The Canadian market has been reaching new heights, with the TSX recently achieving all-time highs, buoyed by optimism surrounding central bank policies and a robust economic outlook. In this environment of growth and opportunity, dividend stocks like PHX Energy Services stand out for their potential to provide steady income streams while benefiting from favorable market conditions.

Top 10 Dividend Stocks In Canada

|

Name |

Dividend Yield |

Dividend Rating |

|

Whitecap Resources (TSX:WCP) |

6.77% |

★★★★★★ |

|

Secure Energy Services (TSX:SES) |

3.11% |

★★★★★☆ |

|

Labrador Iron Ore Royalty (TSX:LIF) |

7.76% |

★★★★★☆ |

|

Power Corporation of Canada (TSX:POW) |

5.24% |

★★★★★☆ |

|

Enghouse Systems (TSX:ENGH) |

3.15% |

★★★★★☆ |

|

Firm Capital Mortgage Investment (TSX:FC) |

8.65% |

★★★★★☆ |

|

Sun Life Financial (TSX:SLF) |

4.15% |

★★★★★☆ |

|

Russel Metals (TSX:RUS) |

4.14% |

★★★★★☆ |

|

Royal Bank of Canada (TSX:RY) |

3.45% |

★★★★★☆ |

|

Canadian Natural Resources (TSX:CNQ) |

4.39% |

★★★★★☆ |

Click here to see the full list of 31 stocks from our Top TSX Dividend Stocks screener.

Let’s take a closer look at a couple of our picks from the screened companies.

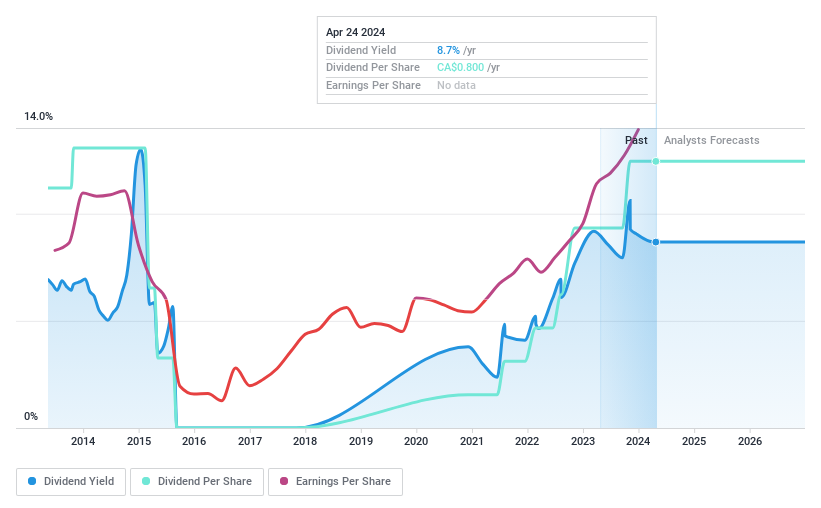

PHX Energy Services

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: PHX Energy Services Corp. offers horizontal and directional drilling services, rents performance drilling motors, and sells motor equipment and parts to oil and natural gas exploration and development companies across Canada, the United States, Albania, the Middle East regions, and internationally with a market cap of CA$425.40 million.

Operations: PHX Energy Services Corp. generates revenue primarily from its horizontal oil and natural gas well drilling services, amounting to CA$655.05 million.

Dividend Yield: 8.3%

PHX Energy Services recently affirmed a quarterly dividend of C$0.20 per share, reflecting its position in the top 25% of Canadian dividend payers. However, sustainability concerns arise as dividends are not covered by cash flows, with a high cash payout ratio of 126.2%. Despite trading at a significant discount to estimated fair value and implementing share buybacks to enhance shareholder returns, past dividend volatility and insider selling may be cautionary signals for investors.

