Super Micro Computer (NASDAQ: SMCI) stock jumped again in Wednesday’s trading. The company’s share price closed out the daily session up 11.3%, according to data from S&P Global Market Intelligence.

On Tuesday, Barclays analysts published a note on Super Micro (known as Supermicro) stock. The firm’s analysts raised their one-year price target from $691 per share to $961 per share due to indications that artificial intelligence (AI) would continue to power strong demand for Supermicro’s rack servers. Based on today’s closing price, the new target from the Barclays analysts suggests additional potential upside of 9% for the stock.

Additionally, it’s likely that Supermicro stock got a boost from a bullish report on Nvidia stock from Susquehanna that was published today. In the Susquehanna note, analyst Christopher Rolland said that he expected Nvidia to record fourth-quarter revenue that beat the market’s current targets thanks to AI-driven demand. With Supermicro also benefiting from surging AI-related related demand, good news for Nvidia could bode well for the server and storage company’s own outlook.

Is Super Micro Computer stock still a buy?

Supermicro’s stock has been on an incredible tear. The company’s share price is already up roughly 210% across 2024’s trading, and it’s rocketed 872% higher over the last year.

To its credit, the company has been posting impressive results to back up the rally. At the end of January, Supermicro published results for the second quarter of its current fiscal year — a period that closed at the end of last December. In addition to posting sales and earnings performance in the period that came in better than the hugely improved guidance it issued shortly before publishing the report, forward guidance also crushed Wall Street’s targets.

The company expects to record revenue between $14.3 billion and $14.7 billion in its current fiscal year, suggesting that sales will more than double compared to the $7.12 billion in sales that it posted in its last fiscal year. AI is driving a huge uptick in demand for Supermicro’s high-performance rack servers, and the trend could last for a while.

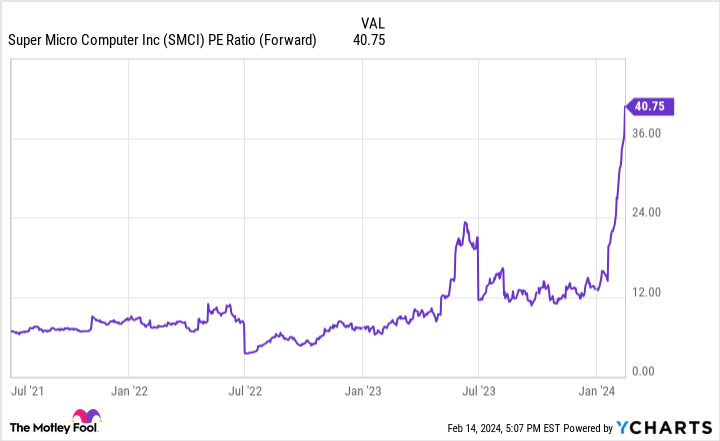

Supermicro’s performance outlook is promising, but investors should also keep the massive run-up for the stock in mind.

Trading at roughly 41 times this year’s expected earnings, Supermicro stock has become much riskier on the heels of its incredible run. Looking ahead, the company is valued at approximately 31 times next year’s expected profits. Given the speculation and uncertainty involved in charting the tech specialist’s business trajectory, Supermicro’s current valuation is probably too rich for investors without high levels of risk tolerance.

On the other hand, it’s possible that the company is still in the early stages of benefiting from powerful long-term demand tailwinds thanks to AI. With Supermicro valued at roughly $49 billion, the stock could still have big upside potential if artificial intelligence continues to power rapid sales and earnings growth. Shares have become riskier and could be volatile, but the stars could be aligning for the company to continue crushing expectations.

Should you invest $1,000 in Super Micro Computer right now?

Before you buy stock in Super Micro Computer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of February 12, 2024

Keith Noonan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool recommends Barclays Plc and Super Micro Computer. The Motley Fool has a disclosure policy.

Super Micro Computer Surged Today — Is It Too Late to Buy the Red-Hot Artificial Intelligence (AI) Growth Stock? was originally published by The Motley Fool