- US stock futures fell ahead of Monday’s opening bell.

- Jerome Powell said the Federal Reserve may only cut interest rates three times this year.

- Treasury yields also climbed higher as investors mulled Friday’s blowout jobs report.

Thanks for signing up!

Access your favorite topics in a personalized feed while you’re on the go.

US stocks looked set to fall at the opening bell Monday after investors’ hopes for early interest rate cuts were dashed by a blowout January jobs report and hawkish comments from Federal Reserve Chair Jerome Powell.

Futures for the S&P 500 and Dow Jones Industrial Average were down 0.2% about 7 a.m. ET, while Nasdaq futures slipped 0.1% in early-morning trading.

Benchmark 10-year Treasury yields edged up 7 basis points, while a widely followed gauge of the US dollar’s strength climbed 0.4%.

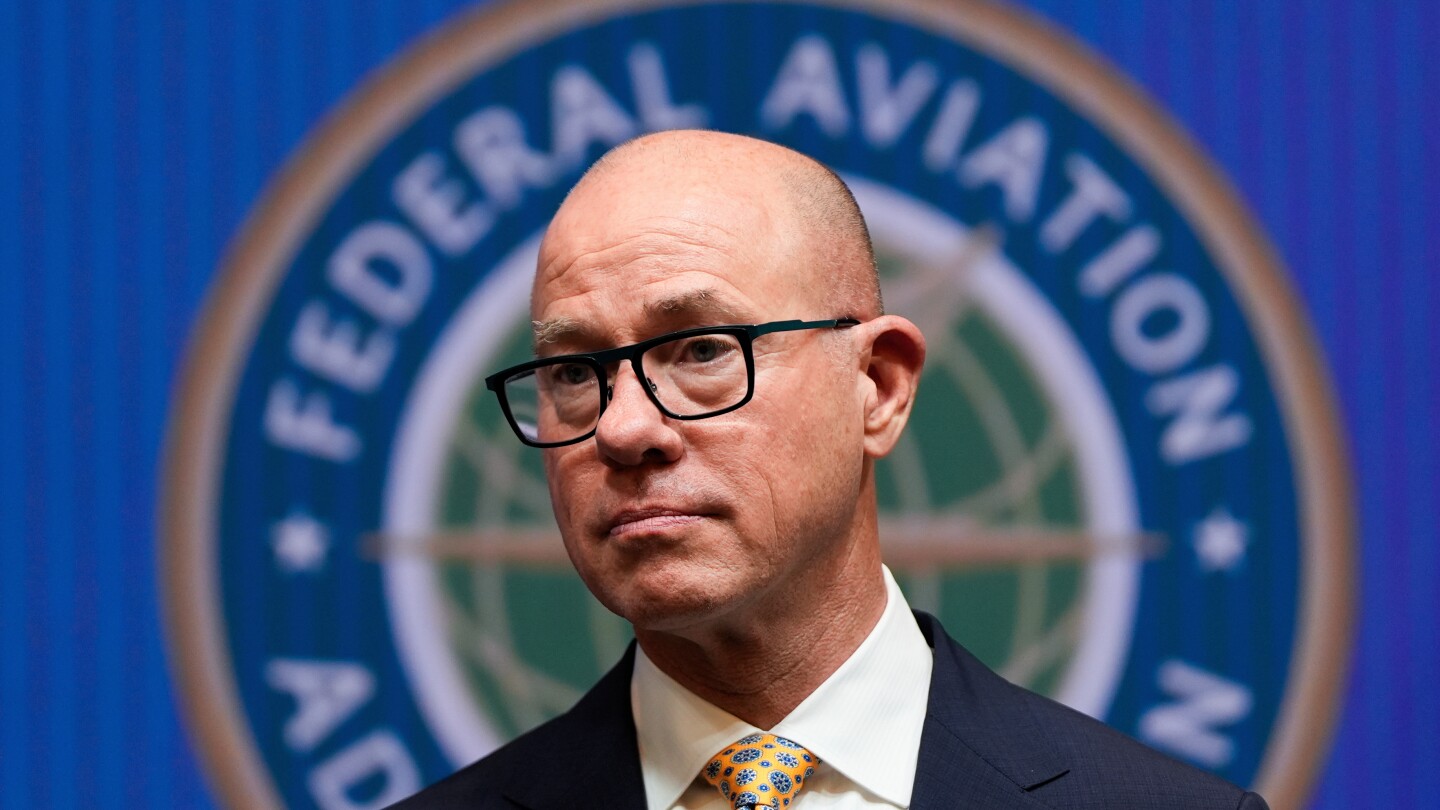

Powell appeared on “60 Minutes” Sunday and said the Fed still plans to cut interest rates three times in 2024, standing by forecasts from December. Just 14% of traders expect the central bank to slash borrowing costs when it next meets in March, per the CME Fedwatch tool.

“The labor market is very, very strong still,” Powell said, referring to Friday’s stellar jobs report, which showed the US economy added 353,000 positions in January.

“So really, the kind of pain that I was worried about and so many others were, we haven’t had that. And that’s a really good thing. And, you know, we want that to continue.”

Cosmetics conglomerate Estée Lauder and pharma company Catalent were the S&P 500’s biggest risers ahead of the opening bell, while Air Products and Chemicals and Agilent Technologies both fell more than 5% in the premarket.

McDonald’s traded flat after posting earnings for the last three months of 2023, while Caterpillar climbed 4% after releasing its own fourth-quarter report.