Synopsis

Toronto-listed Fairfax’s shares have recouped all losses after a short seller report on 8 February alleged asset value manipulation by the company

ETMarkets.com

ETMarkets.comFairfax, which owns multiple companies in India, has refuted charges that its Indian portfolio company Digit Insurance was falsely shown to be profitable in its annual report in 2021 at an investor conference call on Friday. The call was held to respond to the allegations of short seller Muddy Waters, who has accused the company of asset value manipulation.

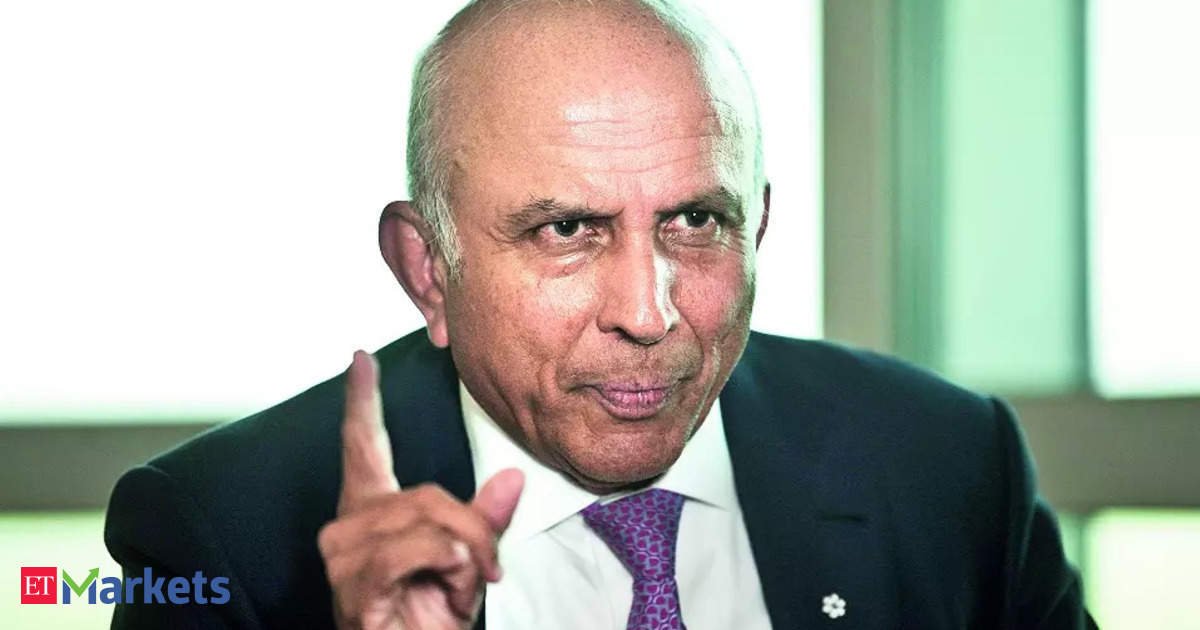

Fairfax’s Indian-Canadian founder Prem Watsa and the company’s management team answered queries refuting all the allegations of Muddy Waters.

Fairfax has invested $7 billion in India.

“Fairfax’s reporting framework is IFRS, not US GAAP. We have been following IFRS since 2010,” Fairfax’s chief financial officer Jennifer Allen clarified.

“Digit was profitable under IFRS in 2021”, she said.

The company’s accounts in India are prepared under Indian accounting rules and showed a loss in 2021. Short seller Muddy Waters had claimed the company had lied about Digit’s profitability.

Digit Insurance became the first unicorn in India in 2021 after Sequoia Capital announced an investment in the company that valued it at $3.5 billion.

“Mr. Block, we don’t tolerate misleading insinuations”, Watsa told Muddy Waters chief Carson Block who had also joined the conference call.

Muddy Waters has claimed that the fair value assigned to certain investments in Fairfax’s books are higher than their market value which makes the company’s financials look better than they are.

Toronto-listed Fairfax’s shares have recouped all the losses that they took in the immediate aftermath of the short seller report. They had dropped 12% on 8 February when the report was first released.

“The carrying value can be below or above market value. We do quarterly reviews”, said Watsa.

He claimed that Muddy Waters had deliberately picked on only those investments where the market value was lower than the value reflected in Fairfax’s books while ignoring several others where Fairfax had marked the investments in its books at below their market value.

“One sided arguments have been made by not mentioning one company where the carrying value is below market value”, he said.

Fairfax also clarified on the status of its investment in Quess Corp. Muddy Waters has alleged that the investment was recorded at an 87% premium to Quess Corp’s share price as on 30 September 2023 in Fairfax’s books.

“In Q4 of 2023 we have recorded a $53 million impairment (on Quess Corp investment). $190.6 million impairment was recorded in 2019. $98.3 million impairment was recorded in 2020”, said chief financial officer Allen.

Watsa ended the call by thanking shareholders and supporters and promised to protect them.

“The board and management will protect shareholders from misleading claims”, he concluded.

(You can now subscribe to our ETMarkets WhatsApp channel)

(What’s moving Sensex and Nifty Track latest market news, stock tips and expert advice, on ETMarkets. Also, ETMarkets.com is now on Telegram. For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds .)

Download The Economic Times News App to get Daily Market Updates & Live Business News.

Subscribe to The Economic Times Prime and read the Economic Times ePaper Online.and Sensex Today.

Top Trending Stocks: SBI Share Price, Axis Bank Share Price, HDFC Bank Share Price, Infosys Share Price, Wipro Share Price, NTPC Share Price

…moreless