IonQ (IONQ 10.54%) stock posted big gains in Tuesday’s trading. The quantum-computing company’s share price closed out the session up 10.5% and had been up as much as 12.2% earlier in the day’s trading.

Yesterday, IonQ published a press release announcing that it had completed a demonstration of its quantum-computing hardware with Nvidia‘s CUDA-Q software platform. With Nvidia gearing up to release its third-quarter earnings results and host a conference call tomorrow, investors may be hoping that the artificial intelligence (AI) leader will share some details about a potential collaboration with IonQ.

Investors are bullish on IonQ’s utilization of Nvidia’s software platform

Nvidia’s CUDA platform is the primary software interface used for getting the most out of the company’s graphics processing units (GPUs) for AI applications. Meanwhile, CUDA-Q is a hybrid platform that allows developers to take advantage of GPUs, central processing units (CPUs), and quantum processing units within a single quantum program.

Quantum-computing technologies have been identified as a potential catalyst for powering even more explosive leaps forward for AI technologies, and this dynamic has helped to power dramatic valuation expansion for IonQ. News that Nvidia has partnered with, or invested in, other companies has powered explosive gains for some stocks over the last year. With Nvidia set to publish its Q3 report after the market closes tomorrow, some investors may be hoping that the AI leader has details to share about a potential collaboration with IonQ.

What comes next for IonQ?

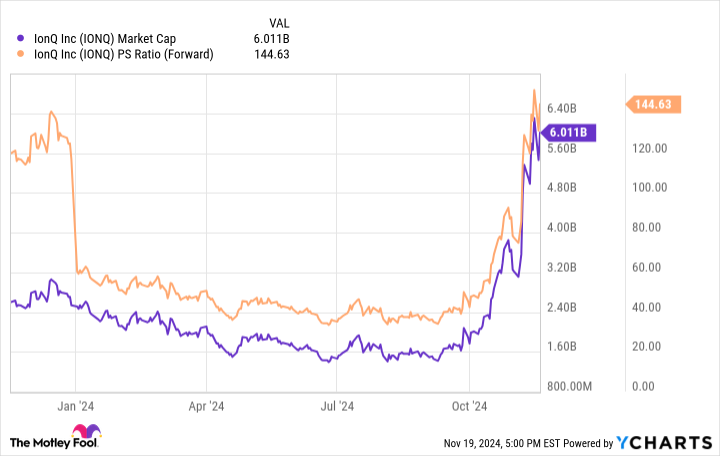

IonQ stock has surged roughly 119% across 2024’s trading. With a market cap of roughly $6 billion, the company is valued at roughly 145 times this year’s expected sales.

IONQ Market Cap data by YCharts.

While IonQ has been reporting some encouraging technological progress and partnerships this year, investors should approach the stock with the understanding that quantum computing is still a speculative technology, and substantial commercial applications could still be years away even in optimistic scenarios.

Additionally, IonQ isn’t the only player in this space. On the other hand, its share price will likely see incredible growth above current levels if the company succeeds with its initiatives to introduce major computing breakthroughs. It’s a high-risk, high-reward stock, and it will likely continue to see volatile swings in the near term.

Keith Noonan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.