Updated 1 min read

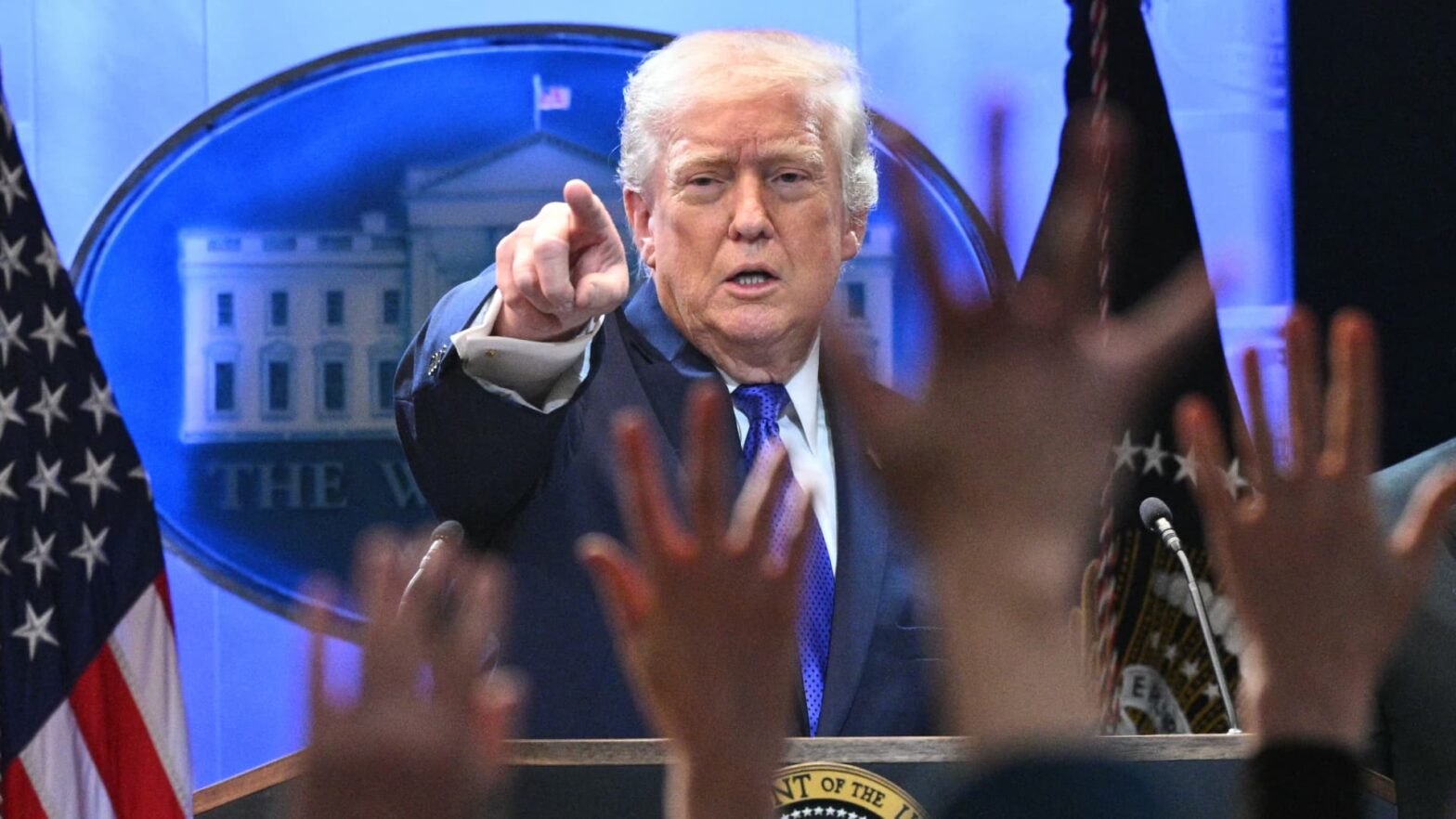

US stocks rose on Friday after the Supreme Court ruled that President Trump’s most sweeping “Liberation Day” tariffs are unlawful, saying he lacked the authority to impose them using emergency powers.

The S&P 500 (^GSPC) rose 0.7%, while the Dow Jones Industrial Average (^DJI) gained roughly 0.2%. The tech-heavy Nasdaq Composite (^IXIC) led gains, jumping over 1%.

