Dilok Klaisataporn

I last wrote about the PIMCO 15+ Year U.S. TIPS Index Exchange-Traded Fund (NYSEARCA:LTPZ) in September last year, declaring it the best risk-reward opportunities I had ever seen. The outlook has further improved since then as yields have risen amid the surge in US equities, marking a significant reversal in trends seen over recent years. This provides investors an opportunity to lock in a high real yield of 2.2%, which stands to benefit in the event of an equity market reversal.

The LTPZ ETF

LTPZ tracks the performance of the BofA Merrill Lynch 15+ Year US Inflation-Linked Treasury Index. With an average maturity of 21 years and a duration of 19 years, the LTPZ is much more sensitive to long-term real interest rate expectations than its shorter dated peers. Like regular bonds that have a yield to maturity that reflects the annual return that investors will receive if they hold the bond to maturity, TIPS have a real (inflation-adjusted) yield to maturity, which is lower to reflect the fact that inflation is expected to be positive. The current real yield to maturity on the portfolio of bonds held by the LTPZ is around 2.2%, which compares with 4.6% on regular bonds of the same maturity, meaning that long-term inflation expectations sit at around 2.4%.

The Equity Bubble Is Putting Upside Pressure On Real Yields, Undermining The LTPZ

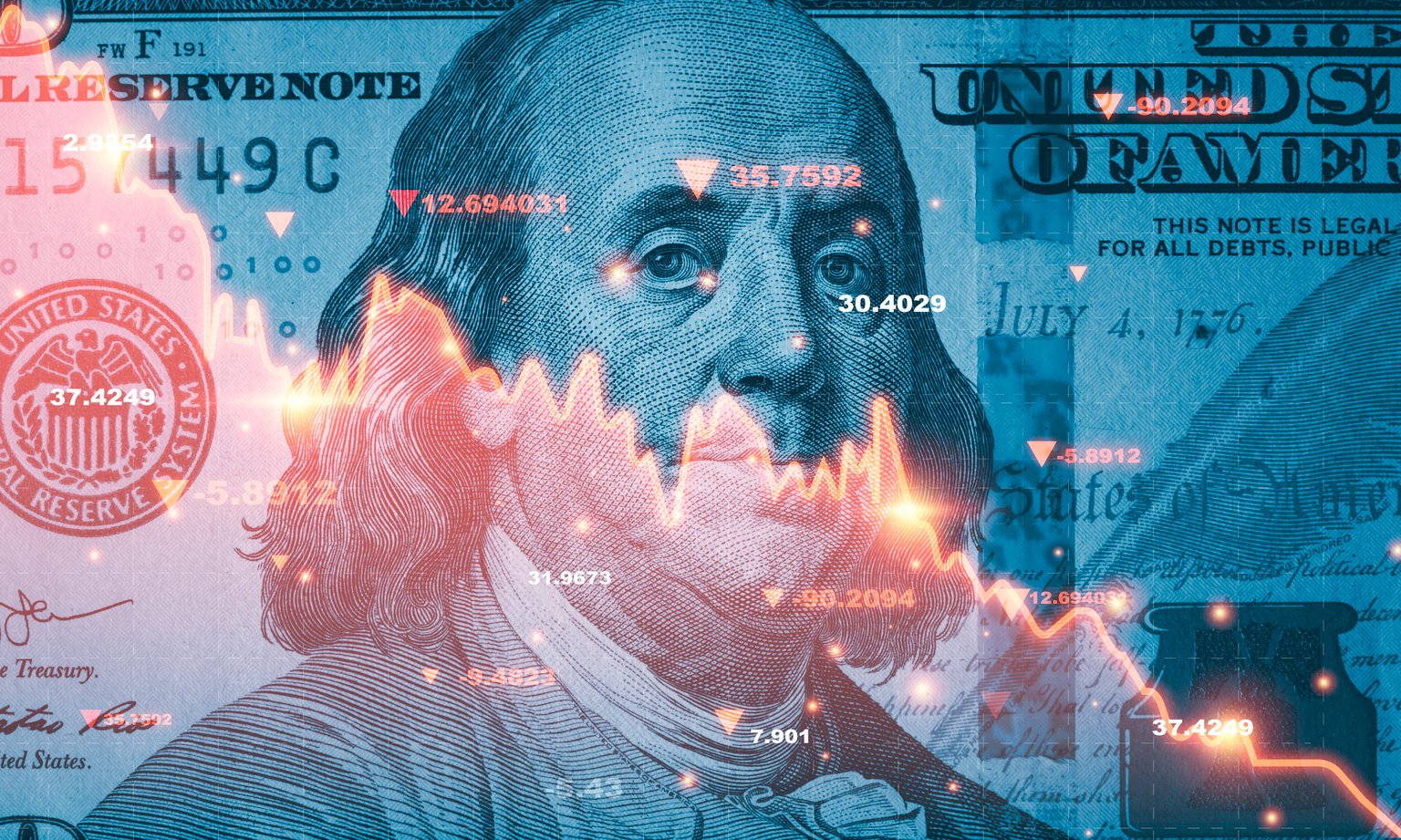

Over the past few months, we have seen a key shift in the relationship between TIPS and risk assets. After moving in lockstep with equities and in recent years as stocks took their cues from rate markets, since the start of 2024 the LTPZ and the SPX have moved in opposite directions. The strength of the equity bubble has led to reduced rate cut expectations, driving up real bond yields to the detriment of LTPZ.

LTPZ Vs SPX (Bloomberg)

The main risk to the LTPZ in the short term comes from continued upside in US stocks, where the recent straight line rise has unwound the aggressive expectations for rate cuts this year. A further melt up would make rate cuts increasingly unlikely, putting renewed upside pressure on interest rate expectations and nominal and real yields. The current pattern of rising yields and rising stocks was also observed in the late-1990s, when the Fed was forced to resume its hiking cycle in response to the equity bubble, causing the yield on 10-year TIPS to rise above 4%.

