Key Events

Pinned Post

Stock futures were dropping on Thursday, with investors still trying to make sense of the U.S.-China trade war after Chinese officials denied reports that the world’s two largest economies have started tariff negotiations. Treasury Secretary Scott Bessent previously signaled that Washington and Beijing were yet to start negotiations on tariffs.

Futures tracking the Dow Jones Industrial Average fell 210 points, or 0.5%. S&P 500 futures were down 0.4%, and contracts tied to the tech-heavy Nasdaq 100 dropped 0.5%.

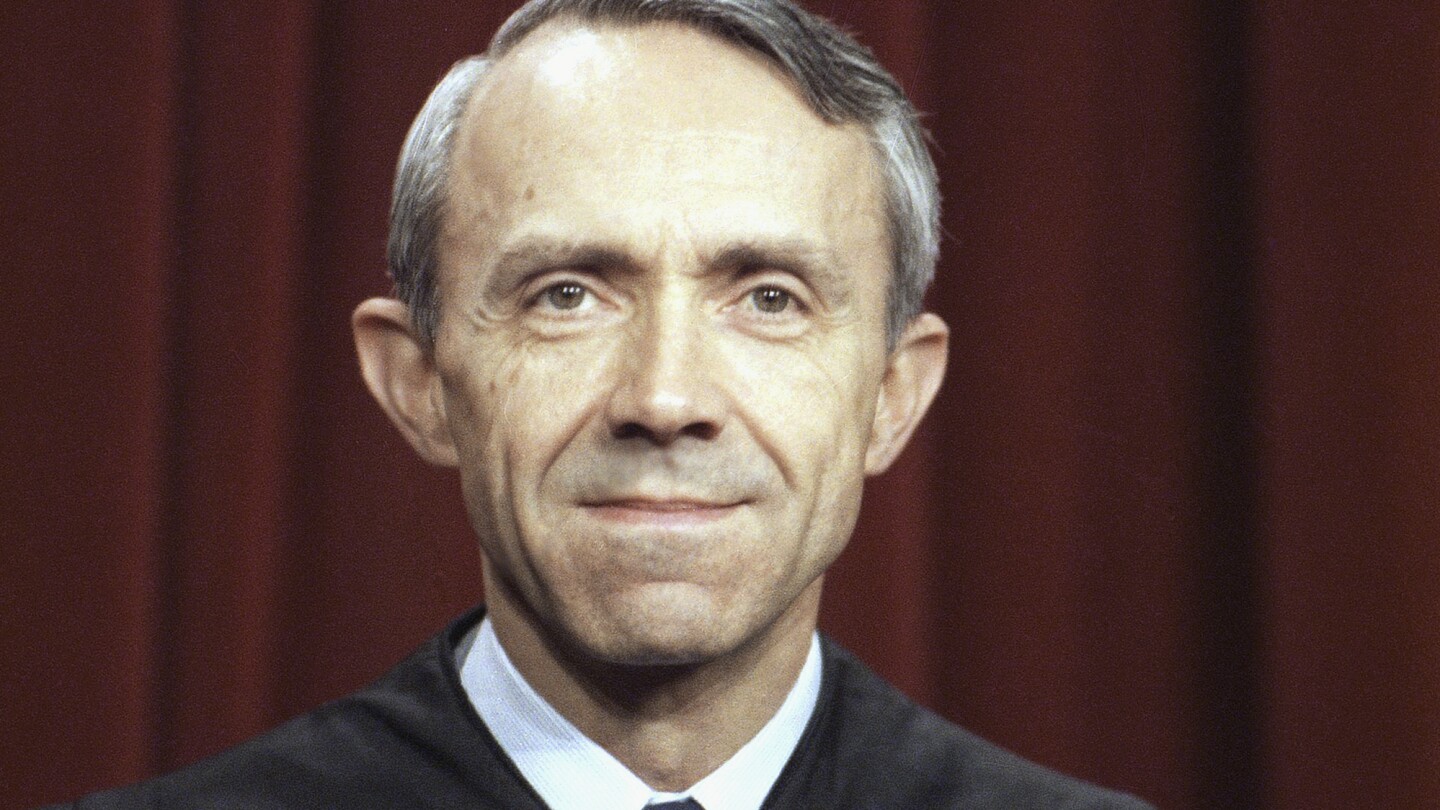

The three blue-chip indexes soared Wednesday after President Donald Trump said he had no plans to fire Federal Reserve Chief Jerome Powell, although Bessent’s comments on China led to equities giving up some of their gains.

“Both sides are waiting to speak to the other,” Bessent told reporters. He replied “Not at all,” when asked if Trump had reached out to Beijing with an offer to lower tariffs.

“Volatility remains high,” Deutsche Bank strategist Jim Reid said Thursday, pointing out that the S&P 500 had given up about half its intra-day gains after Bessent poured cold water on the market’s U.S.-China trade hopes. “Investors struggled to gauge just how much tariff reversal was likely, with Bessent saying there was no unilateral offer to cut tariffs on China. So we’re not quite out of the woods yet.”

Gold jumped 1.4% to $3,340 per Troy ounce Thursday as investors once again bought the precious metal, which is seen by the market as a safe-haven asset that can maintain its value in times of uncertainty. The U.S. Dollar Index, which tracks the greenback against six other currencies, slipped 0.4%.

Bond yields retreated slightly. The yield on the benchmark 10-year U.S. Treasury note slipped 3 basis points to 4.363%, and the yield on the 2-year note was down 4 basis points to 3.846%.