Unlock stock picks and a broker-level newsfeed that powers Wall Street.

Maurie Backman

5 min read

Many people enjoyed tremendous stock market gains in 2023 and 2024 as the S&P 500 soared, buoyed by strong gains in the tech sector. But on March 13, 2025, the S&P 500 officially entered correction territory, which means the index lost at least 10% of its value but less than 20%.

As worries about a market crash continue to escalate, many investors are left wondering what they can do to right the ship. Let’s say, for example, that you and your family had a large amount of money in stocks, and the events of the past week have cost you two years’ worth of market gains.

-

I’m 49 years old and have nothing saved for retirement — what should I do? Don’t panic. Here are 5 of the easiest ways you can catch up (and fast)

-

Home prices in America could fly through the roof in 2025 — here’s the big reason why and how to take full advantage (with as little as $10)

-

Americans with upside-down car loans owe more money than ever before — and drivers can’t keep up. Here are 3 ways to cut your monthly costs ASAP

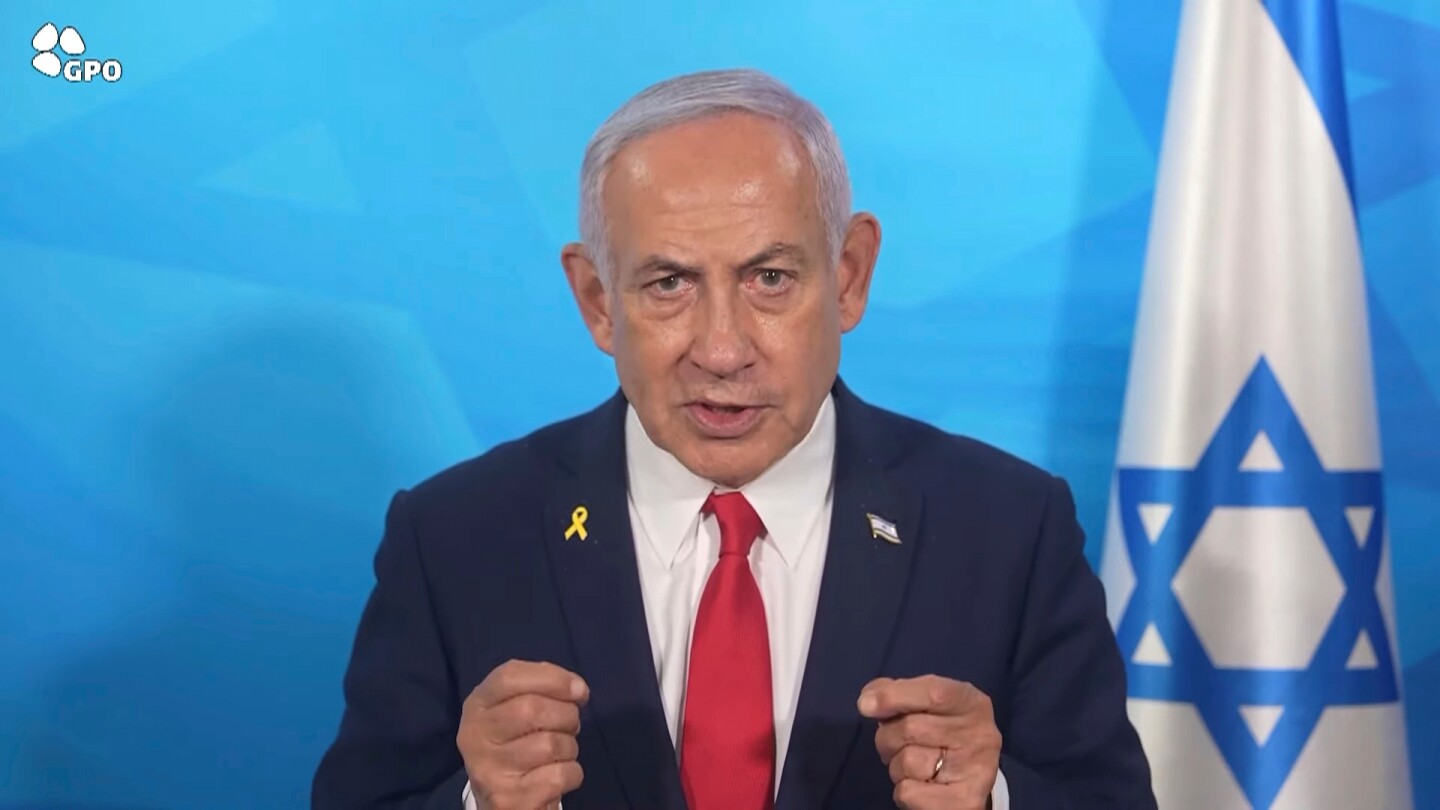

Your family’s portfolio value has declined by $800,000, and President Trump’s aggressive policies have you worried about losing even more. It’s natural to panic in a situation like this, but here’s how to move forward.

It’s natural to get spooked by a stock market correction like the one we’re currently in the midst of. But it’s also important to remember that market corrections are fairly common.

Since 1929, the S&P 500 index has fallen into correction territory 56 times, per a Reuters analysis of data from Yardeni Research. But here’s some encouraging news — of those 56 corrections, only 22 became bear markets, defined as a drop of 20% or more from recent highs.

Even more importantly, the stock market has a strong history of recovering from corrections. Invesco says the average time for the market to recover from a decline of 5% to 10% is three months. For a drop of 10% to 20%, it’s eight months. But either way, the market does tend to recoup losses like these over time and reward investors who stick with it.

For this reason, it’s not a great idea to sell off stocks during a stock market correction. If you do, you’re almost guaranteed to lock in losses in your portfolio. If you wait out a correction, you have a very good chance of a full portfolio recovery, and then some.

Read more: An alarming 97% of older Americans are carrying debt into retirement — here’s why and 4 simple things you can do if you’re stuck in the same situation

One of the best ways to protect yourself from stock market volatility is to maintain a diverse mix of assets. Now’s a good time to check up on your portfolio and make sure you’re not overly concentrated in any single company or sector.