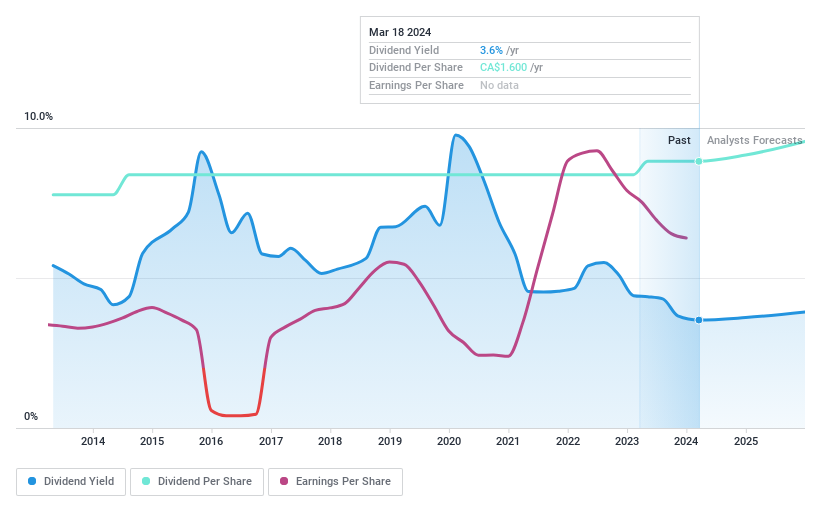

Russel Metals

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Russel Metals Inc. is a metal distribution and processing company operating in Canada and the United States, with a market cap of CA$2.36 billion.

Operations: Russel Metals Inc.’s revenue segments include CA$2.84 billion from Metals Service Centers, CA$984 million from Energy Field Stores, and CA$413.80 million from Steel Distributors.

Dividend Yield: 4.1%

Russel Metals offers a reliable dividend with a 4.14% yield, supported by stable payments over the past decade. The company’s dividends are well-covered by earnings and cash flows, with payout ratios of 47.2% and 40.2%, respectively. Recent actions include redeeming $150 million in senior notes and initiating a share repurchase program for up to 9.91% of its shares, funded through existing resources, which could enhance shareholder value despite recent declines in sales and earnings.

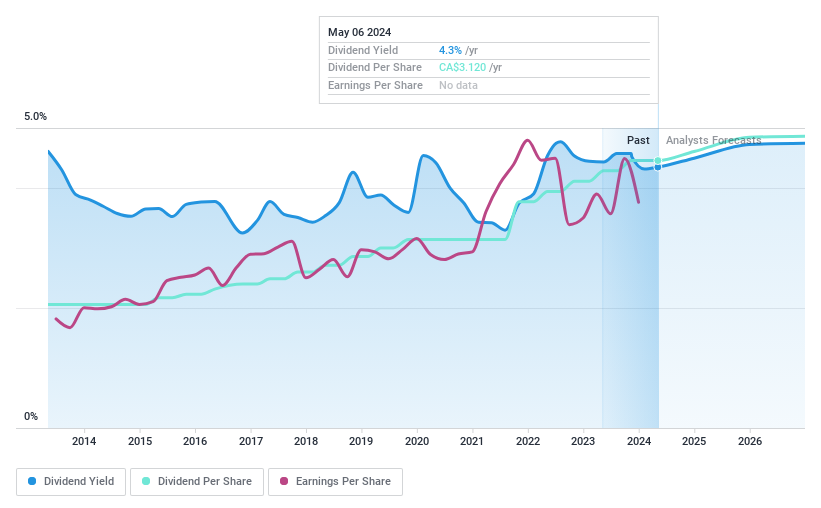

Sun Life Financial

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sun Life Financial Inc. is a global financial services company offering savings, retirement, and pension products, with a market cap of CA$45.12 billion.

Operations: Sun Life Financial Inc.’s revenue segments include CA$4.20 billion from Asia, CA$17.81 billion from Canada, CA$0.42 billion from Corporate, CA$6.39 billion from Asset Management, and CA$13.72 billion from the United States (U.S.).

Dividend Yield: 4.1%

Sun Life Financial’s dividend yield of 4.15% is reliable, with stable growth over the past decade. Dividends are well-covered by earnings and cash flows, with payout ratios of 59% and 48.6%. Recent leadership changes aim to enhance digital capabilities, potentially supporting future financial stability. The company’s share repurchase program and debt redemption indicate a focus on capital management, though its dividend yield lags behind top Canadian payers at 5.89%.

Taking Advantage

-

Click this link to deep-dive into the 31 companies within our Top TSX Dividend Stocks screener.

-

Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St’s portfolio to get a 360-degree view on how they’re shaping up.

-

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

-

Explore high-performing small cap companies that haven’t yet garnered significant analyst attention.

-

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

-

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSX:PHX TSX:RUS and TSX:SLF.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com