- The latest stock market surge is different from bubbles of the past, Capital Economics said.

- Markets are not reflecting any obvious signs of “high and rising leverage.”

- The amount of margin debt relative to the size of the stock market is smaller than past bubbles.

Thanks for signing up!

Access your favorite topics in a personalized feed while you’re on the go.

Soaring equity markets typically invite whispers of an impending stock market crash, but according to Capital Economics, the latest streak of gains doesn’t resemble bubbles of the past.

In a Tuesday note, the firm’s chief markets economist John Higgins pointed out that today’s rising stock market has not been marked by the characteristics that have accompanied past catastrophes.

For starters, similar to the meme-stock craze of 2021 — when retail investors and Reddit traders put pandemic stimulus checks toward juicing shorted stocks like GameStop and AMC – the current market doesn’t exhibit “obvious signs of high and rising leverage,” Higgins said.

Today’s market, like the one three years ago, is unfolding against a backdrop that doesn’t seem to be clearly inflated by leverage, in Capital Economics’ view.

“[W]hereas the US household sector had become a net borrower before the dot com bubble burst and the [Great Financial Crisis], it had become a net lender during the pandemic owing to a big reduction in spending and substantial fiscal support,” Higgins said. “Although the household sector’s financial surplus has since plunged from a very high level, it has picked back up a bit after briefly turning negative.”

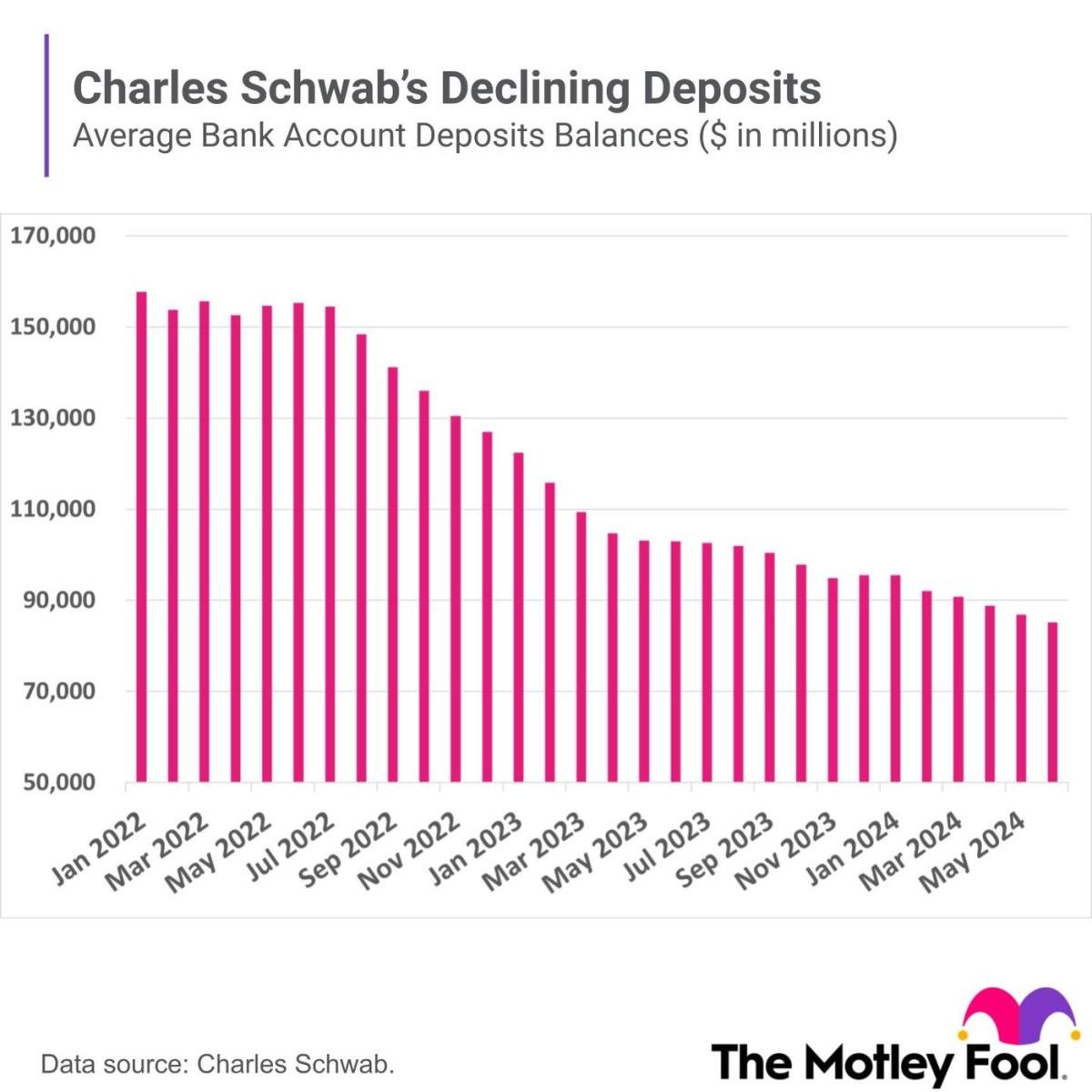

What’s more, the ratio of margin debt to the size of the entire stock market hasn’t climbed like it did ahead of either the 1929 crash or 2008 financial crisis.

As the chart below illustrates, margin debt has actually declined recently, according to Capital Economics, as has its ratio to the total stock market.

Meanwhile, some commentators have observed the secular shift from active to passive funds as a driver of a potential bubble.

Bloomberg data shows the share of US equity mutual funds and ETFs that are considered passive funds has doubled over the last decade to above 60% at the end of last year. Capital Economics forecasts that could climb to 80% by 2030.

Capital Economics’ Higgins, however, doesn’t see this as a variable driving a bubble in the overall stock market.

“After all, whether money is invested in active or passive funds shouldn’t in principle have a bearing on how much overall finds its way into equities,” he said, adding that passive funds make investors more comfortable buying into stocks, given the lower fees.

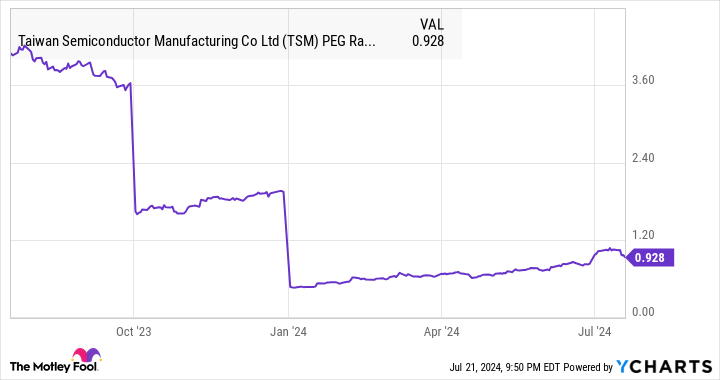

Bubble talk has been concentrated is AI stocks in particular in recent months, with continued gains being seen in a handful of mega-cap names. Investors eyeing a critical earnings report from chip maker Nvidia after the closing bell on Wednesday.

The proportion of S&P 500 companies mentioning AI in earnings calls has jumped since last quarter, and some AI-related names like Super Micro Computer, Arm, and SoundHound have seen blistering single-day rallies of late.

Nonetheless, some analysts such as Wedbush’s Dan Ives aren’t convinced the fervor for AI is a bubble in the making.

“AI is the biggest tech trend we have seen since the start of the Internet in 1995,” Ives wrote last week. “I have been an analyst since late 90’s covering tech, this is not a bubble it’s the start of the AI Revolution.”