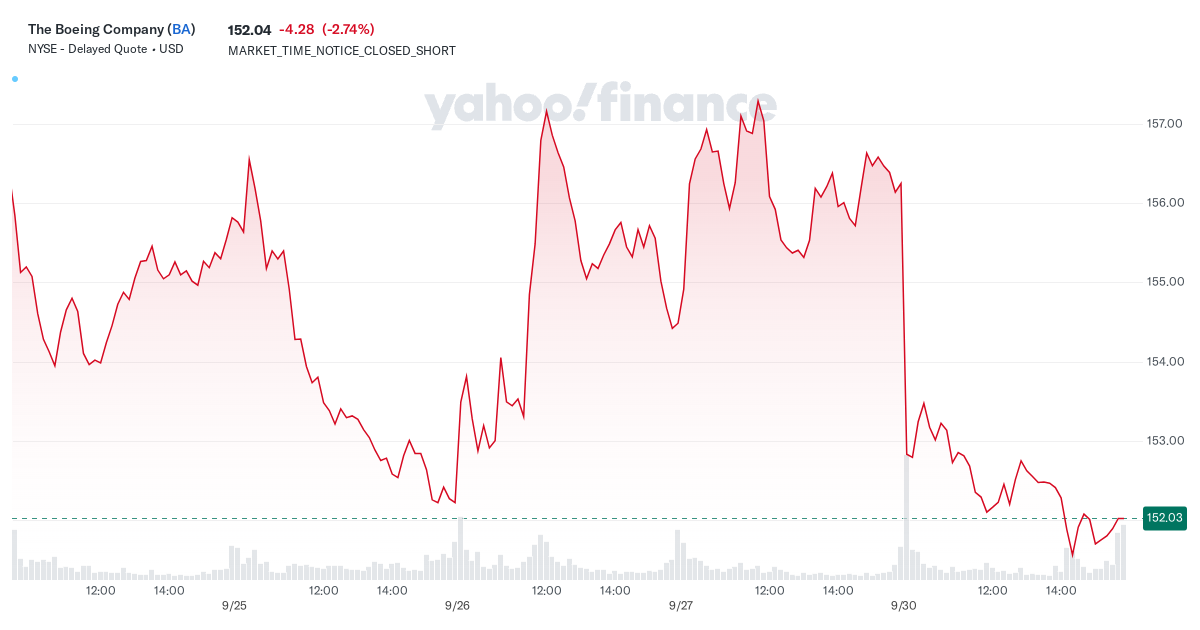

NYSE – Nasdaq Real Time Price • USD

At close: 4:00 PM EDT

After hours: 7:23 PM EDT

- Previous Close

156.32 - Open

154.79 - Bid 152.00 x 1000

- Ask 152.03 x 800

- Day’s Range

151.24 – 155.30 - 52 Week Range

151.24 – 267.54 - Volume

9,832,502 - Avg. Volume

6,969,503 - Market Cap (intraday)

93.691B - Beta (5Y Monthly) 1.58

- PE Ratio (TTM)

— - EPS (TTM)

-5.64 - Earnings Date Oct 23, 2024 – Oct 28, 2024

- Forward Dividend & Yield —

- Ex-Dividend Date Feb 13, 2020

- 1y Target Est

211.76

The Boeing Company, together with its subsidiaries, designs, develops, manufactures, sells, services, and supports commercial jetliners, military aircraft, satellites, missile defense, human space flight and launch systems, and services worldwide. The company operates through Commercial Airplanes; Defense, Space & Security; and Global Services segments. The Commercial Airplanes segment develops, produces, and markets commercial jet aircraft for passenger and cargo requirements, as well as provides fleet support services. The Defense, Space & Security segment engages in the research, development, production, and modification of manned and unmanned military aircraft and weapons systems; strategic defense and intelligence systems, which include strategic missile and defense systems, command, control, communications, computers, intelligence, surveillance and reconnaissance, cyber and information solutions, and intelligence systems; and satellite systems, such as government and commercial satellites, and space exploration. The Global Services segment offers products and services, including supply chain and logistics management, engineering, maintenance and modifications, upgrades and conversions, spare parts, pilot and maintenance training systems and services, technical and maintenance documents, and data analytics and digital services to commercial and defense customers. The Boeing Company was incorporated in 1916 and is based in Arlington, Virginia.

171,000

Full Time Employees

December 31

Fiscal Year Ends

Trailing total returns as of 9/30/2024, which may include dividends or other distributions. Benchmark is .

YTD Return

1-Year Return

3-Year Return

5-Year Return

Select to analyze similar companies using key performance metrics; select up to 4 stocks.

Valuation Measures

As of 9/27/2024

-

Market Cap

96.33B

-

Enterprise Value

141.63B

-

Trailing P/E

—

-

Forward P/E

37.31

-

PEG Ratio (5yr expected)

—

-

Price/Sales (ttm)

1.30

-

Price/Book (mrq)

—

-

Enterprise Value/Revenue

1.93

-

Enterprise Value/EBITDA

112.41

Financial Highlights

Profitability and Income Statement

-

Profit Margin

-4.68%

-

Return on Assets (ttm)

-0.23%

-

Return on Equity (ttm)

—

-

Revenue (ttm)

73.56B

-

Net Income Avi to Common (ttm)

-3.44B

-

Diluted EPS (ttm)

-5.64

Balance Sheet and Cash Flow

-

Total Cash (mrq)

12.6B

-

Total Debt/Equity (mrq)

—

-

Levered Free Cash Flow (ttm)

-3.49B