Super Micro Computer‘s (NASDAQ: SMCI) share price slipped in Wednesday’s trading. The artificial intelligence (AI) stock ended the daily session down 4.1%, according to data from S&P Global Market Intelligence.

Top AI stocks lost ground in today’s trading, and Supermicro got caught up in the pullback. Recent filings published through the Securities and Exchange Commission (SEC) showed that members of Nvidia‘s board of directors had recently sold roughly $80 million worth of company stock.

In addition to news that Nvidia insiders had recently unloaded shares, an analyst’s recent coverage of SoundHound AI stock likely impacted Supermicro’s share price today. Citing valuation concerns, a Northland analyst lowered the firm’s rating on SoundHound from outperform to market perform in a note published today. As a result of these catalysts, investors became more cautious about Super Micro Computer Stock today.

Can Super Micro Computer stock still deliver huge gains?

Nvidia, SoundHound AI, and Super Micro Computer have emerged as some of the market’s most visible and most explosive artificial intelligence stocks. When major players in the space see significant valuation pullbacks, it tends to have ripple effects for other companies in the otherwise red-hot tech category.

Even with today’s pullback, Supermicro stock has seen incredible gains in conjunction with rising demand for its rack-server technologies. The company’s share price is still up 187% year to date, despite today’s sell-off.

Demand for Super Micro Computer’s server and storage solutions has skyrocketed as leading tech companies have made moves to ramp up their AI processing and data transmission capabilities. It looks like these performance catalysts will continue to be quite strong in the near term.

For Supermicro’s current fiscal year, which ends June 30, the company’s midpoint guidance calls for sales of roughly $14.5 billion. If performance were to come in at that level, revenue would more than double, compared to the $7.12 billion in sales the business posted in its last fiscal year.

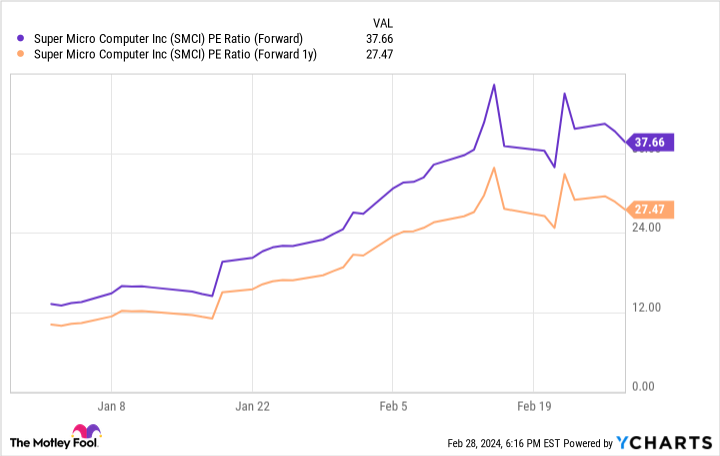

With Supermicro stock trading at roughly 37.7 times this year’s expected earnings and roughly 27.5 times next year’s expected profits, the company has a growth-dependent valuation, even on the heels of today’s valuation pullback. On the other hand, recent momentum for the business has been nothing short of incredible.

There are good reasons to think that growth will continue at very high rates over the next few years and beyond. Supermicro isn’t a low-risk stock, but there are signs that it could surge above current pricing levels.

Should you invest $1,000 in Super Micro Computer right now?

Before you buy stock in Super Micro Computer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of February 26, 2024

Keith Noonan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool recommends Super Micro Computer. The Motley Fool has a disclosure policy.

Super Micro Computer Fell Today — Is This a Great Chance to Buy the Artificial Intelligence (AI) Stock? was originally published by The Motley Fool