Market gains have left some stocks trading at expensive levels.

The S&P 500 entered the third year of a bull market back in October and finished the year with a bang: a double-digit gain that brought the index’s three-year increase to 78%. Over that time period, investors have been particularly optimistic about stocks in high-growth areas, from artificial intelligence and quantum computing to companies leading in the weight loss drug market. In this context, stocks including AI leader Nvidia, quantum innovator IonQ, and weight loss drug giant Eli Lilly each have skyrocketed.

Investors also felt optimistic as the Federal Reserve pursued interest rate cuts — lower rates relieve pressure on the consumer’s wallet and make it easier for companies to borrow — and they bet on an improving economy.

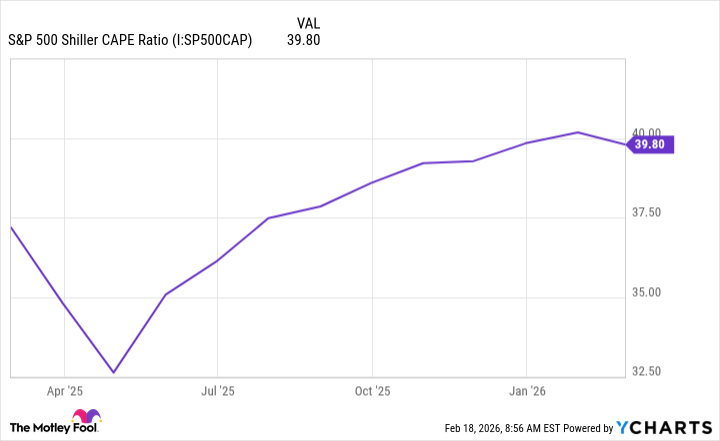

All of this not only boosted the price of stocks, but it also increased their valuations. In fact, stocks reached levels only attained once before throughout history, as we can see through the Shiller CAPE ratio, an inflation-adjusted look at stock price in relation to earnings per share. The Shiller CAPE ratio reached beyond 40 earlier this year. The last — and only — time it did that was during the dot-com boom back in 2000.

Now, in the early months of 2026, investors may be wondering what might happen next. Well, the stock market just did something that it hasn’t done for almost a year. And history offers us a strikingly clear idea about what may lie ahead.

Image source: Getty Images.

The S&P 500 in 2026

Before we dig in, let’s consider what’s unfolded so far in the first few weeks of the year. Concerns about the valuations of AI stocks actually started late in 2025, and many of these companies saw their stock prices dip for this reason in November. Investors worried that high valuations weren’t sustainable — and any dip in AI spending or demand could set off significant declines.

In recent weeks, other concerns joined this potential problem. Uncertainty regarding the pace of interest rate cuts weighed on investor sentiment. Investors also questioned whether ongoing high spending by AI companies would indeed pay off. Finally, progress in AI sparked concerns that certain sectors, such as enterprise software, might suffer — the idea is that customers could shift out of software contracts and opt for AI to do the job. Though Nvidia chief Jensen Huang called this idea “illogical,” it has still made some investors more cautious.

As a result, the S&P 500 is little changed so far this year.

Today’s Change

Current Price

And this brings me to the market move we as investors shouldn’t ignore. Once again, I’ll turn to the Shiller CAPE ratio, the metric that has demonstrated how pricey stocks have become. Just recently, the Shiller CAPE declined for the first time in almost a year.

S&P 500 Shiller CAPE Ratio data by YCharts

A clear sign of something big

This drop was very small, but it is noteworthy considering that it’s the first sign that valuations are coming down. Now let’s consider what may happen next.

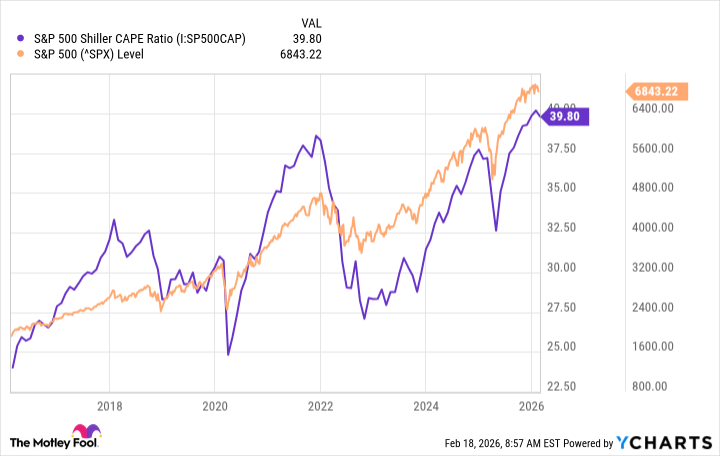

History offers us a strikingly clear pattern. In the past, when valuation has declined, the S&P 500 has also dropped.

S&P 500 Shiller CAPE Ratio data by YCharts

This means that, if history is right, we could be at the start of a period of declines — and recent concerns that I mentioned above, if they persist, could drive this movement.

Does this mean the end of the bull market is near? Not necessarily. As we can see from the chart above, stocks have slipped along with the valuation measure — but these movements aren’t always deep or long-lasting. This means we could be heading for a negative period that may last a few weeks, or the market might stagnate instead of heading significantly higher. It will be important to watch elements such as economic reports, messages from the Fed, and the performance of growth companies in the weeks to come — these should offer us additional clues about near-term market direction.

Now here’s the most important point: Even if the S&P 500 falls this year, investors shouldn’t worry. The index has proven over time that it always recovers and gains significantly over the long term. This means that if you’re invested in quality companies and hold on for a number of years, any short-term down markets and even market crashes won’t impact your performance very much. You still could score a big win down the road.