News of the day for February 21, 2024

Published February 21, 2024

I-Hwa Cheng / AFP / Getty Images

Nvidia shares were down in pre-market trading after tumbling Tuesday ahead of what analysts expect will be a bumper quarterly earnings report after the closing bell today. Investors also await the minutes of the latest U.S. Federal Reserve policy meeting for more clues on when the central bank could start cutting interest rates. Shares in Palo Alto Networks (PANW) are plunging after the cybersecurity company issued disappointing guidance, Intel (INTC) is hosting its first yearly foundry business update, and Amazon.com Inc. (AMZN) is gaining on news it is replacing Walgreens (WBA) in the Dow Jones Industrial Average. Here’s what investors need to know today.

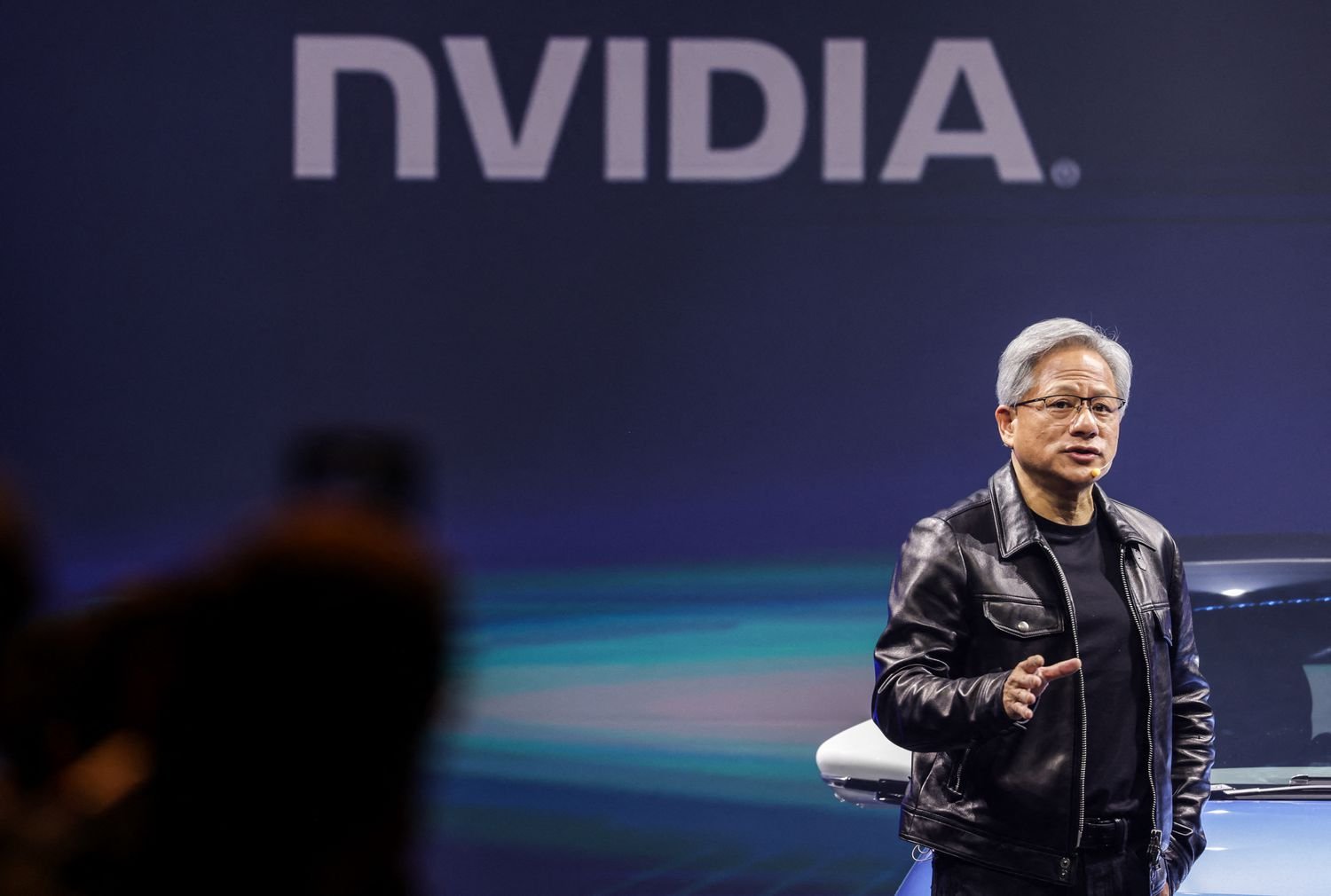

1. Nvidia Slumps Ahead of Hotly Awaited Results

Shares in Nvidia (NVDA) were down about 1.5% in pre-market trading after tumbling 4.4% Tuesday ahead of the company’s highly anticipated fiscal fourth-quarter results due after the bell today. Analysts are expecting large gains in revenue and profit from the chipmaker most associated with the investor optimism that surrounds artificial intelligence (AI). Quarterly revenue is expected to reach $20.38 billion—more than triple the chipmaker’s revenue in the same period a year ago. So hot is the fervor around Nvidia and its chips that power AI that individual investors have poured a net $1.2 billion into its shares this year—more than any of the other megacap tech stocks in the so-called Magnificent Seven, according to Nasdaq Data Link. Goldman Sachs’ trading desk, meanwhile, has called Nvidia, whose shares have more than tripled in price over the past year, “the most important stock on planet earth.”

2. Fed Minutes May Hint at Interest-Rate Cut Timing

The Federal Reserve will release the minutes of its January policy meeting at 2 p.m. ET, as investors look for clues on when the central bank could start cutting its benchmark rate. Fed Chair Jerome Powell and other Fed policymakers have stuck to their stance in recent weeks that they want to see inflation truly subdued before cutting interest rates. Last week’s data wasn’t promising for an impending rate cut: both the consumer-price index and producer-price index reports showed an unexpected increase in price pressures in January.

3. Palo Alto Plunges as Cybersecurity Firm Copes With “Spending Fatigue”

Shares of Palo Alto Networks (PANW) plunged more than 20% in pre-market trading after the cybersecurity firm late Tuesday slashed its revenue forecasts, noting that customers were becoming more demanding and showing signs of “spending fatigue” even as online security breaches rise. The Santa Clara, California-based company now expects to generate revenue of $1.95 billion to $1.98 billion for the current quarter, with the higher end of that guidance falling short of the $2.04 billion expected by analysts.

4. Intel Holds First Foundry Business Conference

Intel (INTC) is hosting its first annual conference for its growing foundry business today, with CEO Pat Gelsinger expected to reveal more details about the chipmaker’s plans to become the world’s “first and only fully integrated systems foundry for the AI era.” The event will also feature appearances by high-profile executives and government officials including U.S. Secretary of Commerce Gina Raimondo, Microsoft (MSFT) Chair and CEO Satya Nadella, OpenAI CEO Sam Altman, and ARM (ARM) CEO Rene Haas, among others. Intel’s foundry business manufactures chips for corporate and government clients,

5. Amazon to Replace Walgreens in Dow Jones Industrial Average

Amazon.com Inc. (AMZN) was up about 1% before the bell following news that the online retailing giant is set to join the Dow Jones Industrial Average, replacing pharmacy chain Walgreens Boots Alliance (WBA). The changes will be effective on Monday next week, according to S&P Dow Jones Indices, which manages the storied 30-stock benchmark. S&P said the changes were sparked by Walmart’s 3-for-1 stock split, which also takes effect next week, and reflect “the evolving nature of the American economy.” Walgreens was down 3%.

Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.