Key Events

Pinned Post

Stock futures were wobbling on Friday as investors tried to figure out if President Donald Trump’s trade framework agreement with the U.K. is a one-off or a sign that the White House is prepared to start scaling back many of its tariffs.

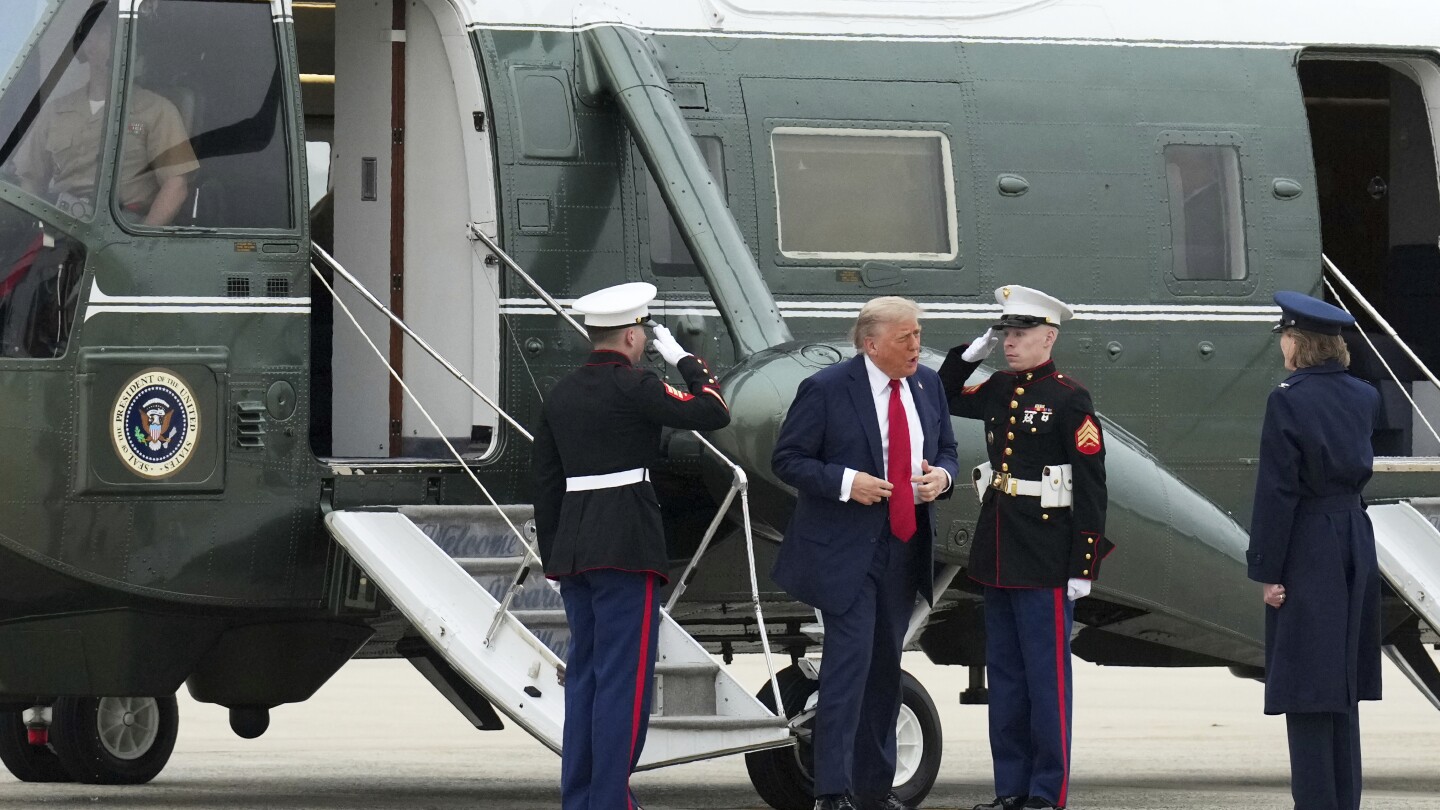

In a Truth Social post, Trump said that “80% Tariff on China seems right!” and that it’s now up to Treasury Secretary Scott Bessent, who meets Chinese officials this weekend. That would be lower than the current 145% levy on Chinese imports.

Futures fell and then quickly recovered after the post. Those tracking the Dow Jones Industrial Average were down less than 0.1%. S&P 500 futures edged up 0.1%, as were contracts tied to the tech-heavy Nasdaq 100.

The three indexes had traded in the green on Thursday after Trump unveiled his trade pact with the U.K., but it’s still uncertain whether his administration will be able to broker some sort of agreement with China.

The Asian country said Friday that its exports of goods to the U.S. had plummeted 21% in April, underscoring how the White House’s 145% tariffs are reshaping the global economy. Bessent is set to meet with officials from Beijing this weekend, and Trump has said he expects the talks to be “very substantive.”

Michael Brown, strategist for the foreign exchange brokerage Pepperstone, said that he “remains inclined to fade upside” in U.S. stocks–in other words, sell now that they’re a bit higher–due to lingering uncertainty about tariffs. He added that the economy is yet to feel the full impact of Trump’s levies, and markets are “clearly not at all priced for a scenario” where tariff rates remain above 10% despite trade agreements.

Bond yields were pretty much flat in early trading Friday. The yield on the 10-year U.S. Treasury note was 4.389%, and the yield on the 2-year note was 3.883%.

Benchmark oil prices ticked up nearly 1%. The U.S. Dollar Index, which tracks the greenback against a basket of six other currencies, slipped 0.2%.