There’s a real possibility that former President Donald Trump may retake the White House in November, according to the latest polls.

Therefore, it’s worth asking: How might a second Trump term impact stocks? Tom Essaye, publisher of Sevens Report Research, recently shared his expectations for which corners of the stock market might outperform, and which might struggle, if Trump triumphs in an expected election rematch with President Joe Biden.

U.S. stocks will outperform their international peers

Four more years of Trump would likely translate to four more years of outperformance by U.S. stocks compared with their international peers.

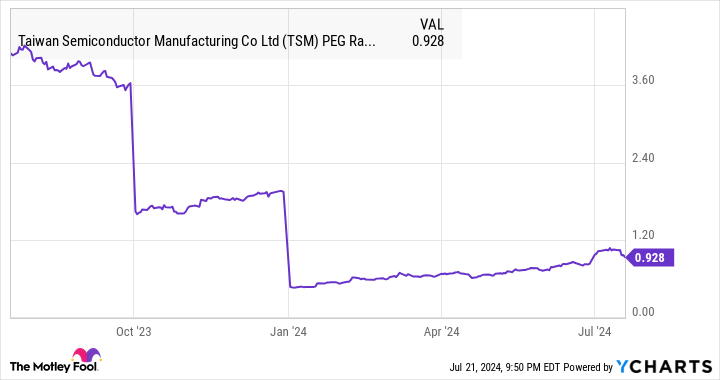

Trump has been vocal about his plans to double down on his international trade policies if reelected which would likely mean increased tariffs on imports from China and elsewhere. He has already threatened 60% tariffs on all Chinese goods entering the U.S.

“Obviously, those policies would be negative for Chinese shares and emerging markets more broadly, as they would increase trade tensions,” Essaye said.

As a result, investors can expect Chinese stocks, and emerging-markets more broadly, to struggle, like they did during Trump’s first term and like they have, relative to the U.S., for much of the past 15 years.

Between January 2017 and January 2021, the iShares MSCI China ETF FXI returned just 12.6%, compared with a total return of 37% for the S&P 500 index. The iShares MSCI Emerging Markets EEM returned 10.5%.

Developed-market stocks would likely also lag their U.S. peers. Trump has said he would make eliminating the U.S. trade deficit a top policy priority, and to help achieve this, has threatened baseline 10% tariffs on all imports.

Assuming Trump wins the 2024 presidential election, the iShares MSCI All Country World Index ex U.S. ETF ACWX would likely lag the S&P 500, like it did during his first term. The index tracks performance of 22 developed markets.

Bet against clean-energy stocks but favorable policies might not be enough to boost oil and gas

Clean-energy stocks had a solid run during the first Trump term after policies intended to punish green energy never materialized, but this time around, Trump has pledged to repeal the Inflation Reduction Act and other Biden-era policies that benefited green-energy and electric-vehicle companies.

This would render a repeat of the Invesco WilderHill Clean Energy ETF’s PBW outperformance during Trump’s first term unlikely, Essaye said. The fund rose more than 53% during his first four years in office.

At the same time, Trump would likely push to boost U.S. oil and gas production. Unfortunately, as evidenced by the oil and gas sector’s stock-market performance during Trump’s first term, higher production doesn’t necessarily translate to higher stock prices in the energy sector.

Energy Select Sector SPDR Fund XLE rose by just 3.6% during the Trump years. Similarly lackluster performance during a second Trump presidency can’t be ruled out, Essaye said.

Defense stocks would likely thrive

Trump was kind to the defense sector during his first term, and stocks of major military contractors responded accordingly by rising more than 40% during his term in office, outperforming the S&P 500.

Investors can expect this dynamic to repeat if Trump once again finds himself in the West Wing, Essaye said.

Despite the outbreak of war in Gaza and the ongoing conflict in Ukraine, the iShares U.S. Aerospace and Defense ETF ITA has underperformed the S&P 500 over the past year, returning roughly 10% with dividends reinvested, compared with more than 27% for the benchmark index.

