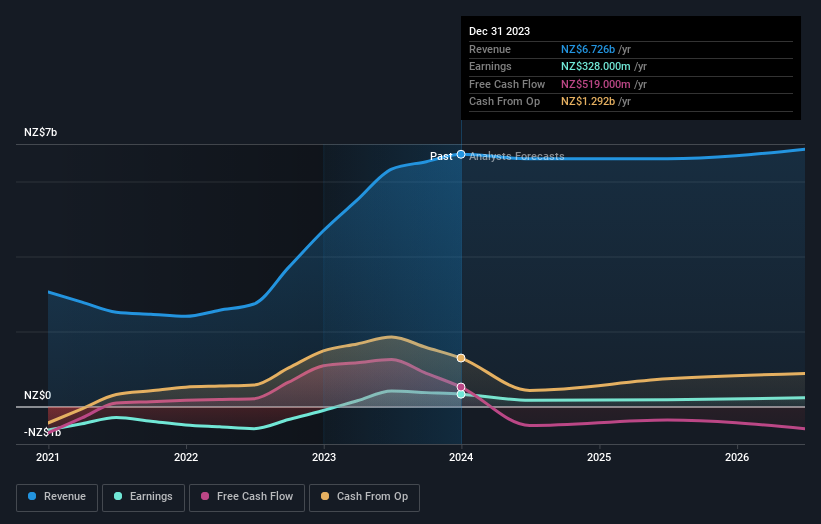

Shareholders might have noticed that Air New Zealand Limited (NZSE:AIR) filed its half-year result this time last week. The early response was not positive, with shares down 6.3% to NZ$0.60 in the past week. Results overall were respectable, with statutory earnings of NZ$0.12 per share roughly in line with what the analysts had forecast. Revenues of NZ$3.5b came in 3.0% ahead of analyst predictions. The analysts typically update their forecasts at each earnings report, and we can judge from their estimates whether their view of the company has changed or if there are any new concerns to be aware of. So we gathered the latest post-earnings forecasts to see what estimates suggest is in store for next year.

View our latest analysis for Air New Zealand

Following last week’s earnings report, Air New Zealand’s five analysts are forecasting 2024 revenues to be NZ$6.61b, approximately in line with the last 12 months. Statutory earnings per share are forecast to crater 55% to NZ$0.044 in the same period. In the lead-up to this report, the analysts had been modelling revenues of NZ$6.66b and earnings per share (EPS) of NZ$0.06 in 2024. The analysts seem to have become more bearish following the latest results. While there were no changes to revenue forecasts, there was a large cut to EPS estimates.

The average price target fell 8.5% to NZ$0.65, with reduced earnings forecasts clearly tied to a lower valuation estimate. The consensus price target is just an average of individual analyst targets, so – it could be handy to see how wide the range of underlying estimates is. Currently, the most bullish analyst values Air New Zealand at NZ$0.80 per share, while the most bearish prices it at NZ$0.51. As you can see, analysts are not all in agreement on the stock’s future, but the range of estimates is still reasonably narrow, which could suggest that the outcome is not totally unpredictable.

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. Over the past five years, revenues have declined around 1.1% annually. Worse, forecasts are essentially predicting the decline to accelerate, with the estimate for an annualised 3.6% decline in revenue until the end of 2024. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to see their revenue grow 9.3% per year. So it’s pretty clear that, while it does have declining revenues, the analysts also expect Air New Zealand to suffer worse than the wider industry.

The Bottom Line

The most important thing to take away is that the analysts downgraded their earnings per share estimates, showing that there has been a clear decline in sentiment following these results. Fortunately, the analysts also reconfirmed their revenue estimates, suggesting that it’s tracking in line with expectations. Although our data does suggest that Air New Zealand’s revenue is expected to perform worse than the wider industry. The consensus price target fell measurably, with the analysts seemingly not reassured by the latest results, leading to a lower estimate of Air New Zealand’s future valuation.

With that said, the long-term trajectory of the company’s earnings is a lot more important than next year. We have estimates – from multiple Air New Zealand analysts – going out to 2026, and you can see them free on our platform here.

Before you take the next step you should know about the 1 warning sign for Air New Zealand that we have uncovered.

Valuation is complex, but we’re helping make it simple.

Find out whether Air New Zealand is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.