Growth Optimism Prone To A Reversal As Inflation Picks Up

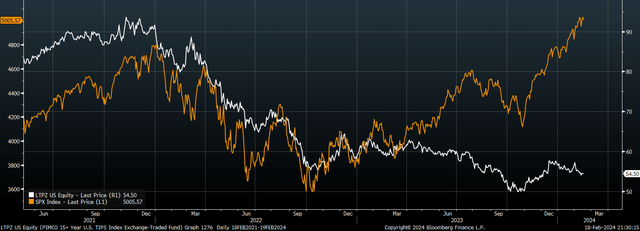

While further losses cannot be ruled out in the short term, the outlook for the LTPZ over the next 12 months is increasingly bright. As we have seen on previous occasions, including 1999, 2006, and more recently in 2018, when stocks and bond yields begin to rise together it can signal that growth optimism has run too far. It then only takes a slight negative shock for both stocks and bond yields to fall in tandem.

SPX Vs 10-Year TIPS Yield (Bloomberg)

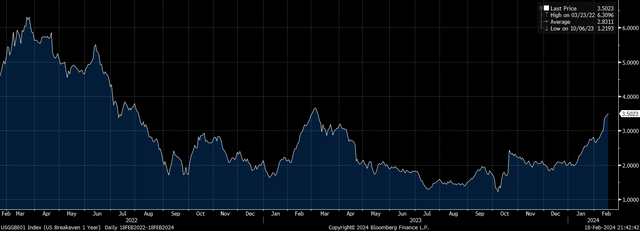

This turning point could come sooner rather than later, as short-term inflation expectations are back on the rise. 12-month inflation expectations currently sit at 3.5% and as returns are linked to inflation, the LTPZ should be expected to return around 5.7% before expenses when its 2.2% yield to maturity is taken into account.

12 Month Breakeven Inflation Expectations (Bloomberg)

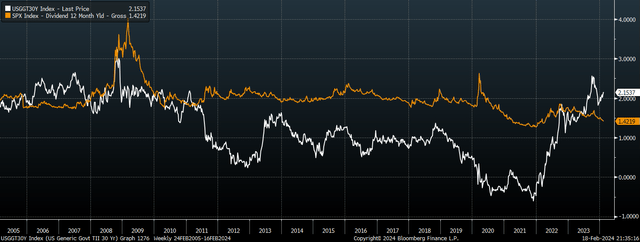

With its 1.4% dividend yield, SPX dividends would therefore have to grow by 4.1% for stocks to generate the same amount of cash for investors. Of course, the margin equity buyer is unlikely to be doing so based on dividend growth, but this is the point. The fact that cash flow prospects for TIPS have risen so far in excess of stocks reflects a lack of concern for discounted future cashflows and a fear of missing out. It would therefore not take much of a growth shock to cause a reversal in recent trends.

SPX Dividend Yield Vs 30-Year TIPS Yield (Bloomberg)

Summary

The elevated real yield on the LTPZ is being sustained by growth optimism as reflected in the surge higher in US stocks, which is putting renewed upside pressure on interest rate expectations. With the TIPS now offering far superior cash flow return prospects relative to US stocks amid rising short-term inflation expectations and an ultra-low dividend yield, even the slightest decline in growth optimism could cause a large shift into the LTPZ. While there are several TIPS funds that offer high real yields, the LTPZ is the longest dated fund and so has more upside potential from any decline in real yields.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of LTPZ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.