Stocks reversed course on the heels of the decision, having slid at the open as investors digested key economic readings and kept an eye out for US-Iran tensions and private credit jitters.

In its decision on Friday morning, the Supreme Court ruled that Trump overstepped his powers in invoking the International Emergency Economic Powers Act to impose tariffs on several trading partners in April.

Get the latest reaction and fallout to the SCOTUS ruling in our tariff blog here

Wall Street learned earlier Friday that US GDP grew more slowly than expected in the fourth quarter, coming in at 1.4%, far behind forecasts. Meanwhile, the “core” personal expenditures index — Fed rate-setters’ preferred gauge of inflation — rose more than expected in December, on a monthly and annual basis.

The watch is on for signs of stress in the private credit sector, after Blue Owl’s (OBDC, OWL) halt to withdrawals. Fears are the move is a “canary in the coal mine” financial crisis-style moment amid concerns about the sector’s holdings of software stocks threatened by AI.

LIVE 20 updates

-

Wedbush’s Ives: SCOTUS tariff ruling a ‘net positive for tech’

The US Supreme Court’s ruling on Friday that struck down President Trump’s widespread tariff regime is bullish for the tech industry, Wedbush Securities managing director Dan Ives said in a client note after the ruling was announced.

In a 6-3 vote released Friday morning, the US Supreme Court ruled that a 1977 national security law does not give the president authority to levy tariffs. Citing the more than $100 billion in potential tariff revenue refunds, the reversal could lead to a stronger financial outlook for the tech sector.

“We believe this would act as a net positive for tech with financial relief for many companies while creating greater supply chain visibility, especially coming from the Asia supply chain,” Ives wrote on Friday.

Of note, the Supreme Court’s Friday ruling, which struck down the president’s authority to levy tariffs under the IEEPA law, did not affect tariffs imposed on national security grounds under Section 232 of the Trade Expansion Act of 1962. Those tariffs include 50% levies on imports of semi-finished copper products, 25% levies on certain imported semiconductors — including Nvidia’s (NVDA) H200 chips.

“This will be a very noisy situation, but for the tech space and AI trade, it’s a net positive out of the gates in our view,” Ives wrote.

-

Add transports to the tariff tailwind trade

The Dow Jones Transportation Average (^DJT) jumped to a five-day high on the SCOTUS/tariffs news, topping out around 1.7% before giving back many of those gains.

At the highs, the index had retraced last week’s AI scare trade drop of roughly 4%.

Participation is broad across rails and carriers: Union Pacific (UNP), CSX (CSX), Norfolk Southern (NSC); FedEx (FDX), UPS (UPS); Delta (DAL), United (UAL), American (AAL); plus logistics names like Old Dominion (ODFL), Expeditors (EXPD), XPO (XPO), and C.H. Robinson (CHRW).

Southwest (LUV) and Alaska Air (ALK) are notable laggards.

As long as the Dow Transports can stick near the top of today’s range, the post-ruling relief bid looks sticky. A full fade back below the morning pop would put last week’s drawdown back in play.

-

CoreWeave stock sinks after report lenders worried about its creditworthiness

CoreWeave (CRWV) stock fell as much as 9% early Friday after a report from Business Insider suggested lenders are worried about the company’s creditworthiness.

Daniel Geiger reports:

Blue Owl (OWL) has spent most of the time in the headlines this week over its decision to halt redemptions from a private credit fund (the company will instead return capital to shareholders on its own terms). Overall, the firm has continued to serve as the poster child of any worried about private credit in the market.

But the CoreWeave story — along with Oracle (ORCL) — will also remain a key canary on any fears investors have about the durability or reliability of the AI data center build-out .

With most of the focus on tariffs on Friday, a drop worth noting with Nvidia (NVDA) earnings up next week.

-

Apparel, luxury stocks pop on tariff rollback

Apparel names are catching a bid this morning after the Supreme Court struck down President Trump’s IEEPA tariffs — a broadly bullish initial read-through for import-heavy retailers.

Nike (NKE) popped immediately on the headline — up about 4.4% at the highs — but has given back most of the gains. Under Armour (UAA), Levi Strauss (LEVI), Deckers Outdoor (DECK), and Kontoor Brands (KTB) saw similar knee-jerk lifts and retreats, to varying degrees.

Even European brands like Adidas (ADS.DE, ADDYY) got pulled in.

