The Dow Jones Industrial Average and other major indexes were mostly unchanged in early trades Monday. While the Dow was up less than 0.1%, the S&P 500 was flat. The Nasdaq managed a 0.2% gain in the stock market today.

X

January’s inflation data is due on Tuesday. Economists see inflation inching up 0.2% after a 0.3% rise in December. On an annual basis, they see the consumer price index falling to a 3% increase from December’s 3.4%. On Thursday, retail sales for January are seen falling 0.1% after 0.6% growth in December, according to Econoday. Ex-vehicles, economists expect it to rise 0.2%.

The SPDR S&P 500 ETF Trust (SPY) was also unchanged in the stock market today.

Volume on the NYSE and on the Nasdaq was lower compared with the same time on Friday. But breadth was strong. Advancers beat decliners by more than 3-1 on the NYSE and 2-1 on the Nasdaq.

The small-cap Russell 2000 bucked the larger trend and added 1%. The index is on track for a three-day winning streak.

The Innovator IBD 50 ETF (FFTY) added slim gains after a three-day rally.

The yield on the benchmark 10-year Treasury note fell less than 1 basis point to 4.18%.

Dow Jones Lags In Stock Market Today

Intel (INTC) rose but other tech stocks lagged in the Dow. Apple (AAPL) fell further below the 50-day moving average. Salesforce (CRM) also fell with fourth-quarter results due Feb. 28.

Retail stocks in the Dow Jones industrials fared well.

Walgreens (WBA) gained nearly 1% as did Home Depot (HD). Walmart (WMT) was nearly flat.

Outside the Dow, video imaging company Beamer Imaging (BMR) surged over 500% after news that the company has partnered with Nvidia (NVDA) and that it would present its research findings on automated video cloud service. BMR traded around 2 per share in premarket trades but was at 13.70 in morning trading.

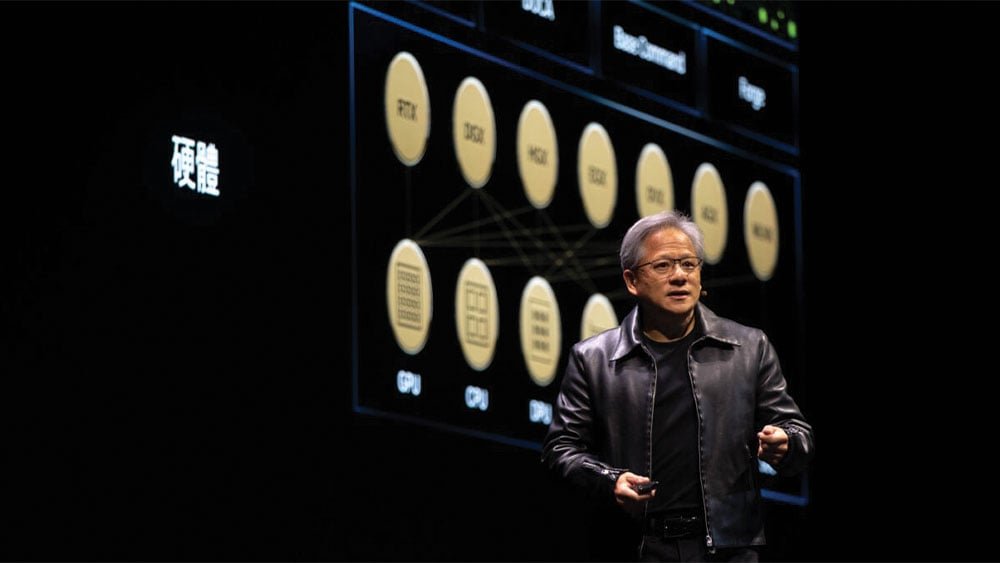

Meanwhile, Nvidia CEO Jensen Huang observed at a global summit that spending on data centers is set to double over the next few years. NVDA stock rose to another all-time high Monday. Fourth-quarter results are scheduled for Feb. 21.

Shares of Monday (MNDY) plunged 8% after the software company reported its fourth-quarter results. While topping expectations, the company’s outlook disappointed. Shares are paring some losses but were at risk of round-tripping as they dived toward an earlier buy point of 189.15.

Oil Deal Lifts FANG

In energy news, Diamondback Energy (FANG) is planning to buy privately held oil and gas producer Endeavor Energy Resources for $26 billion. FANG rebounded from its 50-day moving average in the stock market today and is forming a base.

The cash and stock deal follows several other recent agreements in the oil and gas producers group, including Exxon Mobil‘s (XOM) deal with Pioneer Natural Resources (PXD). Last year, Warren Buffett-backed Occidental Petroleum (OXY) entered into a similar deal with CrownRock.

Cadence Design Systems (CDNS) will report its fourth-quarter results after today’s market close. Also on deck with earnings Monday, Lattice Semiconductor (LSCC) has retaken the 50-day moving average and is testing resistance around 71. In medical research services, Medpace Holdings (MEDP) broke out last week and is in a buy zone from a 317.57 buy point ahead of earnings after close of the stock market today.

NXP Semiconductors (NXPI) is breaking out at 238.27 today. The stock retook the 50-day line after earnings were announced on Feb. 5.

Please follow VRamakrishnan on X/Twitter for more news on the stock market today.

YOU MAY ALSO LIKE:

Top Growth Stocks To Buy And Watch

Learn How To Time The Market With IBD’s ETF Market Strategy

Find The Best Long-Term Investments With IBD Long-Term Leaders

MarketSmith: Research, Charts, Data And Coaching All In One Place

How To Research Growth Stocks: Why This IBD Tool Simplifies The Search For Top Stocks