The recent cryptocurrency slump may have reduced Robinhood’s Q4 revenues, but it hasn’t stopped its blockchain investment, today, Feb. 11, 2026.

Today’s Change

Current Price

Robinhood Markets (HOOD 8.97%), a pioneer of commission-free trading, closed Wednesday at $77.97, down 8.91% as investors reacted to yesterday’s Q4 2025 earnings. Revenue came in below expectations, largely due to cryptocurrency weakness.

Trading volume reached 68.3 million shares, coming in about 146% above its three-month average of 27.8 million shares. Robinhood Markets IPO’d in 2021 and has grown 105% since going public.

How the markets moved today

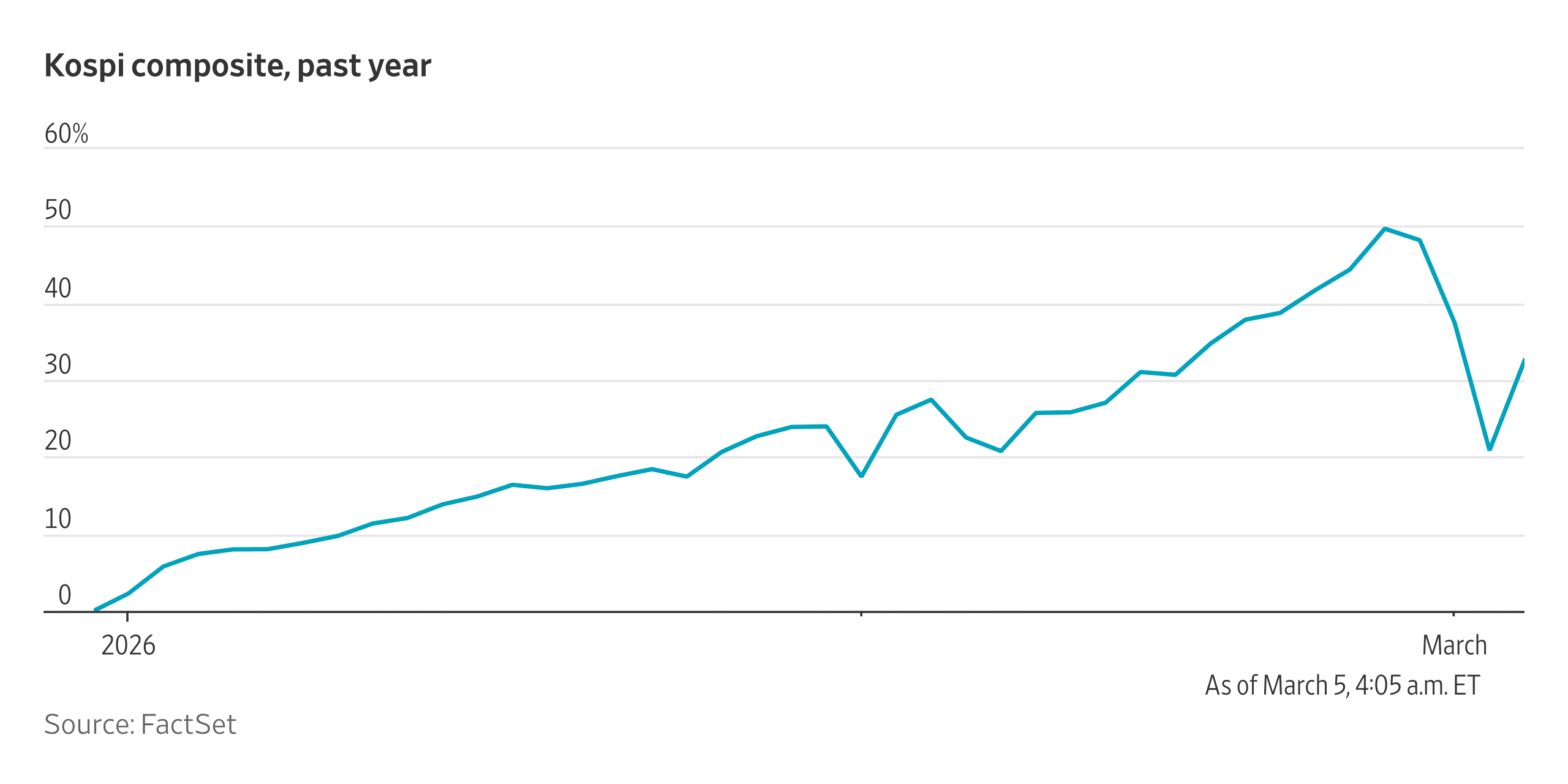

The S&P 500 (^GSPC +0.00%) held steady at 6,941, while the Nasdaq Composite (^IXIC 0.16%) eased 0.16% to finish at 23,066. Within financial services, industry peers Charles Schwab (SCHW 3.75%) closed at $95.45, down 3.83%, and Interactive Brokers Group (IBKR 1.09%) fell 1.10% to finish at $76.35.

What this means for investors

Cryptocurrency prices have been trending downwards since October. Lead crypto, Bitcoin (BTC 1.89%) lost 43% of its value in the past six months. Robinhood has fared a little better, but is still down over 30% in the same time period. It has built a name for itself as a leading crypto broker, making it susceptible to volatility in digital assets.

Analysts at Piper Sandler (PIPR 5.02%), JPMorgan (JPM 2.34%), and Compass Point all cut their price targets today following mixed Q4 results. Robinhood reported a record $4.5 billion in revenue for 2025, but its Q4 figures didn’t quite meet analyst expectations.

Disappointing revenue, particularly from crypto and options trading, shook investor confidence. The company continues to push into blockchain, with Robinhood Chain and decentralized finance products in the pipeline. Investors might weigh its efforts to diversify alongside wider cryptocurrency predictions.

Charles Schwab is an advertising partner of Motley Fool Money. JPMorgan Chase is an advertising partner of Motley Fool Money. Emma Newbery has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Bitcoin, Interactive Brokers Group, and JPMorgan Chase. The Motley Fool recommends Charles Schwab and recommends the following options: long January 2027 $43.75 calls on Interactive Brokers Group, short January 2027 $46.25 calls on Interactive Brokers Group, and short March 2026 $100 calls on Charles Schwab. The Motley Fool has a disclosure policy.