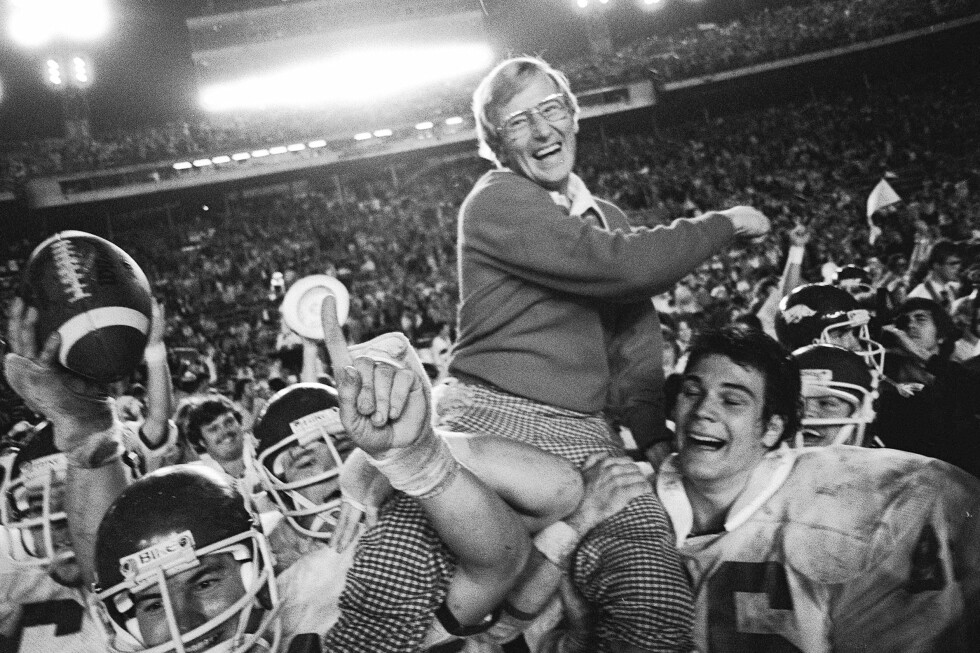

© Reuters. FILE PHOTO: Investors sit in front of a board showing stock information at a brokerage house on the first day of trade in China since the Lunar New Year, in Hangzhou, Zhejiang province, China February 3, 2020. China Daily via REUTERS

© Reuters. FILE PHOTO: Investors sit in front of a board showing stock information at a brokerage house on the first day of trade in China since the Lunar New Year, in Hangzhou, Zhejiang province, China February 3, 2020. China Daily via REUTERS

(Reuters) – Chinese equities headed for their biggest gains in 14 months on Tuesday and the yuan rose on further signs of state support for markets and a news report that President Xi Jinping was set to discuss markets with financial regulators.

Bloomberg News reported the China Securities Regulatory Commission plan to update top leaders on market conditions as soon as Tuesday. China state fund Central Huijin Investment said on Tuesday it has expanded its scope of investment. [.SS][CNY/]

The blue-chip CSI 300 index rose more than 3%. Here are analyst and investor views on the market action:

NICK FERRES, CHIEF INVESTMENT OFFICER, VANTAGE POINT, SINGAPORE:

“(It’s) still far from convincing, but you stop panicking when the policymakers start to panic.

“They’re at least acknowledging that they no longer can stomach the downside…you can see waterfall type collapse in prices … again that was probably a reason for policymakers to panic.”

KHOON GOH, HEAD OF ASIA RESEARCH, ANZ, SINGAPORE:

“I think today, it’s very clear the authorities have come out wanting to put a stop to the rot, particularly just before the Lunar New Year holiday.

“The news flash about President Xi talking with financial regulators about the stock market … it’s also another signal that the President himself is taking this matter seriously.

“I don’t think this is very common, and timing wise you have to suspect that it is really geared towards trying to instil confidence and stop the decline in the equity market.”

VASU MENON, MANAGING DIRECTOR OF INVESTMENT STRATEGY, OCBC BANK, SINGAPORE

“Reports that China’s President Xi Jinping is set to receive a briefing from Chinese regulators on financial markets has once again led to hope that the upper echelon of government will step in with more significant measures.

“For the stock market to see a more sustainable rally, the problems in the property market need to be addressed more aggressively to help boost confidence.

“Nevertheless, President Xi has shown signs of becoming more involved in the nation’s financial and economy policies and this offers hope that China will do more via policy measures in the coming months which may gradually help to improve sentiment and confidence over time.”

RYOTA ABE, ECONOMIST, SMBC, SINGAPORE:

“My sense is that the signals from authorities are very clear, they want to prevent the markets from falling further because the fall may call for another fall and will continue to deteriorate the market sentiment.

I would say these kind of measures were needed to support the investors’ sentiment, so the initial reactions were all positive. However, the economic fundamentals remain unchanged. As long as markets have fundamental concerns on the real economy, the slew of announcements will remain effective only in the short term.”

BEN BENNETT, APAC INVESTMENT STRATEGIST, LEGAL AND GENERAL INVESTMENT MANAGEMENT, HONG KONG:

“Chinese equity markets have been extremely volatile all year, and such swings have probably attracted fast money flows, particularly on the short side. So such regulatory announcements and potential official buying could discourage this and help prop up prices like we’ve seen today.

“But it doesn’t solve the underlying problems of an economy undergoing a lengthy transformation. The switch from old to new sectors is far from complete and is likely to lead to more difficult days in the future.”

KENNY NG, SECURITIES STRATEGIST, CHINA EVERBRIGHT SECURITIES INTERNATIONAL COMPANY, HONG KONG:

“The market continues to anticipate further measures from the mainland to support the market, resulting in a strong rise (in prices).

“It is expected that the short-term market sentiment will continue to be boosted.”