&P/ASX 200 gained 0.7% to 8,279.20, while South Korea’s Kospi edged 0.2% higher, to 2,407.27.

On Thursday, the S&P 500 fell 0.6% to 5,949.17, though it’s still near its all-time high set on Monday. The Dow Jones Industrial Average dropped 0.5% to 43,750.86, and the Nasdaq composite sank 0.6% to 19,107.65.

Some of the stocks that got the biggest bump from Trump’s election lost momentum. Tesla fell 5.8% for just its second loss since Election Day. It’s run by Elon Musk, who has become a close Trump ally.

Smaller stocks also fell harder than the rest of the market, and the Russell 2000 index of small stocks lost 1.4%. It’s a turnaround from the election’s immediate aftermath, when the thought was that an “America First” president would benefit domestically focused companies more than big multinationals that could be hurt by tariffs and trade wars.

Stocks also felt the effects of swinging yields in the bond market following the latest hotter-than-expected economic reports and comments from Federal Reserve Chair Jerome Powell. The Fed just cut its main interest rate earlier this month for the second time this year to ease the pressure on the economy, and investors are eager for more.

But short-term yields climbed after Powell said, “The economy is not sending any signals that we need to be in a hurry to lower rates. The strength we are currently seeing in the economy gives us the ability to approach our decisions carefully.”