When Bill Ackman graduated from Harvard Business School in 1992, he didn’t waste any time.

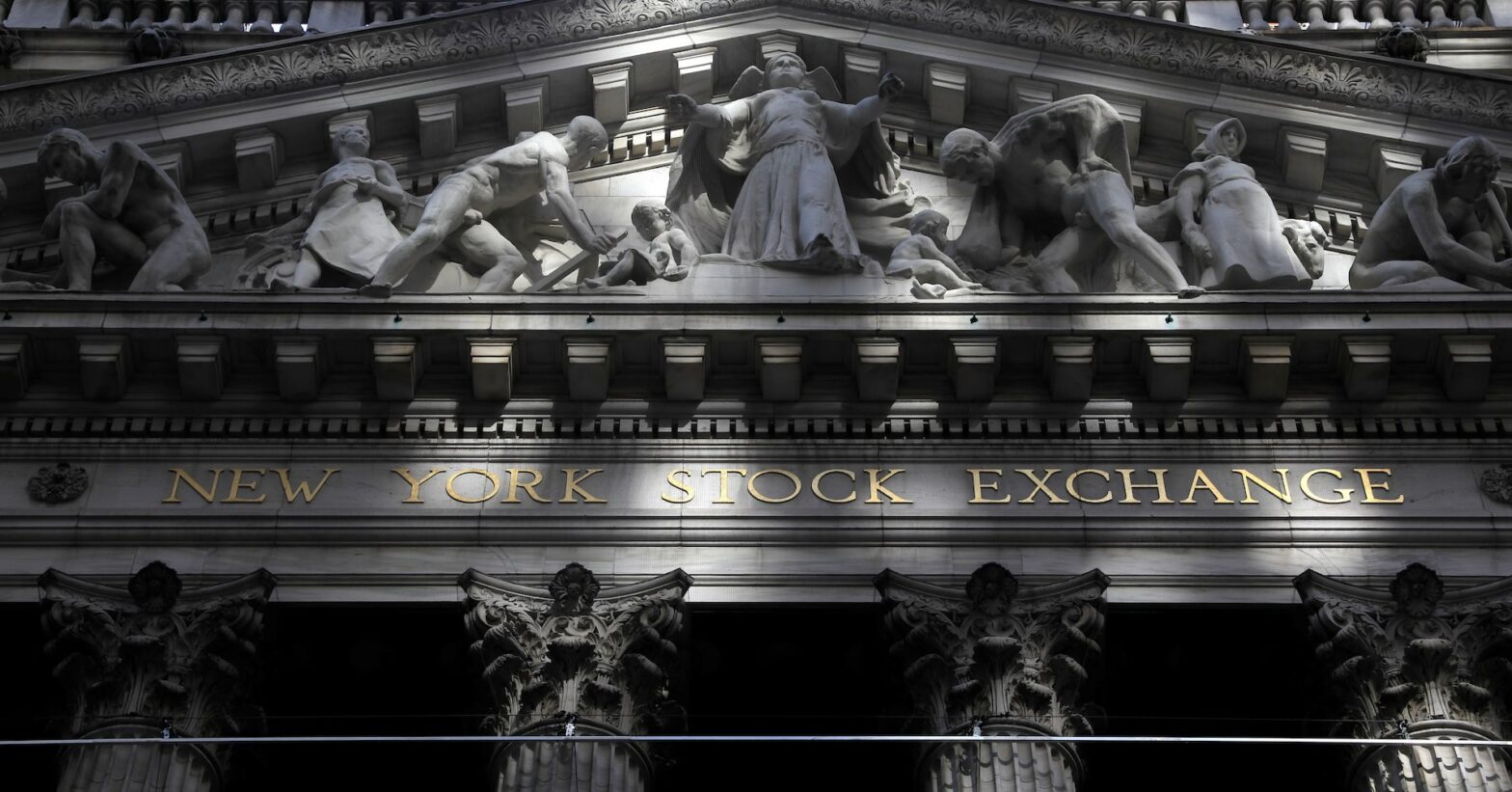

Ackman and fellow Harvard grad David P. Berkowitz founded the investment firm Gotham Partners, which made small investments in public companies.

