- The S&P 500 has finished higher in 14 of the last 15 weeks, notching multiple all-time highs.

- Yet technical and historical data suggest the rally may lose momentum.

- “Historically speaking, this is a ridiculous rally,” a chief global strategist said.

Thanks for signing up!

Access your favorite topics in a personalized feed while you’re on the go.

Stocks have extended last year’s gains into 2024, notching a string of all-time highs in recent weeks.

Last week, the S&P 500 touched 5,000 for the first time ever, and it’s finished higher 14 out of the last 15 weeks. That’s tied for the best streak of all time, and the longest in five decades.

But the longevity of the rally might be in question, according to one market expert.

“[H]istorically speaking, this is a ridiculous rally,” said Jay Woods, chief global strategist of Freedom Capital Markets. In a note Monday, he pointed out that the benchmark index’s 20% gain since November looks “too far too fast,” and the bull run could soon lose momentum.

“This doesn’t mean we’ve become bears, but the market should do what most people tend to do when they are tired — rest,” Woods said.

He pointed to the Relative Strength Indicator, which measures the speed and size of stocks’ price changes. The gauge has made lower highs while the S&P 500 is making brand new ones, he explained, signaling a bearish divergence that tends to happen near the top or bottom of trends.

Meanwhile, the S&P 500 is hovering 11% above its 200-day moving average. While that isn’t a record, it’s above average, according to the strategist. That size gap also occurred during the pandemic rally in 2021, and the gains stalled afterward.

“Shortly after eclipsing the 10% threshold [in 2021] we experienced pauses in the rally and saw the index pull back to the 50-day moving average,” Woods said. “In fact, it occurred eight times in 2021 and held that level each time.”

In any case, the current rally is also an anomaly because 70 days have passed without a 2% decline in the index — something that hasn’t happened since 2018.

The bull run isn’t necessarily over, but in Freedom Capital Markets’ view, a “rest and pullback” to the rising 50-day moving average could be looming.

“We have seen 6 streaks go as many as 100 days without a 2% pullback, so maybe this will be the seventh,” Woods said. “As outlined above, I would be surprised.”

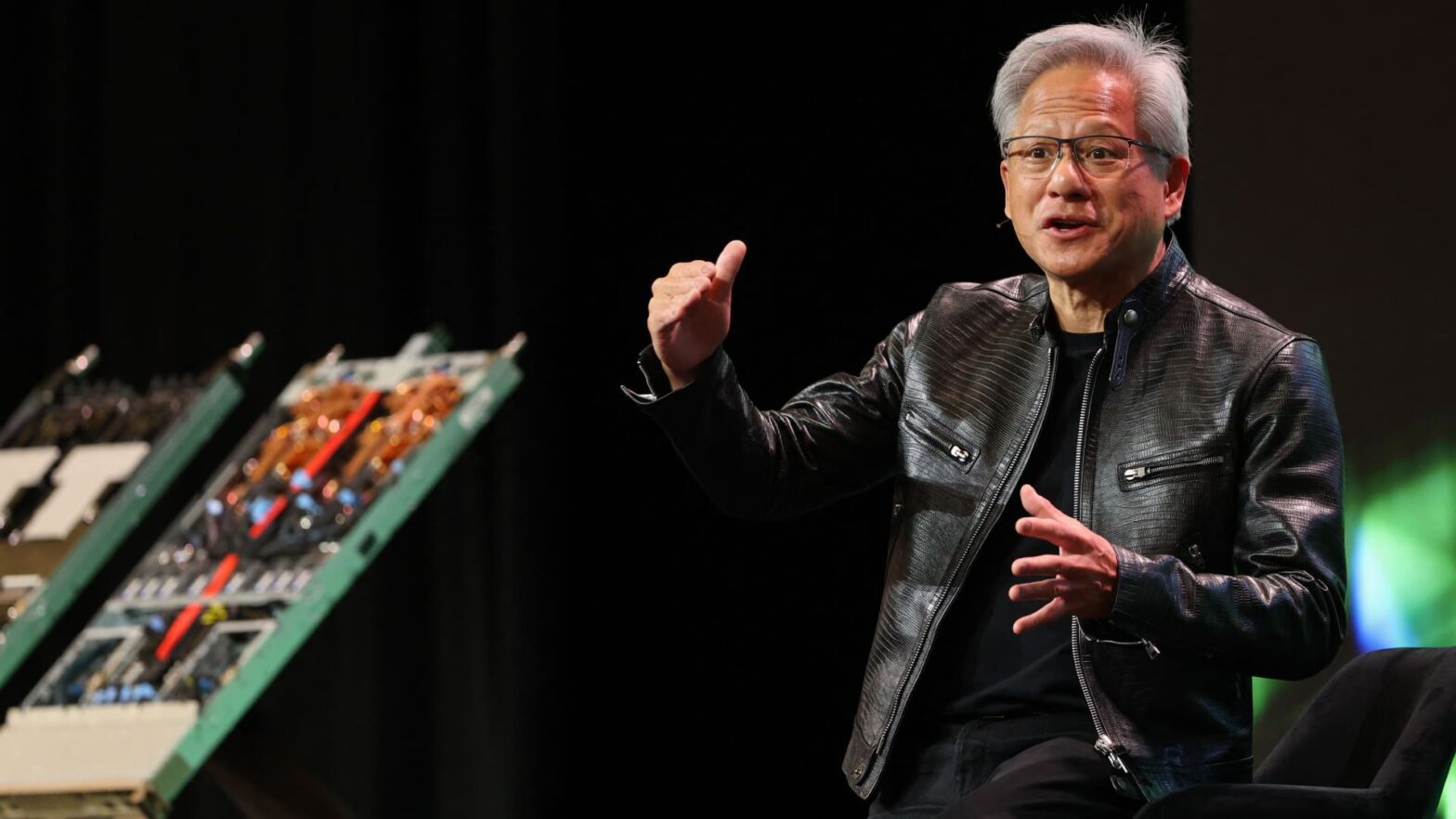

Investors in the coming days will be monitoring earnings from giants including Nvidia and Coca-Cola, while also taking in the latest data on inflation and consumer sentiment to give a clue about the potential path of Fed policy.