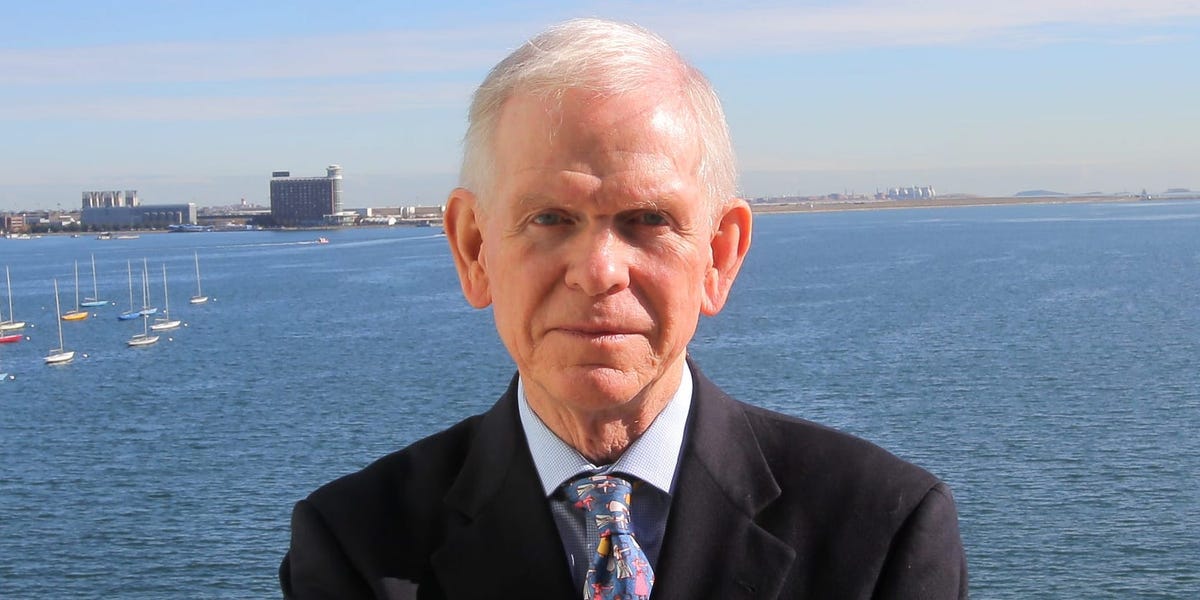

- Jeremy Grantham warned US stocks and the economy are headed for trouble.

- The elite investor and market historian said the AI frenzy is a bubble that’s bound to burst.

- Grantham predicted a decade of disappointment for stocks and flagged several long-term threats.

Thanks for signing up!

Access your favorite topics in a personalized feed while you’re on the go.

Jeremy Grantham says US stocks are massively overvalued and poised to tumble, the AI craze is a bubble that will pop, and the defiant American economy is headed for trouble.

The S&P 500 has surged 30% to record highs since the start of last year, but there has “never been a sustained bull market” with a backdrop like today’s, Grantham told the Exchange conference in Miami this week.

Full employment and a Shiller price-to-earnings ratio of 33 — a figure in the top 2% of the measure’s historical range — makes it a virtual certainty that stocks will underperform in the years ahead, he said.

“If you want to have a long, impressive rally, you want to see profit margins down, unemployment up, and PEs low,” said the GMO cofounder and long-term investment strategist.

“Starting with very high prices is a pretty much guarantee that for the next 10 or 15 years you will be disappointed,” he continued. “You never do well for a long time when you start when everything is rosy. That seems pretty obvious, doesn’t it guys?”

The market historian said the stock-market boom reminded him of the financial frenzies that preceded the Wall Street Crash of 1929 and the ensuing Great Depression, Japan’s economic implosion in 1990 that ushered in two lost decades of growth, and the collapse of the dot-com bubble at the turn of this century.

“Usually they end when you’ve had a long run — check; full employment — check,” Grantham said.

‘Superbubble’

“The surprising thing about this entire event is how US it is,” he noted. “In real estate, everything everywhere is in a dangerous bubble, but in equities for some reason they left out the rest of the world.”

Grantham sounded the alarm on a multi-asset “superbubble” at the start of 2022, and stocks plunged that year as he predicted. However, ChatGPT’s debut that winter ignited the AI boom, lighting a fire under the stock prices of Nvidia, Microsoft, Alphabet, and the rest of the “Magnificent Seven” technology companies expected to cash in on the trend.

The veteran investor said he expects AI to be transformative, but he cautioned that would take time, and the current buzz was overblown and would end painfully. He called out companies rushing to buy microchips to power their AI projects, when they “don’t know what they’re going to use the chips for.”

“It’s like selling shovels in the gold rush, and the shovel sellers are completely freaking out,” Grantham said. “We’ll have that euphoria like we had in railroads and in internet, and then we will have the setback that followed every single case.”

“We’re way over our skis, and when that subsidiary bubble breaks, will it take the air out of the rest of the market, who will then do maybe what they would have done anyway? he asked. “That’s my bet.”

‘Living on air’

Grantham also declared that America’s resilient growth and robust employment was unsustainable and detached from the global reality.

“The same with the economy, it’s been living on air,” he said. “Please be advised, the rest of the world is looking with amazement at the US, the US economy, the US stock market,” he said.

Grantham noted that other countries were “nervous” about the wars raging in Ukraine and Gaza, geopolitical and trade tensions, and long-term headwinds like climate change, dwindling resources, and population decline across much of the developed world.

It’s worth emphasizing that the US stock market and economy have defied Grantham’s warnings of crashes and recession for several years now, and might well continue to do so.