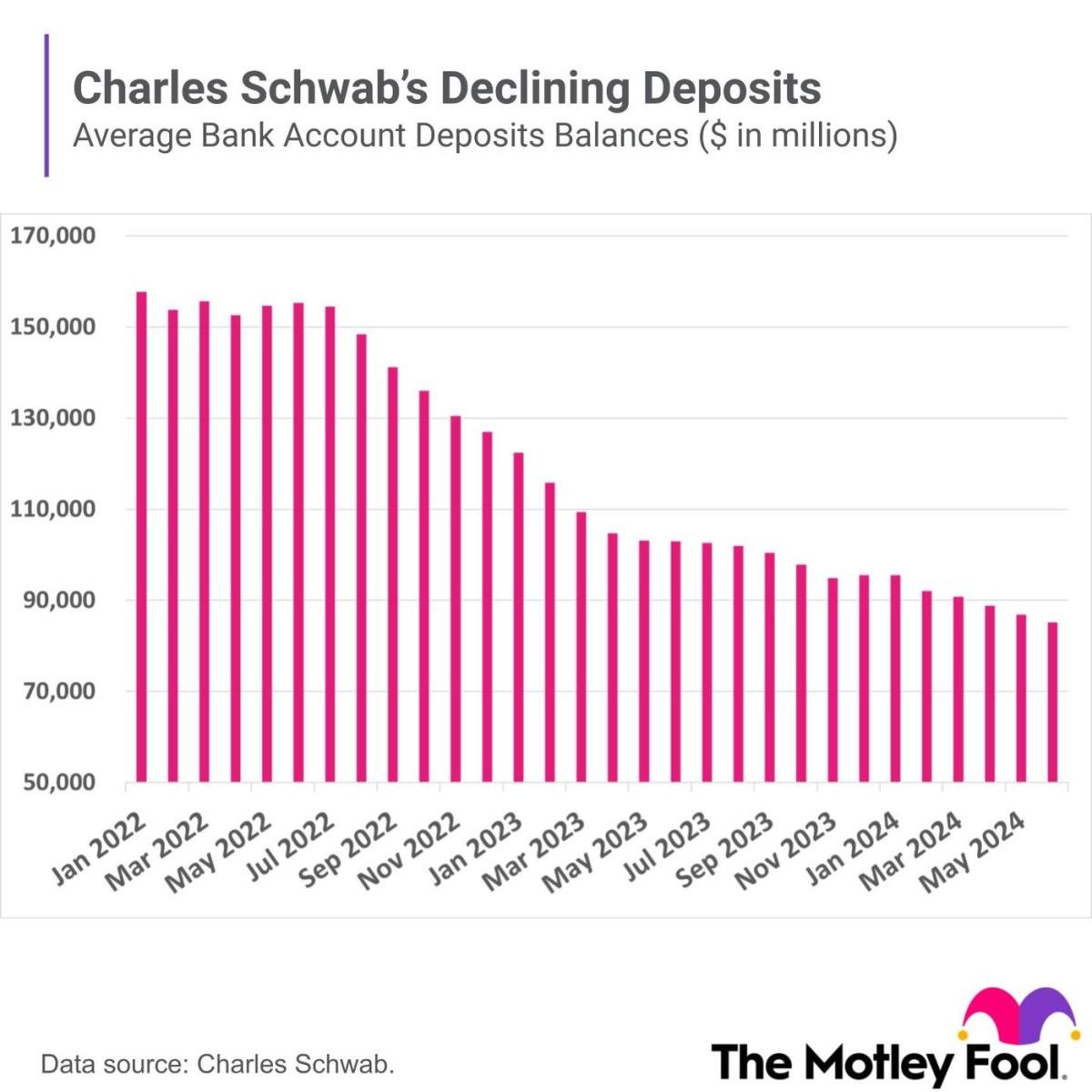

Bank stocks could also benefit

Shares of U.S.-traded banks lagged during the first Trump term despite his administration’s loosening of Dodd-Frank rules that included raising the threshold for what qualifies as a systemically important financial institution.

Should he win a second term, Trump has said he would reject Basel III’s increased capital requirements. Doing so would likely help banks boost profits by allowing them to hold less of their capital in reserve against their loan books.

At the same time, Trump has said he would likely replace Federal Reserve Chairman Jerome Powell when his term expires in two years. This would likely result in a more dovish monetary policy from the Fed, putting downward pressure on interest rates over the long term, Essaye said. This should, at least in theory, help boost demand for bank loans.

All of this adds up to a bullish outlook for bank stocks during a second Trump term, Essaye said.

The SPDR Bank ETF KBE and SPDR Regional Bank ETFs KRE returned 14% and and 11.7%, respectively, between January 2017 and January 2021, according to Essaye.

Whatever happens, investors can expect some volatility around the vote. Demand for portfolio hedges that would cover the Nov. 5 election is already rising, pushing up the cost of futures contracts tied to the Cboe Volatility Index VIX expiring in October.

See: Traders are already bracing for the U.S. presidential election to roil the stock market