The U.S. stock market has kicked off February with a strong performance, as major indexes like the Dow Jones Industrial Average and S&P 500 have surged, reflecting optimism amid recent economic developments such as trade deals and manufacturing growth. In this dynamic environment, identifying promising stocks often involves looking beyond the usual suspects to uncover lesser-known companies that are poised for growth due to unique positioning or innovative strategies in their respective industries.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

Below we spotlight a couple of our favorites from our exclusive screener.

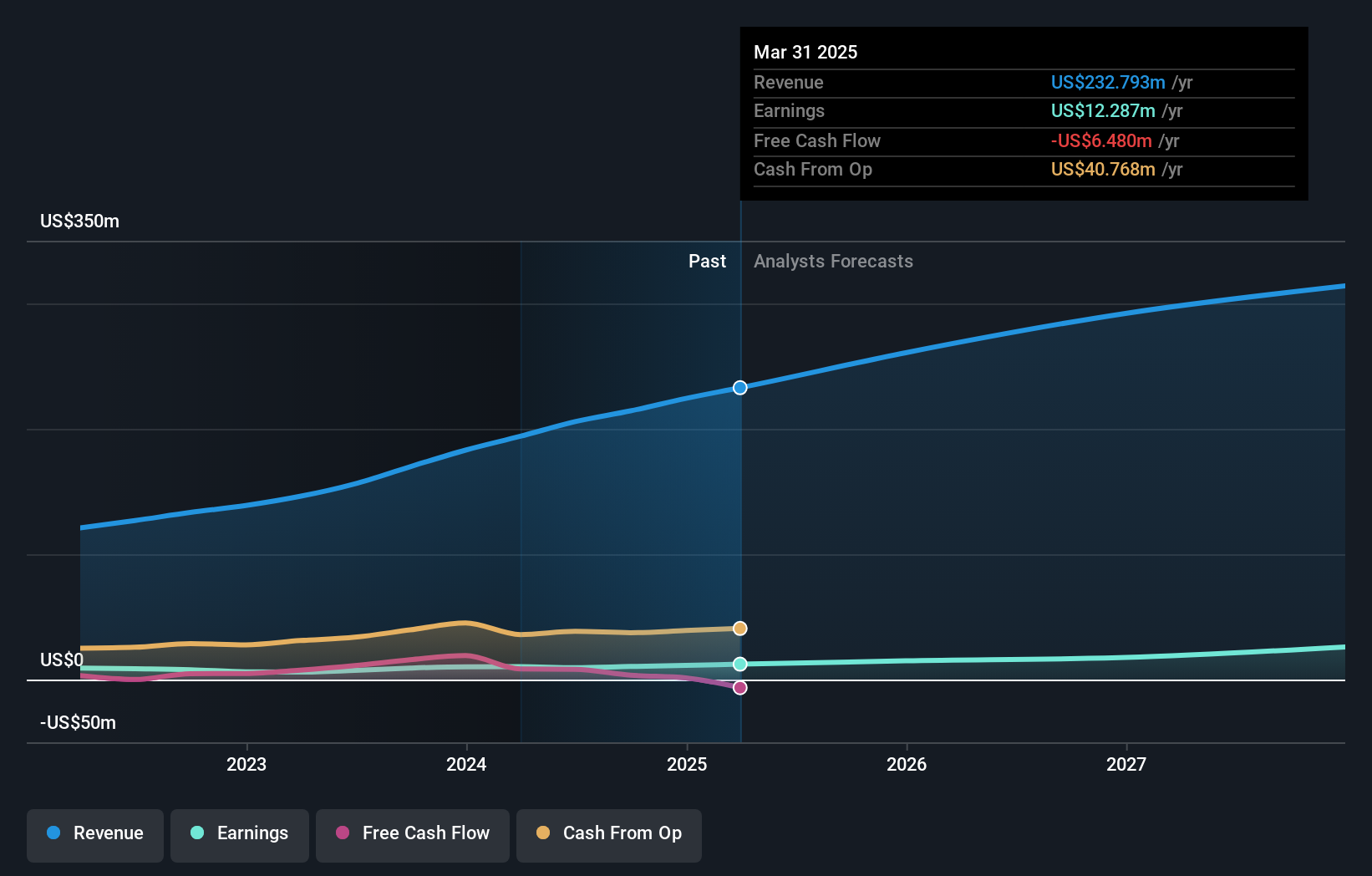

Viemed Healthcare (VMD)

Simply Wall St Value Rating: ★★★★★☆

Overview: Viemed Healthcare, Inc. operates in the United States offering home medical equipment and post-acute respiratory healthcare services, with a market cap of $307.95 million.

