One of the most high-upside names among energy-transition stocks is Plug Power (NASDAQ: PLUG).

Why the big upside potential? Because Plug is making a massive all-or-nothing bet on a fuel that should garner much more attention than it does today: hydrogen.

But the company’s massive ambitions come at a cost — a cost so high that it’s unclear if and when the company will ever make profits or potentially even survive.

The question is, will the hydrogen economy take off as many think it will? And will Plug be able to capitalize on it with the right business model?

Plug’s 2030 vision

Plug has lofty ambitions for its future. By 2030, management believes it can achieve a whopping $20 billion in revenues at a 35% gross margin, with operating costs at 13% of revenues. That means Plug sees itself making $4.4 billion in operating income, which would probably translate to about $3 billion or so in net earnings.

That would be pretty exciting if Plug could pull that off, given that the company’s entire market cap is only $2.7 billion today!

Needless to say, reaching those targets would be a boon for shareholders. But it also seems very far away since Plug is only estimated to make $1.2 billion in revenue this year. And not only is the company well below its revenue goals, it’s inking massive losses. In fact, it’s currently running its business at a significantly negative gross margin.

Plug sees the hydrogen economy booming as does the government

But Plug’s optimism over hydrogen is not unfounded. While hydrogen hasn’t gotten as much attention as, say, solar or wind, that’s starting to change. In October, the Biden administration awarded $7 billion in funding for seven massive hydrogen hubs across different regions of the U.S., with money from the 2021 Bipartisan Infrastructure law. So the administration at least seems to believe hydrogen will be a valuable tool in the low-carbon economic toolbox.

This is likely because if hydrogen costs come down enough, it could be a game changer. The only hydrogen combustion by-product is water, making it a zero emission fuel. And hydrogen can be stored relatively easily, making it a potential baseload source of power. For all the advances in battery technology, it is still somewhat difficult to store wind and solar-generated power in batteries in large-enough quantities. So in hard-to-electrify sectors, hydrogen is likely the best emissions-free choice. In addition, hydrogen can even be used to actually power vehicles, especially heavy-duty trucking, busing, and industrial equipment. The flexibility is why hydrogen has often been called the “Swiss army knife” of clean power.

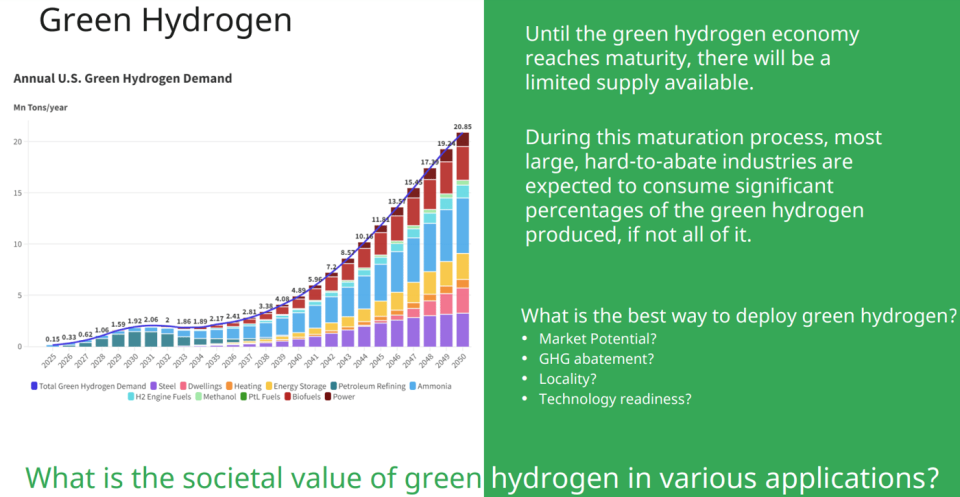

Today, hydrogen is used to power industrial forklifts and in certain heavy industries such as petroleum refining and ammonia production. But in the future, hydrogen seems poised to find its way into more and more use cases. In fact, just this week, steelmaker Cleveland-Cliffs (NYSE: CLF) completed its second successful hydrogen-injection test in the past year at its Indiana Harbor blast furnace, replacing coal-based coke in steelmaking. But that’s just one of many potential future-use cases.

Overall, the U.S. Department of Energy sees U.S. hydrogen demand growing from near zero today to over 20 million tons per year by 2050 as end-use applications expand.

But there are roadblocks on the path to 2030

Even though Plug’s opportunity is massive, investors aren’t seeing the value reflected in the stock. Outside of the dot-com bubble and then again in the post-pandemic bubble we just lived through, Plug’s stock just hasn’t delivered. During the meme-stock craze, Plug’s stock surged to the high $60 range before plummeting to a recent 52-week low of $2.26 and the current price of $4.44 as of this writing. In fact, the company is not only far below its 2021 highs but even its 1999 initial public offering (IPO) price of $15!

This is because, as Plug’s ambitions have grown, so have its costs. While the company began as a fuel-cell provider for forklifts, Plug has expanded into the capital-intensive production of hydrogen itself, as well as the sale of hydrogen-producing equipment and infrastructure.

This takes an absolutely massive amount of spending. But thus far, Plug’s revenue growth has been underwhelming relative to costs. Last quarter, Plug’s revenue grew just 5.3%, but gross losses skyrocketed from $46 million to $138 million, and its operating losses grew from $160 million to $274 million. Keep in mind, this just in a single quarter! Over the first three quarters of 2023, Plug burned over $1.35 billion of cash through both operating cash losses and capital expenditures.

How Plug is trying to turn the tide

Last month, Plug announced a potential $1 billion at-the-market share sale, which the company can make at any time. Unfortunately, the stock plunged to the 52-week low of $2.26 on the announcement, making any capital raise highly dilutive.

However, shares have already nearly doubled since then as the company soon thereafter announced the completion of its new Georgia liquid hydrogen plant. Impressively, Plug said it finished the plant in just 18 months, about half the time it usually takes the industry. That plant will now begin producing about 15 tons per day of liquid hydrogen, enough to power 15,000 forklifts per day.

With more positive news flow and hopefully a higher stock price, Plug could potentially raise more needed capital to continue its ambitious buildout.

But the future is too uncertain to recommend Plug stock

Even if Plug is able to raise capital at these levels or even at higher prices, it will still mean a lot more dilution for shareholders. Despite 25 years as a public company, it’s kind of disappointing that Plug still needs to tap the capital markets and ink losses in pursuit of its vision.

While the company may reach its 2030 goals, it’s hard to know how many more shares may need to be issued to get there. As such, Plug is an exciting name worth tracking, but it’s still too speculative to recommend the stock, especially with so much red ink being spilled.

Investors should track this name for potential high upside but may want to hold off purchasing shares until a more sustainable pathway to profits comes into focus.

Should you invest $1,000 in Plug Power right now?

Before you buy stock in Plug Power, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Plug Power wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of January 29, 2024

Billy Duberstein has no position in any of the stocks mentioned. His clients may owns ahres on the companies mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Where Will Plug Power Be in 7 Years? was originally published by The Motley Fool