Speaking of European brands, a scan of the high-end luxury sector also reveals broad strength — Tapestry (TPR), LVMH (MC.PA, LVMUY), Hermès (RMS.PA, HESAY), Richemont (CFR.SW, CFRUY), Burberry (BRBY.L, BURBY).

The closing print today will be critical to judge if this is a lasting tailwind trade.

-

SCOTUS ruling leaves Section 232 tariffs on copper, semiconductors, and other products untouched

The Supreme Court’s tariff ruling on Friday, which overturned President Trump’s vast tariff regime instituted under the International Emergency Economic Powers Act (IEEPA), does not affect other “Section 232” tariffs implemented through his second term on products ranging from metals and lumber to cars.

In a 6-3 vote released Friday morning, the US Supreme Court ruled that IEEPA does not give the president authority to levy tariffs, dealing a major blow to what has become the signature tool of the Trump administration’s foreign policy dealmaking.

The ruling, however, leaves tariffs implemented under Section 232 of the Trade Expansion Act of 1962 — which cite national-security concerns — unchanged, keeping in place a ream of import duties on products ranging from copper and semiconductors to automobiles and wood products such as cabinetry.

Section 232 tariffs include 50% levies on imports of semi-finished copper products, 25% levies on certain imported semiconductors — including Nvidia’s (NVDA) H200 chips — and automobile tariffs, including 25% levies on trucks and 10% levies on buses.

The administration has also proposed 100% tariffs on specific pharmaceutical products, which, if implemented, would be done so under Section 232.

The metals market saw only a slight reaction in the minutes after the ruling. Futures on copper (HG=F) rose by roughly 1.1%, while aluminum (ALI=F) ticked up by 0.6%. Elsewhere in the industrial sector, lumber (LBR=F) futures fell by roughly 0.4% on Friday as traders priced in cheaper import prices.

-

GOOGL breaks out of the 5-day doldrums

Alphabet (GOOGL, GOOG) is the green-shoots standout in megacap stocks Friday morning, up over 2.5%.

It’s on pace for its best day in nearly three months, after a negative stretch where it was down six of the last seven sessions.

The tape is catching the eyes of swing traders, given GOOGL opened above its five-day moving average after spending the prior 11 days trapped underneath it. Many punters — like Brian Shannon of AlphaTrends — will wait until a stock has climbed over its five-day moving average before buying (alongside other criteria, which vary from trader to trader).

There’s not a clean company headline driving the pop, though the news of the Supreme Court striking down President Trump’s tariffs is providing broad strength to US stocks.

Meanwhile, on Yahoo Finance’s Opening Bid this morning, Winthrop Capital chief investment officer Adam Coons was talking up the search giant, saying, “[Alphabet] is backed by real earnings … real revenue growth … really strong margins.”

For many traders, as long as GOOGL holds above the five-day, the bounce is intact.

-

IEEPA tariff refunds could total $175 billion

Refunds on President Trump’s widespread tariff scheme could cost the US as much as $175 billion, according to new estimates from Penn-Wharton Budget Model economists.

Reuters first reported the new estimate.

On Friday morning, the Supreme Court on Friday ruled in a 6-3 vote that the International Emergency Economic Powers Act (IEEPA) does not give the president the authority to levy tariffs, dealing a blow to the Trump administration’s signature economic policy and setting up a bevy of questions over what a reversal of the foreign policy will look like.

Now that the president’s tariff scheme has been struck down, importers are likely to begin scrambling to claim refunds from US Customs and Border Protection on import duties paid throughout the year.

The White House has previously said that if the Supreme Court were to strike down Trump’s IEEPA tariffs, the administration would replicate them through other policies that could mirror their effects.

However, the replacement measures the White House will have at its disposal could be more limited in scope and slower to enact, according to Bloomberg.

-

Supreme Court ruling likely doesn’t mark the end of Trump’s tariff push

The Supreme Court on Friday ruled in a 6-3 decision that President Trump does not have the authority to levy a broad swath of tariffs under the International Emergency Economic Powers Act (IEEPA).

But the initial reaction from some on Wall Street is that this legal defeat is unlikely to mark the end of the administration’s push to use tariffs to achieve its economic goals, primarily that of lowering our trade deficit and onshoring US manufacturing.