Operations: The company generates revenue primarily from healthcare facilities and services, amounting to $254.79 million.

Viemed Healthcare, a notable player in the healthcare sector, has been on an upward trajectory with earnings growing 30.5% over the past year, outpacing the industry average of 16.3%. This growth is supported by high-quality earnings and a satisfactory net debt to equity ratio of 7.4%, indicating prudent financial management. The company’s interest payments are well covered by EBIT at 20 times coverage, showcasing financial stability. Additionally, Viemed is set to present at the Lytham Partners Healthcare Investor Summit on January 15th, which may provide further insights into its strategic direction and future prospects.

- Take a closer look at Viemed Healthcare’s potential here in our health report.

-

Gain insights into Viemed Healthcare’s past trends and performance with our Past report.

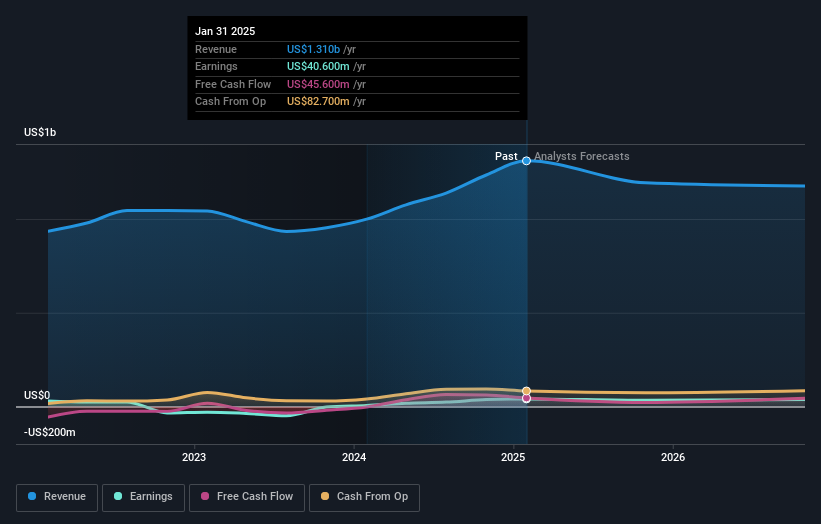

Mission Produce (AVO)

Simply Wall St Value Rating: ★★★★★★

Overview: Mission Produce, Inc. is involved in the sourcing, farming, packaging, marketing, and distribution of avocados, mangoes, and blueberries to food retailers, wholesalers, and foodservice customers both in the United States and internationally with a market cap of $968.37 million.

Operations: Mission Produce’s revenue is primarily driven by its Marketing & Distribution segment, contributing $1.27 billion, followed by International Farming at $125.9 million and Blueberries at $93.10 million. The company has a market cap of approximately $968.37 million.

Mission Produce, a player in the U.S. avocado market, showcases promising financial health with a satisfactory net debt to equity ratio of 5.9% and interest payments well covered by EBIT at 8.5 times. Over the past year, earnings rose by 2.7%, outpacing the food industry average of 1.4%. Despite recent leadership changes, including John M. Pawlowski stepping up as CEO in April 2026, Mission continues its strategic growth efforts with share repurchases totaling $6.72 million since September 2023 and plans for further expansion under new board member Douglas Stone’s guidance in global initiatives and opportunities for growth.

- Dive into the specifics of Mission Produce here with our thorough health report.

-

Assess Mission Produce’s past performance with our detailed historical performance reports.

