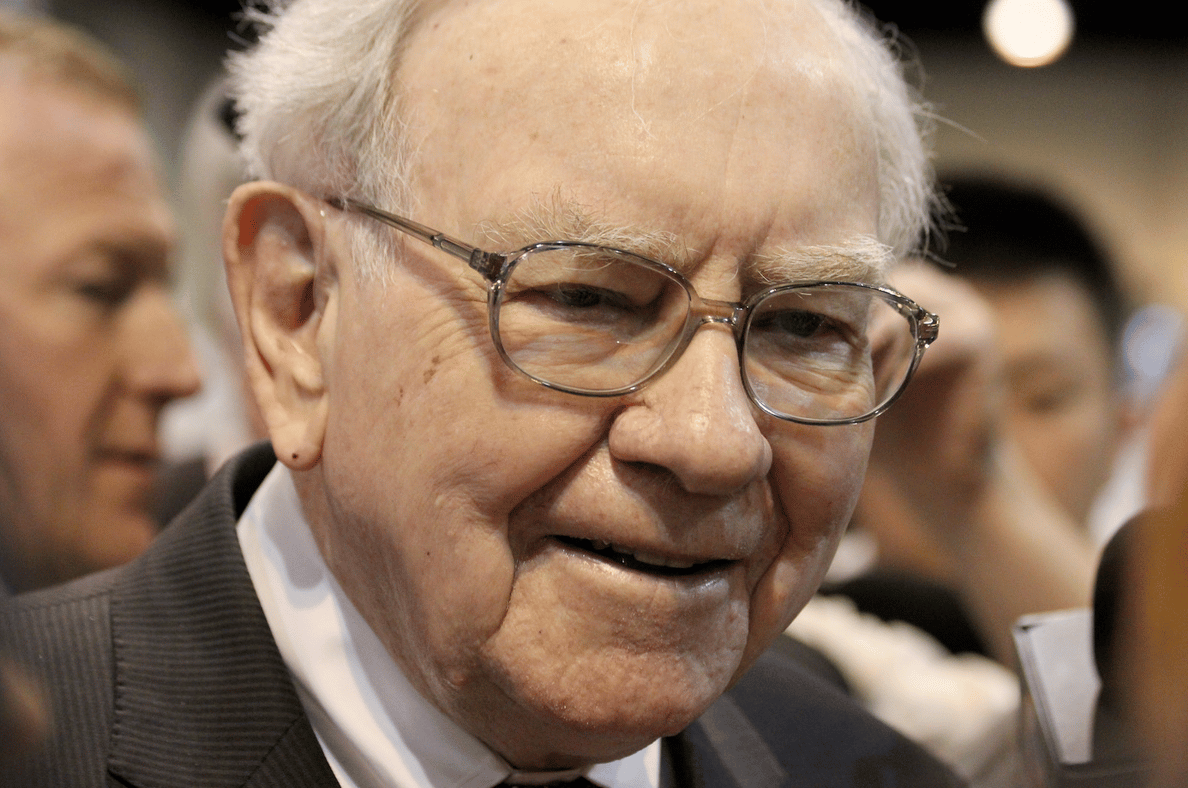

These three high-quality stocks each have Warren Buffett’s seal of approval.

On Dec. 31, 2025, Warren Buffett stepped down as CEO of Berkshire Hathaway. For 60 years, the legendary investor ran the company, turning it from a floundering textile mill into one of the world’s largest conglomerates.

Buffett is no longer at the helm, but Berkshire remains largely unchanged. Buffett’s successors continue to employ his time-tested investing approach. The company has yet to make a major exit from any of the positions initiated when Buffett was in charge.

If you have $2,000 to start building a long-term, diversified portfolio, you may want to consider adding some of these Warren Buffett investments. Three that stand out in particular are Chubb (CB 0.77%), Chevron (CVX +1.77%), and DaVita (DVA 1.77%).

Image source: The Motley Fool.

Chubb is a standout among insurance stocks

Since 2023, Berkshire Hathaway has been accumulating Chubb shares. Currently, it owns an 8.8% stake, worth around $11.2 billion. It’s unclear whether these purchases are a prelude to an eventual acquisition. After all, Berkshire has acquired numerous insurance companies over the past few decades.

Today’s Change

Current Price

Even if a takeover never happens, you may still want to buy this insurance stock. In the near term, prospects appear very promising. Following strong fiscal results for 2025, Chubb’s management anticipates “double-digit growth” in earnings per share and tangible book value in 2026.

Chubb’s focus on underwriting quality rather than volume suggests strong fiscal performance will continue. Chubb is also a standout in dividend growth, with 32 years of consecutive dividend increases under its belt. Although Chubb’s dividend gives shares a modest forward yield of just 1.2%, these payouts have increased by an average of 3.7% annually.

Many long-term catalysts remain on tap for Chevron

Since the start of the year, Chevron has soared by 20%. Yes, recent geopolitical events have contributed greatly to this oil and gas stock’s rally. Also, following Chevron’s latest melt-up, shares trade at 24 times forward earnings.

Today’s Change

Current Price

That’s a forward multiple more commonly seen with tech stocks than with energy stocks. However, while Chevron may seem pricey today, consider the long-term picture. The company continues to aggressively pursue increased production. This has led to various promising exploration contract wins in Libya, Syria, and Turkey.

Chevron also hasn’t yet put the brakes on its efforts to reduce operating expenses. Atop these catalysts, there’s also the company’s involvement in a partnership to provide natural gas-derived power for AI data centers. Together, these catalysts could result in significant earnings growth and, in turn, steady price appreciation in the coming years.

DaVita continues to exit from its multiyear slump

Berkshire has owned shares in the kidney dialysis center operator since late 2011. So far this decade, DaVita has traded sideways. Since the start of 2026, however, the stock has been on a tear, rallying by 32%. Chalk this up to well-received quarterly results.

Today’s Change

Current Price

As management noted on the post-earnings conference call, factors such as international expansion are helping drive earnings growth. For 2026, management anticipates adjusted earnings per share of $13.60 to $15, representing a 25% to 39% increase compared with 2025.

Berkshire Hathaway recently sold some of its DaVita position. However, it still holds a 45.1% stake. This latest sale may be related to Berkshire’s agreement to keep its stake below 45%. DaVita’s aggressive share repurchase efforts require Berkshire to do this periodically.