“Everyone told me it was a really stupid idea to start my own hedge fund right out of business school,” Ackman said. “That’s how I knew that it was a good idea.”

In a few years, Gotham had $500 million in assets under management.

Ackman started Pershing Square Capital Management in 2004 with $54 million from his personal funds and former business partner. Today, the fund has $18.5 billion in assets under management.

“I’m an extremely, extremely persistent person,” Ackman once said. “Extremely. And when I believe I am right, and it is important, I will go to the end of the earth.”

Related: Nvidia’s maiden 13F filing sends AI-focused tech stock soaring

While these filings do not include the full scope of holdings nor possible bets against a particular security, they do provide a glimpse into the strategies of some of the world’s biggest investors.

Pershing Square reduced its stake in Chipotle Mexican Grill (CMG) by over 13% to 824,998 shares. The hedge fund also cut its stake in hotelier Hilton HLT by 11% to 9.2 million shares.

The fund raised its stake in Howard Hughes (HHC) by over 12%, adding 2.1 million shares.

In addition, Pershing Square sold about 5.8 million shares of home-improvement retailer Lowe’s (LOW) during the quarter, cutting its stake by 82% to 1.2 million shares worth about $273 million.

“You should sell an investment when you learn new information which is inconsistent with the original thesis,” Ackman said in a 2022 interview. “If you keep twisting the thesis to come up with a reason for owning the stock, it’s going to be a problem.”

Lowe’s is scheduled to release its fourth-quarter results on Feb. 27. Analysts surveyed by FactSet expect the company to post earnings of $1.68 per share on revenue of $18.4 billion.

A year ago, Lowe’s reported $2.28 per share earnings on $22.4 billion in sales.

A pullback in DIY spending

Lowe’s saw a 7.4% decline in comparable sales in the third quarter.

Chairman and CEO Marvin Ellison told analysts in November that the results were driven by a greater-than-expected pullback in do-it-yourself (DIY) discretionary spending, especially in bigger ticket categories.

“While we’ve seen a more cautious consumer for some time now, this quarter, we saw some of these consumers increasingly prioritizing experiences over goods, spending on travel and entertainment,” he said, according to a transcript of the call.

Ellison said 75% of Lowe’s revenue comes from DIY customers and 25% from professionals. The broader market mix is roughly 50% DIY and 50% pro.

JPMorgan analyst Christopher Horvers has faith in the company. He upgraded Lowe’s to overweight from neutral with a price target of $265, up from $210, on Feb. 12.

Horvers added Lowe’s shares to the firm’s Analyst Focus List as a value stock idea.

The analyst said he believes Lowe’s share of wallet headwind is moderating, with trends reverting toward wage growth.

Moreover, appliances, the company’s largest sales category, is further along in deflation, Horvers said.

Homebuilder confidence is up

Builder confidence in the market for newly-built single-family homes climbed four points to 48 in February, according to the National Association of Home Builders/Wells Fargo Housing Market Index, the highest level since August 2023.

“Buyer traffic is improving as even small declines in interest rates will produce a disproportionate positive response among likely home purchasers,” NAHB Chairman Alicia Huey said.

More 13F fund holdings:

-

Warren Buffett just sold shares of this popular streaming stock

-

Paul Tudor Jones’ hedge fund just made a big bet on Nvidia stock

“And while mortgage rates still remain too high for many prospective buyers, we anticipate that due to pent-up demand, many more buyers will enter the marketplace if mortgage rates continue to decline this year,” Huey added.

However, the Joint Center for Housing Studies of Harvard University’s Leading Indicator of Remodeling Activity (LIRA) report predicted a 5.9% decrease in home renovation spending through the second quarter.

In contrast, the COVID-19 pandemic sparked a surge in home improvements, and repairs increased in 2020 as people modified living spaces for work, school, and leisure in response to the shutdown.

Meanwhile, according to a regulatory filing, Ackman is planning to launch a closed-end fund, investing in 12 to 24 large-cap, investment-grade, “durable growth” companies in North America. There will be no minimum investment.

Related: Veteran fund manager picks favorite stocks for 2024