“I don’t think we have heard the last from Trump and tariffs,” wrote Neil Dutta, head of economics at Renaissance Macro. There is a vast legal architecture that Trump can draw from to prosecute this… The issue is if he does not dial the tariff threat back on, he basically looks like a lame duck. The issue is more political than economic, at least right now. If Trump turns the trade knob back on, we get more uncertainty. If he decides to give in, then he is basically cooked politically.”

In a separate note, Chris Rupkey, chief economist at FWDBONDS, wrote, “The headline shock for markets, even if largely expected since the November 2025 Supreme Court arguments, is likely to fade in the trading days to follow.”

“It is important to realize that the import tariffs are only bringing in about $250 billion a year more than they did in the Biden administration,” Rupkey added. “A $250 billion loss of revenue is not make or break for getting the country’s $7 trillion in Federal government spending under control, nor is it in any way fixing the fiscal year 2025 $1.7 trillion Federal budget deficit.”

-

Supreme Court rules president does not have authority to levy tariffs under emergency powers

The Supreme Court on Friday ruled in a 6-3 vote that the International Emergency Economic Powers Act (IEEPA) does not give the president the authority to levy tariffs, dealing a blow to the Trump dministration’s signature economic policy.

Chief Justice John Roberts and Justices Sonia Sotomayor, Elena Kagan, Neil Gorsuch, Amy Coney Barrett, and Ketanji Brown Jackson voted in the majority.

Justices Clarence Thomas, Samuel Alito, and Brett Kavanaugh formed the dissent.

Throughout his second term, Trump has leaned on the IEEPA to grant him broad authority to set tariff policy as he saw fit, beginning with the April 2025 “Liberation Day” announcement of tariffs on a slew of allies and other countries. That announcement sent the markets careening downward before a recovery later in the year.

It remains to be seen exactly how the Supreme Court’s decision will impact the tariffs the president has already imposed. The market’s initial reaction to Friday’s ruling was muted.

-

UBS: US equity market ‘underpinned by supportive monetary policy and resilient economic growth’

The US dollar (DX-Y.NYB) is at its highest level in nearly a month following a rally over the past two weeks, a typically bearish signal for stocks. Even so, readings on the US economy’s direction give investors a broad range of opportunities in US equities, UBS strategists wrote in a client note Friday morning.

Given the split in perspectives over where to take rates in the Fed’s January meeting — the minutes were released on Wednesday — the Fed is likely to maintain its position and hold rates steady, said the UBS strategists, led by global wealth management CIO Mark Haefele.

“While the minutes did not suggest officials were contemplating the possibility of rate increases, they made clear policymakers were in no rush to cut rates as ‘the vast majority of participants judged that downside risks to employment had moderated in recent months while the risk of more persistent inflation remained,'” the UBS strategists wrote.

Yet, despite the short-term hold on the horizon, the US central bank likely has “further to go its easing cycle, and this remains a key pillar in our positive outlook on US equities overall,” the strategists wrote.

“With the easing cycle still intact, and the US economy showing resilience amid an improvement in manufacturing activity and industrial output, we expect healthy and broadening profit growth across sectors,” the strategists wrote, noting “attractive opportunities” in financials, health care, utilities, consumer discretionary, and industrials.

-

US stocks slide at the open

The US stock market fell into the red on Friday as investors digested economic data that showed the US economy’s growth slowed down in the fourth quarter, while so-called “core” PCE, the Fed’s favored inflation gauge, heated up in December. The market is also watching tensions in the Middle East, nerves in the private credit market, and a potential tariff decision from the US Supreme Court.

The S&P 500 (^GSPC) fell by 0.2%, while the Dow Jones Industrial Average (^DJI) slid into the red by 0.4% after a the end of a three-day winning streak on Thursday. The Nasdaq Composite (^IXIC) turned down by 0.5% before paring losses to a slide of 0.2%.

Prices rose by 0.4% in December over the previous month, according to Personal Consumption Expenditures index data, while the so-called “core” PCE, which excludes the more volatile food and energy categories, also rose 0.4% on the month, a step up from the previous month’s 0.2% growth.

New data from the Bureau of Economic Analysis on Friday showed the economy grew at an annualized rate of 1.4% in the final three months of 2025. Economists had expected GDP to grow at an annualized rate of 2.9% in the fourth quarter.

-

For what it is worth on this GDP report….