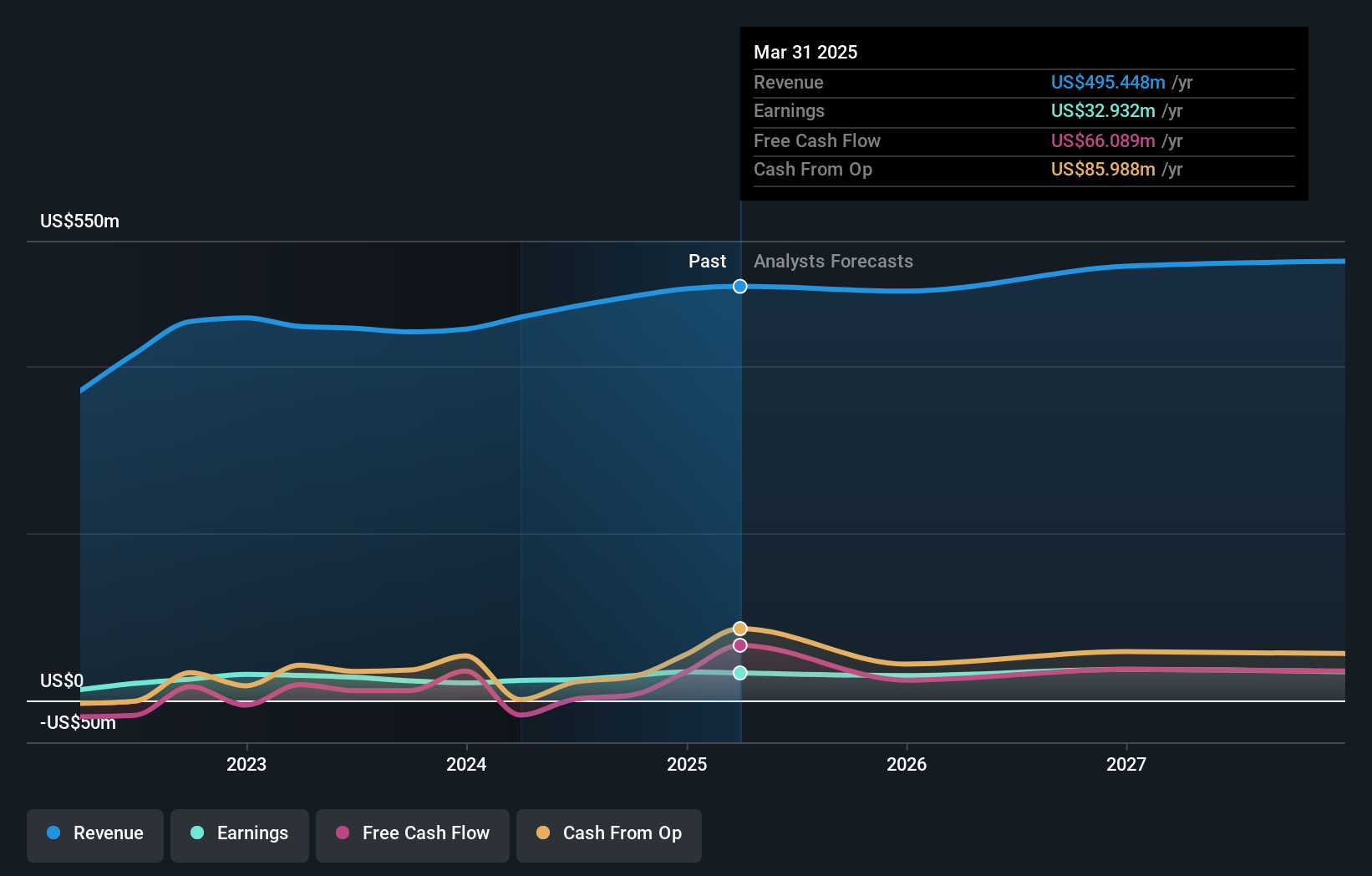

NWPX Infrastructure (NWPX)

Simply Wall St Value Rating: ★★★★★☆

Overview: NWPX Infrastructure, Inc. operates in the manufacture and sale of water-related infrastructure products across North America and Canada, with a market capitalization of $662.01 million.

Operations: NWPX Infrastructure generates revenue primarily from its Water Transmission Systems and Precast Infrastructure and Engineered Systems segments, with revenues of $349.39 million and $170.60 million, respectively.

NWPX Infrastructure, a key player in water-related infrastructure, navigates a challenging environment with its net debt to equity ratio at 9.6%, indicating satisfactory leverage. Over the past five years, earnings have grown by 13.8% annually, although recent growth of 23.9% lagged behind the Construction industry’s 26.2%. The company’s interest payments are well covered by EBIT at 15.6 times coverage, showcasing financial resilience despite an increasing debt to equity ratio from 5.5% to 10.3%. Recent strategic leadership promotions and innovative product advancements like the Permalok Radial Bending Joint highlight NWPX’s commitment to adaptability and growth amidst market challenges.

Next Steps

- Discover the full array of 313 US Undiscovered Gems With Strong Fundamentals right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St’s portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven’t yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if NWPX Infrastructure might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com