I still think the strong earnings report out of Walmart (WMT) yesterday is a better proxy on the economy right now than a government GDP report.

I got no indication (nor saw any in the earnings report) in my chat below with Walmart CFO John David Rainey the business has slowed at all:

-

Fed’s favored inflation gauge ticks up 0.4% in December, in sign inflation remains sticky

Prices rose by 0.4% in December over the previous month, marking an increase from the previous month, according to Personal Consumption Expenditures index data released Friday by the Bureau of Economic Analysis.

The growth exceeded economists’ expectations of 0.3%, according to Bloomberg’s consensus estimates.

So-called “core” PCE, which excludes the more volatile food and energy categories, also rose 0.4% on the month, a step up from the previous month’s 0.2% growth. Economists had predicted that the Federal Reserve’s preferred inflation measure would rise by 0.3%.

On an annual basis, the headline and core PCE price indexes rose 2.9% and 3.0%, respectively, in December from the previous year, also slightly above economist estimates for the two gauges.

Meanwhile, personal income remained consistent, rising 0.3% in December on a monthly basis, in line with the previous month’s growth and matching economist expectations.

Personal spending increased 0.4% from last month, coming in above expectations of 0.3% but falling below the previous month’s growth of 0.5%.

-

US GDP growth disappoints, Trump blames government shutdown

The US economy grew at a slower pace than expected in the fourth quarter of 2025.

New data from the Bureau of Economic Analysis on Friday showed the economy grew at an annualized rate of 1.4% in the final three months of 2025. Economists had expected GDP to grow at an annualized rate of 2.9% in the fourth quarter.

In a post on Truth Social ahead of the report, President Trump said the government shutdown that lasted 43 days back in the fall cost the US economy “at least two points in GDP.” The president also again called for lower interest rates.

In its release, the BEA said, “Compared to the third quarter, the deceleration in real GDP in the fourth quarter reflected downturns in government spending and exports and a deceleration in consumer spending that were partly offset by an acceleration in investment.”

Underlying spending trends, however, remained solid, with real final sales to private domestic purchasers — the sum of consumer spending and gross private fixed investment — increasing 2.4 percent in the fourth quarter, compared with an increase of 2.9 percent in the third quarter.

Friday’s report had been set for release on Jan. 29, but data collection was delayed by the shutdown that covered all of October and parts of November.

-

Chemours stock falls after reporting $47M loss in Q4 earnings

Chemours Co. (CC) stock slumped 9% before the bell on Friday after reporting a loss of $47 million in its fourth quarter earnings.

The AP reports:

-

Grail stock sinks after cancer trial results fail to impress investors

Grail (GRAL) stock sank over 40% before the bell on Friday after the healthcare company’s cancer trial results failed to impress investors.

Barron’s reports:

-

Premarket trending tickers: Chemours, Live Nation, and AppLovin

Chemours (CC) fell 9% during premarket trading on Friday after reporting a loss in its fourth quarter earnings and a dip in revenue. This was driven by a drop in its titanium technologies and advanced performance materials businesses.

Live Nation (LYV) stock rose more than 3% before the bell on Friday after the ticket provider posted an 11% increase in fourth-quarter revenue to $6.31 billion, driven by a 12% gain in concert sales.

AppLovin’s (APP) stock jumped 5% during premarket hours on Friday after the release of its fourth quarter earnings and the company’s plan to launch a social networking platform.

-

Nvidia is moving in on Intel and AMD’s home turf

Beyond the splashy AI chip news, there’s something else worth a deeper look in the stepped-up data center partnership agreed by Nvidia (NVDA) and Meta (META) this week.

The agreement will also see Meta roll out Nvidia Grace CPU-only servers in its data centers, the first large-scale deployment of the chips. It’s part of Nvidia’s CPU play — and that could ring alarm bells for Intel (INTC) and AMD (AMD).

Yahoo Finance’s Daniel Howley writes:

-

Opendoor stock rallies on 46% jump in home acquisition volume

Opendoor’s (OPEN) stock jumped 14% in premarket trading on Friday after the company reported that home purchases rose 46% quarter over quarter. Revenue reached $736 million, surpassing Wall Street estimates of $576.94 million.

The digital real estate company posted a fourth quarter loss of $1.26 per share, missing analysts’ estimates.

Investing.com reports:

-

OpenAI and Nvidia in final negotiations for $30B investment

Reuters reports: